Shares of Hologic HOLX closed the primary buying and selling session of the 12 months at $74.56, which is kind of near the 52-week excessive of $75.34, reached on Dec. 15, 2025. Up to now six months, the corporate has gained 15.9%, outperforming its trade and sector, whereas the proposed $18.3 billion-take-private deal by Blackstone and TPG continued to attract widespread focus. At present ranges, the transaction implies roughly a 1.9% upside potential to the $76 provide, assuming stockholder approval and different customary closing situations forward of the anticipated completion within the first half of 2026.

The inventory additionally surpassed the S&P 500 composite, which rallied 13% in the identical interval. Amongst its main rivals, Abbott ABT fell 7.1%, whereas CooperCompanies COO rose 10.7%, each trailing behind Hologic’s efficiency.

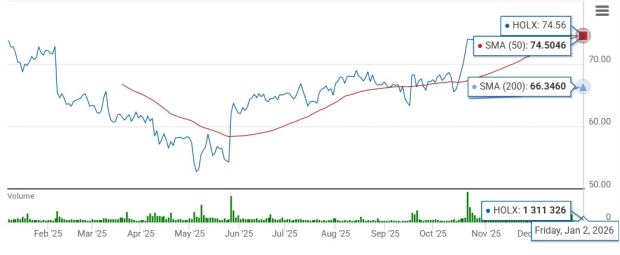

HOLX 6-Month Value Efficiency

Picture Supply: Zacks Funding Analysis

From a technical standpoint, HOLX inventory is buying and selling above its 50-day and 200-day shifting averages, suggesting sturdy investor confidence.

Picture Supply: Zacks Funding Analysis

What’s Favoring Hologic?

The corporate continues to profit from Molecular Diagnostics, comprising a variety of assays that run on the Panther and the Panther Fusion platforms. The BV, CV/ TV assay ranks as Hologic’s second-largest globally, from being a newly launched product in 2019. With a lot of the development coming from the conversion of current guide testing to Panther, Hologic is working to extend penetration within the huge U.S. vaginitis market by driving consciousness and securing reimbursement for this high-throughput check. As well as, the sturdy adoption of the Breast Most cancers Index (“BCI”) check is driving greater lab testing volumes throughout the Biotheranostics enterprise.

In Breast Well being, initiatives carried out by the brand new business management, together with a bifurcated gross sales construction and rollout of the end-of-life technique for older gantries, supported the division’s return to development within the fourth quarter of fiscal 2025. Interventional breast well being merchandise are additionally a robust development driver as a result of Endomagnetics acquisition, which expanded the portfolio with wire-free breast surgical procedure localization and lymphatic tracing options.

The Mysore suite of gadgets, the Fluent fluid administration system and robust gross sales of the NovaSure gadgets in worldwide markets are driving the GYN Surgical division’s efficiency. Hologic acquired Gynesonics final 12 months, including the extremely complementary Sonata System to the fibroid therapy portfolio. The corporate’s M&A technique has all the time been pursuing tuck-in offers that align with its three franchises, aiming to amass belongings that leverage the present strengths, drive top-line development and add accretion to earnings over time.

Hologic’s Medical Momentum & New Wins

With the rising significance of AI in mammography, a number of latest research underscore Hologic’s potential to assist radiologists work extra effectively with out compromising high quality. A retrospective research of greater than 160,000 screening mammography exams in contrast most cancers detection charges earlier than and after adopting the corporate’s 3DQuorum imaging know-how, with findings exhibiting no important distinction in most cancers detection charges post-implementation.

In one other research, Hologic’s Genius AI Detection answer carried out at par with 108 radiologists from the U.Okay. and america reviewing 75 difficult breast most cancers circumstances. Moreover, Genius AI was discovered to flag a 3rd of breast most cancers circumstances initially interpreted as adverse in a retrospective evaluation of seven,500 digital breast tomosynthesis (3D mammography) screening exams. At RSNA 2025, Hologic additionally showcased the next-generation Envision Mammography Platform, anticipated to launch within the coming months.

In Diagnostics, new proof from 11 investigational research affords deeper perception into premenopausal affected person populations, helps extra nuanced endocrine remedy decision-making and highlights the consistency of the BCI Take a look at’s efficiency throughout numerous affected person subgroups and pattern varieties. Additional, the Genius Digital Diagnostics System obtained expanded CE marking within the European Union, now accepted to picture and assessment each cell and tissue specimens. The corporate additionally achieved FDA 510(okay) clearance and the CE-IVDR for the brand new Panther Fusion Gastrointestinal Bacterial and Expanded Bacterial Assays.

HOLX’s Valuation Metrics

Hologic seems undervalued. Primarily based on the ahead, three-year price-to-earnings (P/E), shares are buying and selling at 16.12X, decrease than their median in addition to the 29.91X trade common. The inventory carries a Worth Rating of B at current. In the meantime, Abbott and CooperCompanies have a three-year P/E of 21.90X and 17.72X, respectively.

Hologic’s 3-Yr P/E

Picture Supply: Zacks Funding Analysis

Macro Woes Keep a Concern for Hologic

Hologic faces ongoing macroeconomic volatilities, together with a ten% baseline tariff on all U.S. imports. The corporate manufactures most of its GYN Surgical and Breast Well being interventional breast options and disposable merchandise at its Costa Rica facility, and sources uncooked supplies and parts from China which might be topic to considerably greater charges. Primarily based on the mitigation efforts taken and deliberate, direct tariff prices are anticipated to complete almost $10-$14 million per quarter in fiscal 2026. This excludes the potential price will increase from distributors and suppliers. Additional, the difficult working surroundings in China and USAID funding cuts additionally stay a headwind, significantly for the Diagnostics division.

Conclusion

At present a Zacks Rank #3 (Maintain) firm, Hologic seems well-positioned to maintain benefiting from its divisional strengths. The corporate’s improvements proceed to assemble robust scientific proof, whereas latest regulatory developments are additionally encouraging. The inventory’s latest favorable value efficiency and interesting valuation justify a maintain place for present buyers. Nevertheless, potential patrons can look forward to higher visibility earlier than getting into. You’ll be able to see the entire record of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

Zacks’ Analysis Chief Picks Inventory Most More likely to “At Least Double”

Our specialists have revealed their Prime 5 suggestions with money-doubling potential – and Director of Analysis Sheraz Mian believes one is superior to the others. In fact, all our picks aren’t winners however this one might far surpass earlier suggestions like Hims & Hers Well being, which shot up +209%.

See Our Prime Inventory to Double (Plus 4 Runners Up) >>

Abbott Laboratories (ABT) : Free Inventory Evaluation Report

Hologic, Inc. (HOLX) : Free Inventory Evaluation Report

The Cooper Corporations, Inc. (COO) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.