Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum has proven indicators of renewed momentum, climbing 6.7% over the previous week and briefly reclaiming the $3,400 stage on Wednesday, January 14. As of early January 17 (round 2:30 a.m. EST), the value has pulled again barely to $3,291, with 24-hour buying and selling quantity dropping 21% to $20.5 billion suggesting a quieter day of exercise amid consolidation.

This latest uptick comes in opposition to a backdrop of sustained institutional curiosity within the asset, which may assist gas additional features within the close to time period.

Ethereum Sees Vital Institutional, ETF Inflows

Ethereum continues to draw sturdy curiosity from institutional buyers, with spot Ethereum exchange-traded funds (ETFs) seeing practically $500 million in inflows within the final week, in line with Coinglass knowledge.

Wednesday alone introduced in $175.1 million, marking the largest single-day ETF influx of 2026 and the best since December 2025.

Whereas weekly and each day buying and selling volumes take a plunge, some companies, like Bitmine, led by Wall Avenue Strategist Tom Lee, are nonetheless including ETH to their holdings.

The latest buy by Bitmine was $65 million price of Ethereum, which highlights rising institutional confidence within the cryptocurrency.

JUST IN: 🔥 🇺🇸 Tom Lee’s Bitmine simply bought $65,000,000 price of $ETH.

Bullish for Ethereum. pic.twitter.com/zD3bMf41K7

— Crypto Rover (@cryptorover) January 17, 2026

This transfer by Tom Lee’s crypto infrastructure agency underscores Ethereum’s rising attraction past its good contract capabilities, because it features traction throughout DeFi, NFTs, and tokenized property.

Furthermore, the acquisition displays a broader pattern of institutional curiosity within the king of altcoins, which is seen as a flexible asset with potential for scalability enhancements and future demand from a doable spot ETH ETF.

Such institutional exercise may bolster Ethereum’s value stability, particularly in unstable market circumstances.

Will Ethereum Surge Once more From Right here?

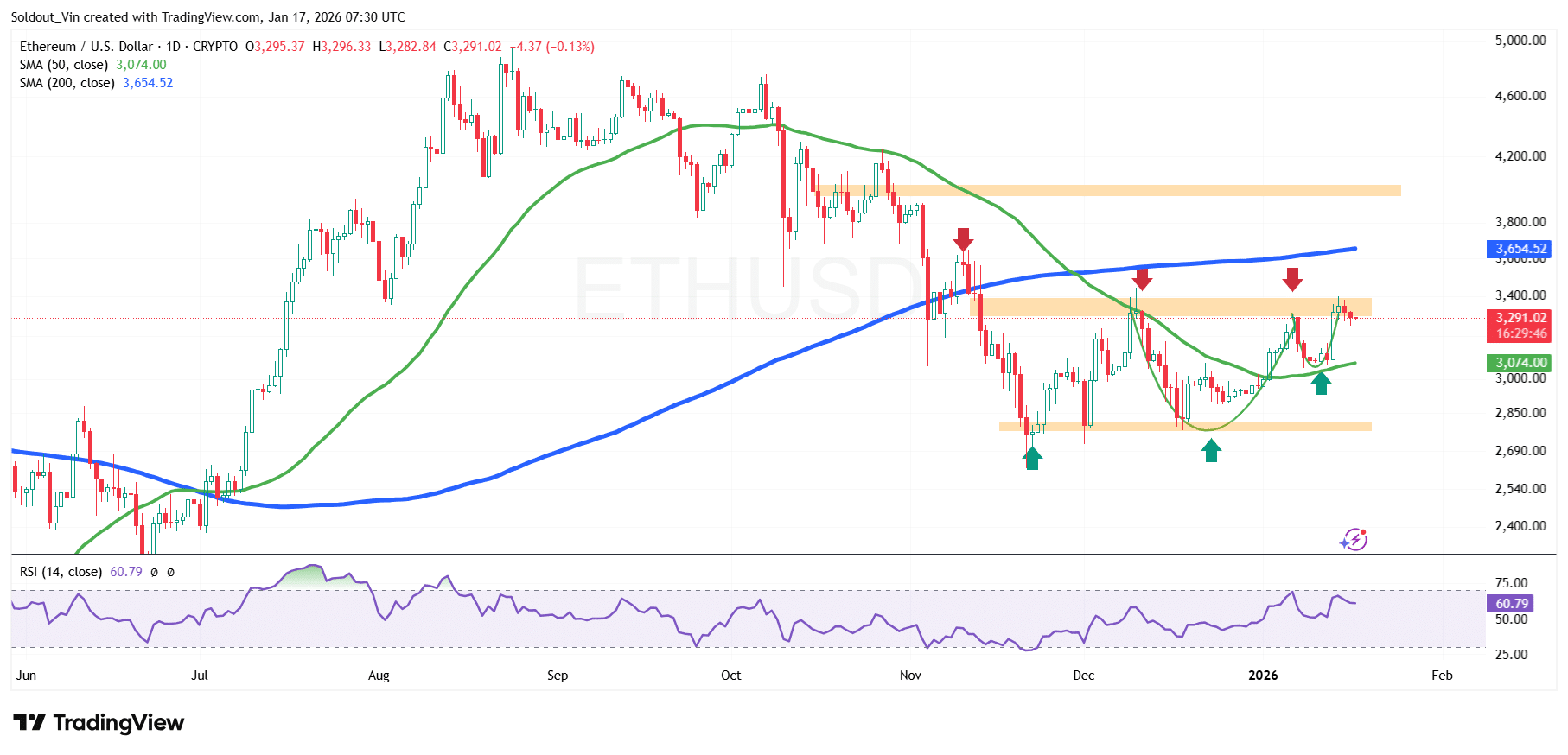

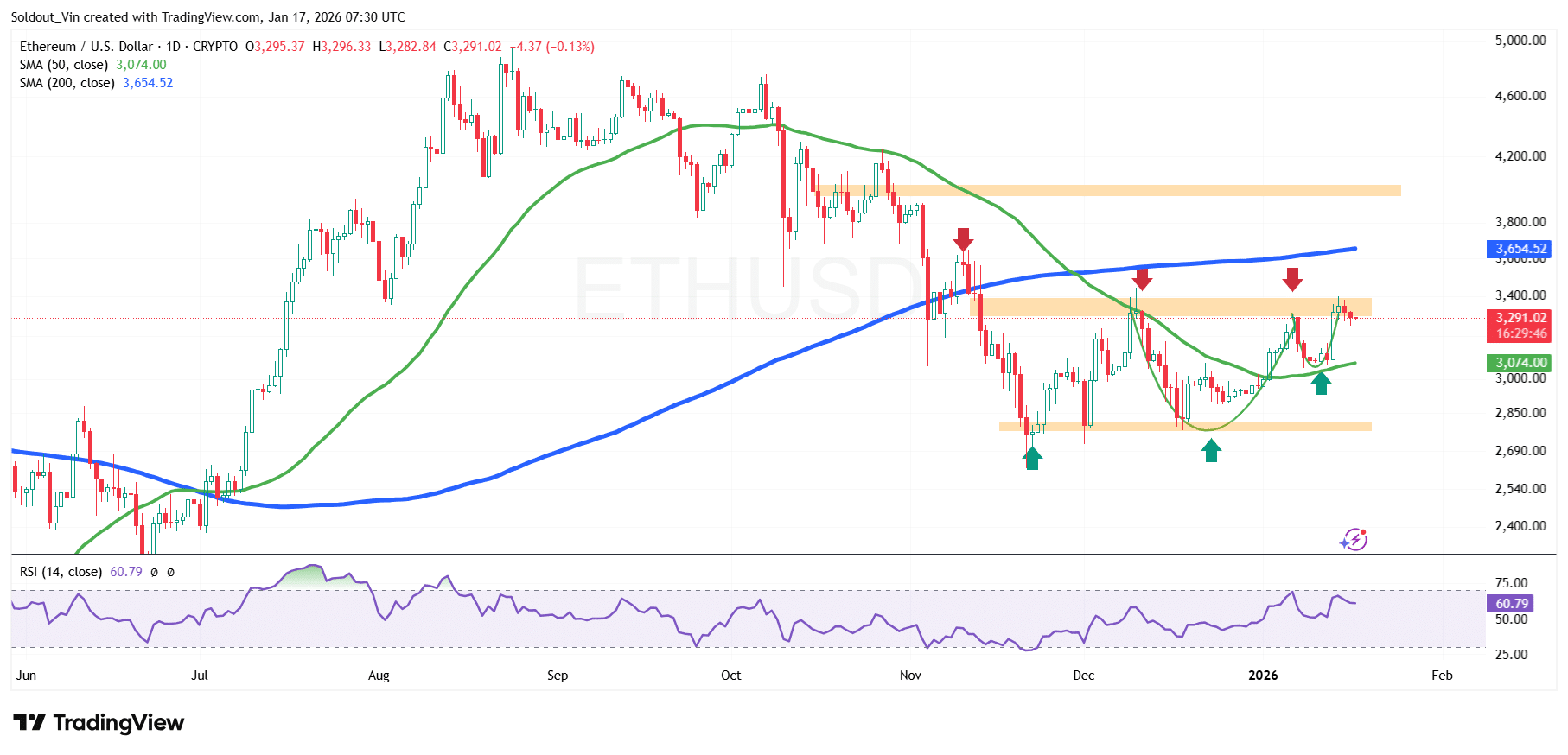

Ethereum value is at present consolidating above the $3,070 help zone, which aligns intently with the 50-day Easy Transferring Common (SMA). The latest rebound from the $2,750–$2,850 demand space signifies that patrons are actively defending this area, forming a better low on the each day chart.

In consequence, ETH has efficiently reclaimed the 50-day SMA at $3,074, which helps a short-term bullish outlook. Nonetheless, the 200-day SMA at $3,654 stays a key overhead resistance. A number of rejections close to this stage counsel that sellers are nonetheless energetic, making it a essential barrier for pattern continuation.

Ethereum’s Relative Power Index (RSI) is at present round 60.79, which is above the impartial 50 stage however beneath overbought circumstances. This means that bullish momentum is constructing whereas nonetheless leaving room for additional upside earlier than the market turns into overheated.

On the identical time, the value construction reveals a rounded backside formation and bettering momentum, signaling a possible pattern transition section moderately than a confirmed breakout.

The 1-day ETH/USD chart evaluation means that Ethereum may try a transfer towards the $3,350–$3,450 resistance zone, which beforehand acted as help. A each day shut above this space may open the door for a retest of the 200-day SMA close to $3,650, marking the following main upside goal.

On the draw back, if the value of ETH fails to carry above the 50-day SMA, short-term profit-taking may push the value again towards the $2,850 help zone, the place patrons have beforehand stepped.

Total, Ethereum is exhibiting early indicators of restoration, however a confirmed bullish continuation would require a clear break and acceptance above the 200-day SMA.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection