Asia session abstract

-

Japan’s November companies PPI printed as anticipated at an elevated 2.7% y/y

-

BOJ October minutes landed however had been largely missed after December’s fee hike

-

Broad USD weak spot lifted G10 FX, with JPY, AUD and KRW outperforming

-

APAC equities traded blended in skinny pre-holiday situations

-

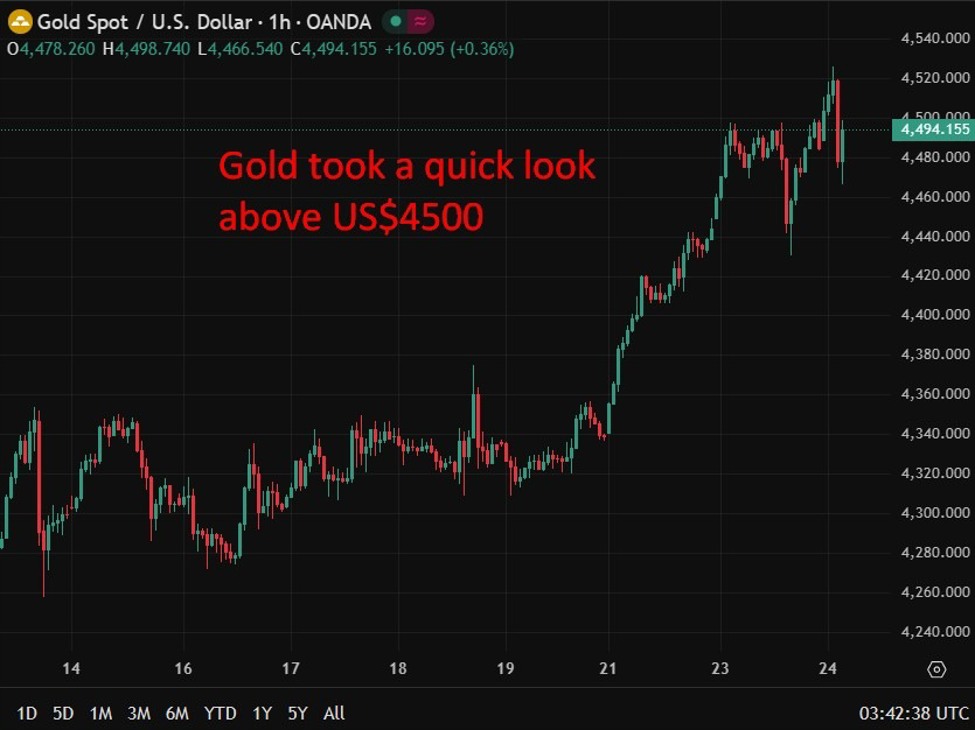

Gold and silver prolonged features, with silver breaking above US$72

Information and coverage alerts from Japan had been the early focus in Asia. Japan’s November Company Service Value Index , the services-sector PPI, printed in keeping with expectations at a still-elevated 2.7% year-on-year, reinforcing the view that underlying service-sector value pressures stay agency. The Financial institution of Japan additionally launched minutes from its October coverage assembly, although these attracted little consideration given they pre-dated December’s way more consequential determination to elevate the short-term coverage fee to its highest degree in round 30 years.

In FX markets, broad U.S. greenback weak spot dominated value motion. The greenback index remained on the again foot in holiday-thinned commerce, extending losses seen earlier within the week and pushing a number of G10 currencies to session highs. The yen continued to strengthen, supported by current official jawboning that strengthened authorities’ discomfort with extreme JPY weak spot. The Australian greenback additionally superior, whereas the euro and sterling pushed up towards three-month highs.

The standout transfer in Asia FX got here from South Korea, the place the gained strengthened sharply after stories that the nation’s pension fund had activated strategic foreign-exchange hedging measures — a growth seen as including institutional assist for the foreign money.

Asian fairness markets had been blended and largely range-bound, reflecting mild volumes as merchants wind down forward of the Christmas interval. Japan’s Nikkei 225 posted modest features, whereas Hong Kong’s Grasp Seng and the Shanghai Composite had been little modified. U.S. fairness futures traded quietly in a single day, hovering round flat in slender ranges.

In commodities, treasured metals prolonged their current surge. Gold briefly popped above the US$4,500 degree earlier than easing again under the psychological threshold, whereas silver pushed decisively greater once more, buying and selling above US$72 and outperforming on the session.