- CHRW Inventory’s Six-Month Value Comparability

- Tailwinds Working in Favor of CHRW

- Spectacular Valuation Image for CHRW Inventory

- CHRW P/S Ratio (Ahead 12 Months) Vs. Trade

- What Do Earnings Estimates Say for CHRW?

- Headwinds Weighing on CHRW Inventory

- Time to Retain CHRW

- Radical New Expertise Might Hand Buyers Large Positive factors

Shares of C.H. Robinson Worldwide, Inc. (CHRW) have had fun on the bourses of late, bettering in double-digits over the previous six months. The encouraging worth efficiency resulted in CHRW outperforming its transportation-services trade within the mentioned timeframe. Moreover, CHRW’s worth efficiency seems favorable in contrast with that of different trade gamers like Expeditors Worldwide of Washington, Inc. (EXPD) and Schneider Nationwide, Inc. SNDR in the identical timeframe.

CHRW Inventory’s Six-Month Value Comparability

Picture Supply: Zacks Funding Analysis

Given the latest rally, the query that naturally arises is whether or not CHRW inventory can maintain its bullish worth efficiency or ought to traders ebook income now. Earlier than that, let’s delve deep to unearth the explanations behind this northward worth motion.

Tailwinds Working in Favor of CHRW

C.H. Robinson has been making uninterrupted dividend funds for greater than 25 years. Highlighting its pro-investor stance, the board of administrators(on Nov. 6, 2025) accepted a dividend hike of 1.6%, thereby elevating its quarterly money dividend to 63 cents per share ($2.52 annualized) from 62 cents ($2.48 annualized). The raised dividend will probably be paid on Jan. 5, 2026, to shareholders of document on the shut of enterprise on Dec. 5, 2025. The transfer displays CHRW’s intention to make the most of free money to reinforce its shareholders’ returns.

C.H. Robinson Worldwide, Inc. Dividend Yield (TTM)

C.H. Robinson Worldwide, Inc. dividend-yield-ttm | C.H. Robinson Worldwide, Inc. Quote

We wish to remind traders that CHRW has been constantly making efforts to reward its shareholders by dividends and share buybacks, that are encouraging. C.H. Robinson rewarded its shareholders in 2022 by a mix of money dividends amounting to $285.32 million and share repurchases value $1.45 billion. Persevering with the shareholder-friendly strategy, in 2023, CHRW paid $291.56 million in money dividends and repurchased shares value $63.88 million. Throughout 2024, CHRW returned $294.77 million within the type of money dividends (didn’t repurchase any shares). Through the first 9 months of 2025, CHRW returned $227.05 million within the type of money dividends and $240.25 million by share repurchases. As of Nov. 5, 2025, CHRW had nearly 118,403,777 shares excellent.

A lower in working expensesaids C.H. Robinson’s bottom-line outcomes. Through the first 9 months of 2025, working bills decreased 8.5% yr over yr to $1.5 billion. Personnel bills fell 6.2% yr over yr to $1.0 billion, owing to price optimization efforts and productiveness enhancements and the divestiture of our Europe Floor Transportation enterprise. Common worker headcount declined 10.9%. Different SG&A bills decreased 13.7% to $425.6 million, primarily because of a $57.0 million loss within the prior yr associated to the divestiture of our Europe Floor Transportation enterprise.

CHRW’s AI integration drives real-time pricing, costing, and automation by a robust mixture of machine studying, giant language fashions and autonomous brokers.

Spectacular Valuation Image for CHRW Inventory

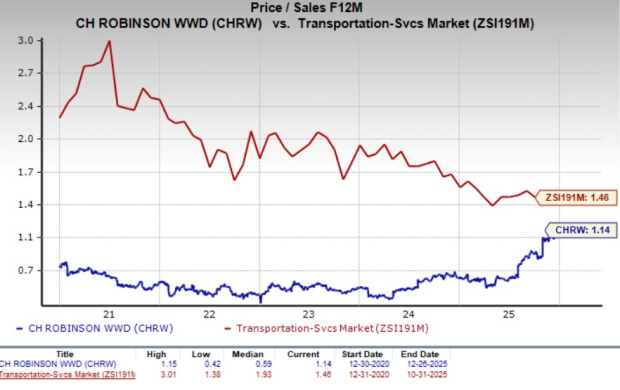

From a valuation perspective, CHRW is buying and selling at a reduction in comparison with the trade, going by its ahead 12-month price-to-sales ratio.

The inventory has a ahead 12-month P/S-F12M of 1.14X in contrast with 1.46X for the trade over the previous 5 years. These elements point out that the inventory’s valuation is engaging.

CHRW P/S Ratio (Ahead 12 Months) Vs. Trade

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

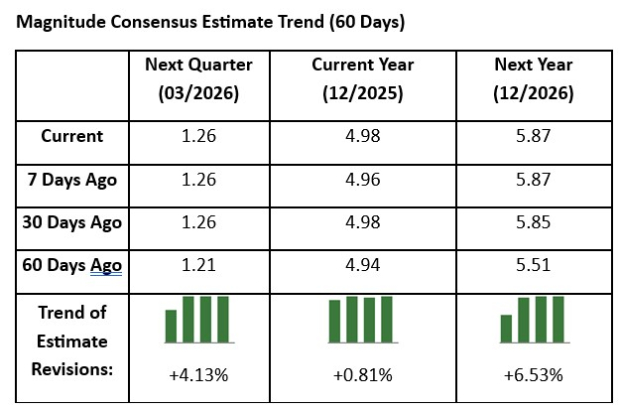

What Do Earnings Estimates Say for CHRW?

The optimistic sentiment surrounding the inventory is obvious from the truth that the Zacks Consensus Estimate for C.H. Robinson’s 2025 and 2026 earnings has been revised upward over the previous 60 days. The consensus mark for first-quarter 2026 earnings has additionally been projected northward up to now 60 days.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The favorable estimate revisions point out brokers’ confidence within the inventory.

Headwinds Weighing on CHRW Inventory

C.H. Robinson is being damage by weak freight demand. The highest line is being dented by decrease pricing in its truckload providers. The decrease truckload pricing displays an oversupply of truckload capability in comparison with freight demand.

Furthermore, CHRW’s weak liquidity place is regarding. On the finish of third-quarter 2025, the corporate’s money and money equivalents stood at $136.83 million, a lot decrease than the long-term debt of $1.18 billion. This means that the corporate doesn’t have ample money to satisfy its present debt obligations.

Time to Retain CHRW

It’s understood that CHRW inventory is attractively valued and has been constantly rewarding its shareholders by dividend payouts and share buybacks. We imagine such shareholder-friendly initiatives ought to increase investor confidence and positively affect the corporate’s backside line. Regardless of these positives, we advise traders to not purchase CHRW inventory now because of headwinds like weak freight demand. CHRW’s weak liquidity place can also be regarding.

We advise traders to attend for a greater entry level. For many who already personal the inventory, it will likely be prudent to remain invested. The corporate’s present Zacks Rank #3 (Maintain) justifies our evaluation. You’ll be able to see the whole checklist of in the present day’s Zacks #1 Rank (Robust Purchase) shares right here.

Radical New Expertise Might Hand Buyers Large Positive factors

Quantum Computing is the subsequent technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the know-how was years away, it’s already current and transferring quick. Massive hyperscalers, comparable to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what could possibly be “the subsequent massive factor” in quantum computing supremacy. Right this moment, you’ve got a uncommon likelihood to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

C.H. Robinson Worldwide, Inc. (CHRW) : Free Inventory Evaluation Report

Expeditors Worldwide of Washington, Inc. (EXPD) : Free Inventory Evaluation Report

Schneider Nationwide, Inc. (SNDR) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.