Anchorage Digital, a New York–primarily based crypto financial institution, is transferring to boost contemporary capital because it prepares to enter public markets. In line with Bloomberg, individuals accustomed to the matter say the agency is trying to safe between $200 million and $400 million in new funding.

Anchorage Seeks Main Funding

Stories say the Agency is exploring a $200M–$400 million spherical to strengthen its enterprise earlier than a potential public itemizing. The plan would put Anchorage amongst a small group of crypto-native corporations which have tried to checklist on inventory markets after constructing regulated providers for establishments.

The corporate’s financial institution affiliate holds a federal constitution, a standing that offers it a special footing in contrast with many crypto corporations. That federal backing is usually cited by buyers as a cause Anchorage can supply custody and different providers seen as safer by large purchasers.

Based mostly on reviews, Anchorage final raised capital in a earlier spherical that valued the enterprise at over $3 billion, and the contemporary funding is seen as a runway towards a public debut.

Anchorage Digital, whose affiliate is the primary federally chartered US digital-asset financial institution, is searching for to boost contemporary capital because it explores a possible public itemizing, in response to individuals with data of the matter https://t.co/6xLNEJN54W

— Bloomberg (@enterprise) January 16, 2026

Regulatory Edge And Product Push

Some reviews say the financial institution can also be rising groups tied to stablecoin work and exploring partnerships that might widen its product set for big prospects. These strikes seem geared toward making the corporate extra engaging to public buyers.

Market observers be aware that crypto corporations have been contemplating public listings extra typically as regulation clears up in sure areas and as institutional demand for custody and controlled rails grows.

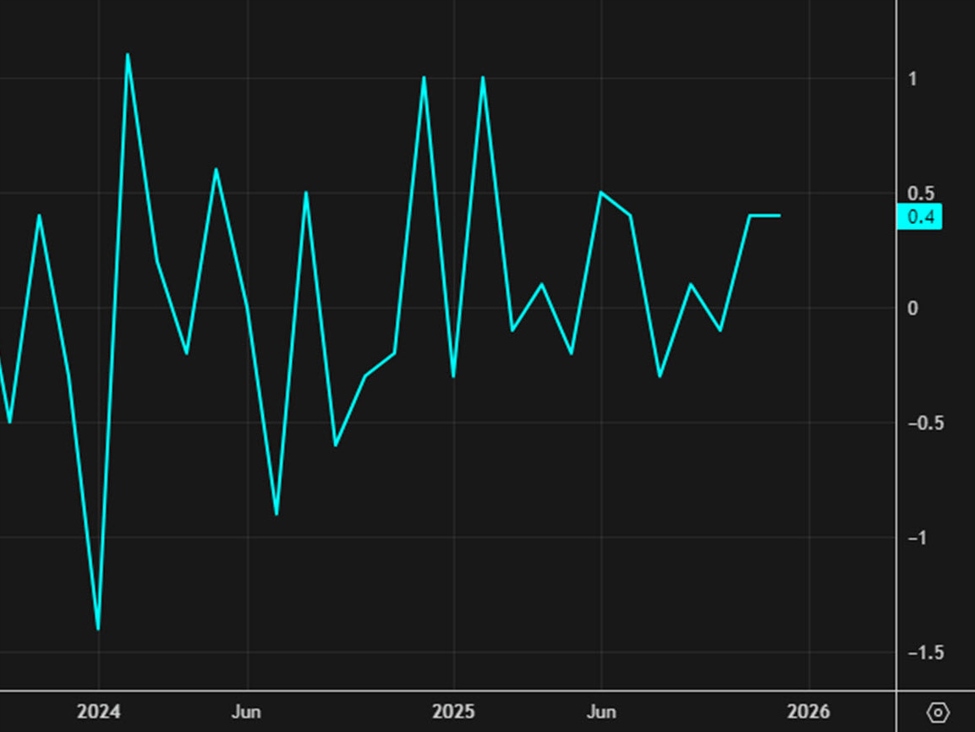

BTCUSD buying and selling at $95,149 on the 24-hour chart: TradingView

Anchorage’s timing comes whereas different custody and asset corporations weigh comparable steps, a pattern that might reshape how large buyers entry crypto providers. The environment is cautious, however there’s clear curiosity in regulated gamers.

Market Response And IPO Timing

In line with market chatter, the financial institution may search a itemizing as quickly as subsequent 12 months, though some protection says 2027 can also be potential. Sources quoted by Bloomberg gave a variety of potential timing, and Anchorage has not offered a public touch upon the plans.

If Anchorage completes a profitable increase and goes public, the occasion would sign confidence in corporations that mix crypto providers with bank-style oversight.

Buyers will probably be watching how the corporate makes use of the proceeds — whether or not to construct new merchandise, rent workers, or enhance its steadiness sheet forward of scrutiny that comes with public possession. The subsequent few months are more likely to reveal extra particulars as underwriting and investor talks advance.

Featured picture from Yellow, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.