Intel Company INTC is scheduled to report fourth-quarter 2025 earnings after the closing bell on Jan. 22. The Zacks Consensus Estimate for gross sales and earnings is pegged at $13.37 billion and eight cents per share, respectively. Over the previous 60 days, earnings estimates for INTC have elevated from 32 cents to 34 cents per share for 2025 however declined from 59 cents to 58 cents per share for 2026.

INTC Estimate Pattern

Picture Supply: Zacks Funding Analysis

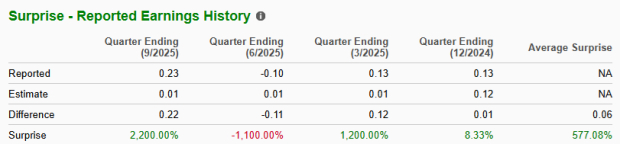

Earnings Shock Historical past

The main semiconductor producer delivered a stellar four-quarter earnings shock of 577.1%, on common, beating estimates thrice. Within the final reported quarter, the corporate’s earnings shock was 2,200%.

Picture Supply: Zacks Funding Analysis

Earnings Whispers

Our confirmed mannequin predicts an earnings beat for Intel for the fourth quarter. The mixture of a optimistic Earnings ESP and a Zacks Rank #1 (Robust Purchase), 2 (Purchase) or 3 (Maintain) will increase the probabilities of an earnings beat. That is completely the case right here. You possibly can uncover the very best shares to purchase or promote earlier than they’re reported with our Earnings ESP Filter.

Intel at present has an ESP of +17.39% with a Zacks Rank #3.

You possibly can see the entire record of right this moment’s Zacks #1 Rank shares right here.

Components Shaping the Quarterly Efficiency

Within the quarter, Intel previewed the Intel Core Extremely collection 3 processor (code-named Panther Lake) and Xeon 6+ (code-named Clearwater Forest). Manufactured in a brand new, state-of-the-art manufacturing facility in Chandler, AZ, each merchandise are constructed on Intel 18A, essentially the most superior semiconductor course of in the US. Panther Lake is designed to energy a broad spectrum of client and business AI PCs, gaming gadgets and edge options. Clearwater Forest is an E-core server processor that allows enterprise enterprises to scale workloads, cut back vitality prices and energy extra clever providers. These are more likely to have generated extra buyer curiosity, translating into incremental revenues within the quarter.

In the course of the to-be-reported quarter, trade grapevines had been abuzz with Intel probably creating Apple Inc.’s AAPL M collection chips for the latter’s MacBook Air and iPad Professional by early 2027. Though each firms’ spokespersons refused to touch upon the matter, it created a renewed curiosity in Intel Foundry. With new administration, Intel is enterprise a complete assessment of its companies to place the corporate again on its development trajectory. Interim administration has vouched to maintain the core technique unchanged regardless of efforts to drive operational effectivity and agility. The corporate is emphasizing the diligent execution of operational objectives to determine itself as a number one foundry. These are more likely to have generated extra revenues within the quarter.

Nevertheless, Intel lagged NVIDIA Company NVDA on the innovation entrance, with the latter’s H100 and Blackwell graphics processing items being a runaway success. An accelerated ramp-up of AI PCs is more likely to have affected the short-term margins of Intel because it shifted manufacturing to its high-volume facility in Eire, the place wafer prices are usually larger. Margins are additionally more likely to have been adversely impacted by larger prices associated to non-core companies, prices related to unused capability and an unfavorable product combine. Consequently, Intel restructured its prime administration within the quarter to gasoline its development engine.

Furthermore, China’s supposed transfer to exchange U.S.-made chips with home alternate options might considerably have an effect on Intel because it derives a good portion of its revenues from the communist nation. The latest directive to section out international chips from key telecom networks by 2027 underscores Beijing’s accelerating efforts to cut back reliance on Western know-how amid escalating U.S.-China tensions. As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in essential industries. This shift poses a twin problem for Intel, because it faces potential market restrictions and elevated competitors from home chipmakers like Superior Micro Gadgets, Inc. AMD and NVIDIA. These are more likely to have adversely impacted its backside line within the quarter below assessment.

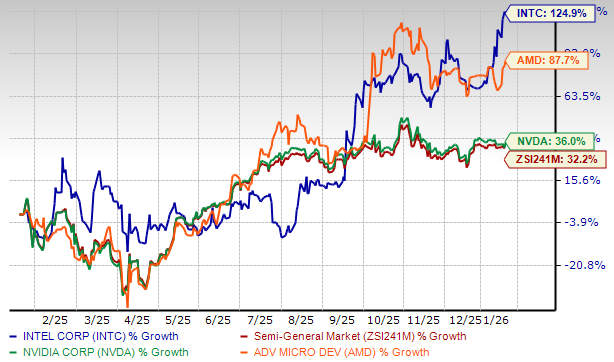

Worth Efficiency

Over the previous 12 months, Intel has surged 124.8% in contrast with the trade’s development of 32.2%, outperforming its friends, NVIDIA and AMD. Whereas NVIDIA has gained 36%, AMD has soared 87.7% over this era.

One-Yr INTC Inventory Worth Efficiency

Picture Supply: Zacks Funding Analysis

Key Valuation Metric

From a valuation standpoint, Intel seems to be comparatively cheaper than the trade however above its imply. Going by the value/gross sales ratio, the corporate’s shares at present commerce at 4.25 ahead gross sales, decrease than 17.48 for the trade however larger than the inventory’s imply of two.46.

Picture Supply: Zacks Funding Analysis

Funding Concerns

Intel’s modern AI options are set to profit the broader semiconductor ecosystem by driving down prices, enhancing efficiency and fostering an open, scalable AI atmosphere. It has secured a $5-billion funding from NVIDIA to collectively develop cutting-edge options which might be more likely to play an integral position within the evolution of the AI infrastructure ecosystem. Softbank additionally invested $2 billion in Intel to propel AI analysis and improvement initiatives that help digital transformation, cloud computing and next-generation infrastructure.

The corporate has obtained $7.86 billion in direct funding from the U.S. Division of Commerce for its business semiconductor manufacturing initiatives below the U.S. CHIPS and Science Act. The funds will help Intel in advancing essential semiconductor manufacturing and superior packaging initiatives in Arizona, New Mexico, Ohio and Oregon, probably paving the way in which for innovation and development.

Nevertheless, rising competitors from different established gamers and rising China-based companies is more likely to adversely impression INTC’s backside line. The communist nation’s stonewalling efforts and push for technological autonomy might reshape the dynamics of the semiconductor trade and have an effect on Intel’s efficiency to a big extent. Furthermore, Intel has been dealing with challenges because of the disruptive rise of over-the-top service suppliers on this dynamic trade. This has affected its margins. Worth-sensitive competitors for buyer retention within the core enterprise is predicted to accentuate within the coming days.

Finish Notice

Intel’s technique for open, scalable AI techniques extends past {hardware}, encompassing software program, frameworks and instruments. By fostering a broad ecosystem of AI gamers, together with gear producers, database suppliers and software program builders, Intel goals to supply enterprises a various vary of options that cater to their distinctive GenAI necessities. This collaborative method not solely promotes innovation but additionally enhances interoperability and compatibility, empowering enterprises to leverage current ecosystem companions with confidence.

Nevertheless, it seems that the latest product launches are “too little too late” for Intel. With continued commerce skirmishes and an on-and-off tariff regime, the inventory is witnessing an unsure enterprise atmosphere, though it’s buying and selling comparatively cheaply. Intel appears to be treading in the course of the street, and buyers may very well be higher off in the event that they commerce with warning.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in essentially the most vital wealth-building alternatives of our time.

At this time, you’ve gotten an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you will uncover the little-known shares we consider will win the quantum computing race and ship large positive aspects to early buyers.

Intel Company (INTC) : Free Inventory Evaluation Report

Apple Inc. (AAPL) : Free Inventory Evaluation Report

Superior Micro Gadgets, Inc. (AMD) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.