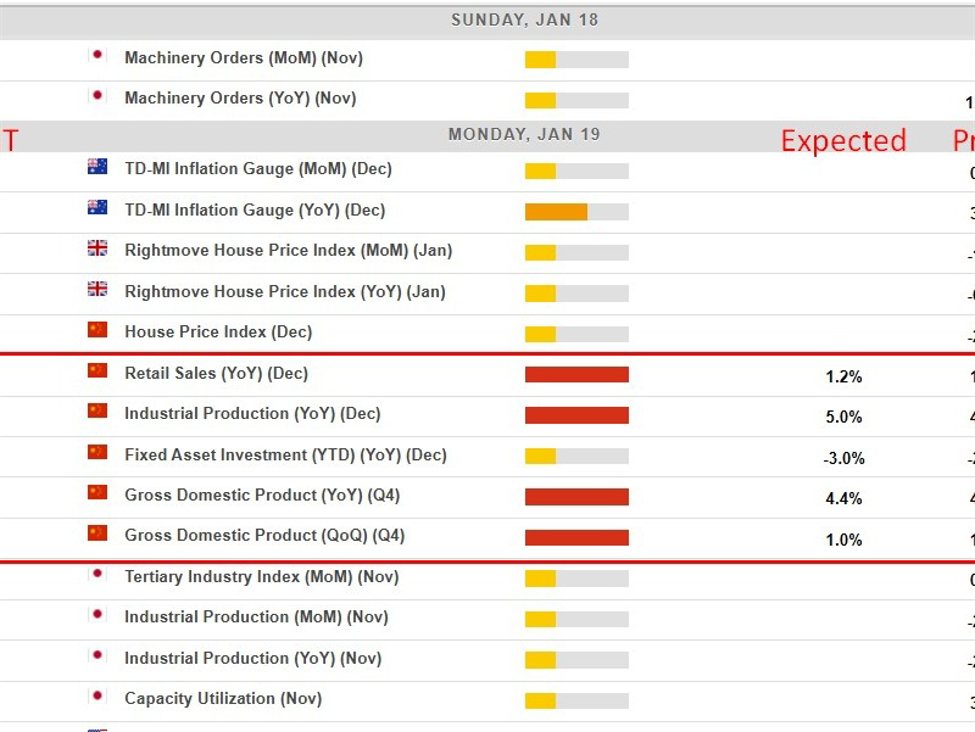

This snapshot is from the investingLive financial knowledge calendar.

- The occasions within the left-most column are GMT.

- The numbers within the right-most column are the ‘prior’ (earlier month/quarter because the case could also be) consequence. The quantity within the column subsequent to that, the place there’s a quantity, is the consensus median anticipated.

The information of most observe as we speak is from China, particularly:

- Retail Gross sales for December

- Industrial Manufacturing for December

- Mounted Asset Funding for December

- Gross Home Product for This fall 2025

You possibly can see the survey ‘anticipated’ median consensus and the priors above for all of those. Preview:

-

This fall GDP seen at 4.5% y/y, weakest in three years

-

Full-year 2025 development possible meets ~5% goal, however nominal development lags

-

Retail gross sales and funding stay key drags on exercise

-

Industrial manufacturing supported by resilient exports

-

Coverage stance cautious, with restricted urge for food for main stimulus

China is anticipated to have ended 2025 with its weakest quarterly development in three years, highlighting an more and more uneven restoration pushed by exports quite than home demand because the economic system heads into 2026.

Information are forecast to point out that whereas abroad demand has remained resilient, consumption and funding proceed to pull on development. Economists anticipate gross home product to have expanded 4.5% y/y in This fall, the slowest tempo because the post-pandemic reopening, at the same time as full-year development reaches round 5%, consistent with Beijing’s official goal.

The composition of development stays the important thing concern. A historic contraction in funding and faltering family demand are anticipated to offset momentum from exports, which have been boosted by file shipments outdoors the US regardless of renewed commerce tensions underneath U.S. President Donald Trump.

Retail gross sales development is forecast to ease to a contemporary three-year low in December, reflecting weak revenue development, smooth labour situations and ongoing stress from falling house costs. Mounted asset funding is anticipated to publish its first annual contraction since official data started three a long time in the past, underscoring the depth of the property downturn and the saturation of infrastructure spending.

Against this, industrial manufacturing is more likely to have accelerated in December to its quickest tempo since September, supported by robust exterior demand. That divergence reinforces expectations that China’s two-speed development mannequin will persist into 2026, with exports carrying the load as home demand stays subdued.

Deflation continues to complicate the outlook. Whereas actual GDP development might meet the federal government’s goal, nominal growth is anticipated to be considerably weaker, weighing on company earnings, family wealth and monetary revenues.

Policymakers seem reluctant to reply with large-scale stimulus. President Xi Jinping has signalled higher tolerance for slower development, whereas issues round native authorities debt restrict Beijing’s willingness to develop aggressively.

China’s central financial institution has strengthened that message. The Folks’s Financial institution of China has leaned towards focused easing, just lately reducing the price of structural lending instruments whereas solely cautiously flagging scope for broader price cuts. Officers have more and more acknowledged that financial easing is dropping effectiveness in an economic system constrained by weak demand and structural imbalances.

Retail gross sales development is forecast to ease to a contemporary three-year low in December