The Dwelling Depot, Inc. HD has been sharpening its give attention to complicated, high-value skilled work by introducing digital instruments that scale back the time and friction contractors face when bidding and executing massive initiatives. Administration has launched two new instruments to assist contractors plan massive initiatives quicker, estimate extra precisely and consolidate buying.

The primary is a mission planning software launched final September that permits Professionals to construct and handle materials lists, monitor orders and deliveries and coordinate multi-stage procurement. The second, the blueprint takeoff software, makes use of synthetic intelligence and proprietary algorithms to generate correct materials estimates from building plans. This know-how replaces guide processes that usually took weeks, enabling contractors to buy total mission necessities from a single provider in document time.

By positioning itself as a one-stop vacation spot for multi-trade initiatives, Dwelling Depot is growing engagement in big-ticket transactions, which grew 2.3% within the third quarter of fiscal 2025. The synergy between specialised wholesale footprints and high-speed digital success is designed to make the retailer indispensable for execs managing large-scale renovations.

The latest addition of GMS in September 2025, together with the sooner SRS acquisition, has created a considerable wholesale operation spanning classes comparable to roofing, drywall and metal framing. These strategic strikes allow the retailer to seize a large-project pockets share.

What the Newest Metrics Say About Dwelling Depot

Dwelling Depot, which competes with Ground & Decor Holdings, Inc. FND and Lowe’s Corporations, Inc. LOW, has seen its shares fall 11.2% prior to now 12 months in contrast with the business’s decline of 16.7%. Whereas shares of Ground & Decor Holdings have declined 35.6%, Lowe’s has fallen 1.2% within the stated interval.

Picture Supply: Zacks Funding Analysis

From a valuation standpoint, Dwelling Depot trades at a ahead price-to-earnings ratio of twenty-two.96, increased than the business’s 21.18. HD carries a Worth Rating of D. Dwelling Depot is buying and selling at a reduction to Ground & Decor Holdings (with a ahead 12-month P/E ratio of 29.46) however at a premium to Lowe’s (19.05).

Picture Supply: Zacks Funding Analysis

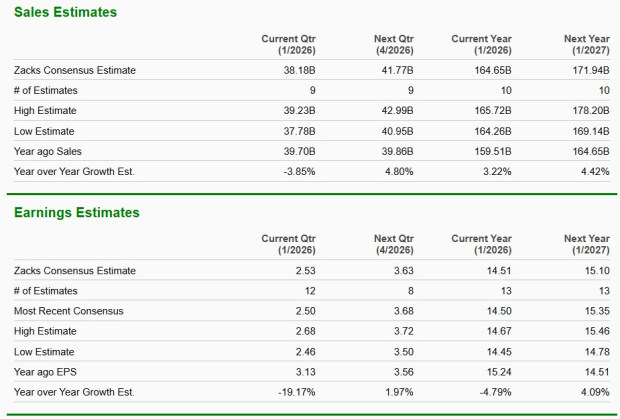

The Zacks Consensus Estimate for Dwelling Depot’s present financial-year gross sales implies year-over-year progress of three.2%, whereas the identical for earnings per share suggests a decline of 4.8%. For the subsequent fiscal 12 months, the consensus estimate signifies a 4.4% rise in gross sales and 4.1% progress in earnings.

Picture Supply: Zacks Funding Analysis

Dwelling Depot presently carries a Zacks Rank #4 (Promote).

You’ll be able to see the whole listing of immediately’s Zacks #1 Rank (Robust Purchase) shares right here.

Zacks’ Analysis Chief Picks Inventory Most More likely to “At Least Double”

Our specialists have revealed their Prime 5 suggestions with money-doubling potential – and Director of Analysis Sheraz Mian believes one is superior to the others. After all, all our picks aren’t winners however this one may far surpass earlier suggestions like Hims & Hers Well being, which shot up +209%.

See Our Prime Inventory to Double (Plus 4 Runners Up) >>

Lowe’s Corporations, Inc. (LOW) : Free Inventory Evaluation Report

The Dwelling Depot, Inc. (HD) : Free Inventory Evaluation Report

Ground & Decor Holdings, Inc. (FND) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.