MercadoLibre MELI and JD.com JD characterize two of essentially the most outstanding e-commerce platforms working outdoors america, with MercadoLibre main throughout Latin America and JD.com commanding a robust presence in China. Each firms have advanced past conventional on-line marketplaces into vertically built-in ecosystems that mix commerce, proprietary logistics networks and increasing fintech operations, positioning themselves as complete digital commerce options of their respective areas.

As international traders search progress alternatives past U.S. e-commerce giants, MercadoLibre and JD.com supply contrasting publicity to giant rising markets with distinct aggressive dynamics and macroeconomic backdrops. Nevertheless, each face intensifying aggressive pressures whereas investing closely to defend market share, elevating the query of which firm is best positioned to ship returns. Allow us to delve deep to find out which one is a greater funding now.

The Case for MELI

MercadoLibre operates as a marketplace-centric platform with asset-light economics, differentiating from JD.com’s inventory-heavy first-party mannequin by commission-based revenues that require minimal working capital. This enterprise mannequin allows fast geographic growth throughout Latin America with out the procurement financing and stock danger inherent in direct merchandising approaches. MercadoLibre delivered 39% income progress within the third quarter of 2025 in comparison with JD.com’s 15% growth. Nevertheless, this progress differential got here alongside margin compression as working earnings grew simply 30%, revealing profitability trade-offs underlying the accelerated top-line efficiency.

The platform reached 75 million quarterly lively consumers with 7.8 million internet additions within the third quarter, demonstrating profitable consumer acquisition momentum. Nevertheless, sustaining this progress has required aggressive free delivery subsidies and promotional spending that compressed contribution margins to multi-year lows, as intensifying competitors forces ongoing funding in consumer acquisition relatively than near-term profitability optimization.

MercadoLibre’s fintech operations by Mercado Pago introduce stability sheet depth by bank card issuance and client lending. Practically 50% of bank card quantity now comes from worthwhile cohorts older than two years, validating the underwriting strategy in mature markets like Brazil. Nevertheless, simultaneous launches in Argentina and continued scaling in Mexico create near-term margin strain, whereas elevated funding prices in risky macroeconomic environments strain internet curiosity margins.

The Zacks Consensus Estimates for MELI’s 2025 EPS is pegged at $39.80 per share, down by 1.17% over the previous 30 days and indicating year-over-year progress of 5.6%.

MercadoLibre, Inc. Value and Consensus

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

The Case for JD

MercadoLibre’s fintech operations by Mercado Pago introduce stability sheet depth by bank card issuance and client lending. Practically 50% of bank card quantity now comes from worthwhile cohorts older than two years, validating the underwriting strategy in mature markets like Brazil. Nevertheless, simultaneous launches in Argentina and continued scaling in Mexico create near-term margin strain, whereas elevated funding prices in risky macroeconomic environments strain internet curiosity margins.

The platform’s vertically built-in logistics infrastructure spanning over 20 JD Malls and greater than 100 JD Equipment Metropolis flagship shops creates achievement differentiation in classes the place velocity and authenticity matter. Core electronics classes face persistent excessive comparability bases from prior-year authorities subsidies, whereas basic merchandise segments delivered 19% income progress as the corporate diversifies into less-penetrated classes.

JD.com’s market and promoting revenues accelerated to 24% progress within the third quarter of 2025, with lively service provider counts growing greater than 200% 12 months over 12 months, reflecting efforts to construct higher-margin income streams. Nevertheless, this ecosystem improvement stays earlier-stage in comparison with MercadoLibre’s established market dominance. The meals supply enterprise represents a strategic guess on capturing on-demand commerce synergies, although reaching profitability requires navigating intense competitors in a market dominated by established gamers.

The Zacks Consensus Estimates for JD’s 2025 EPS is pegged at $2.82 per share, unchanged over the previous 30 days and indicating a year-over-year decline of 33.8%.

JD.com, Inc. Value and Consensus

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

Value Efficiency and Valuation of MELI and JD

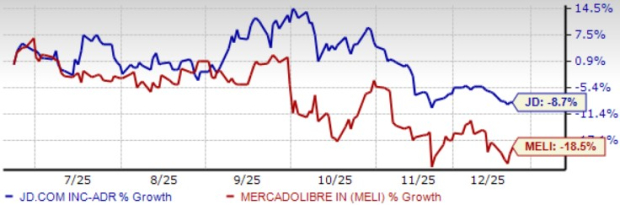

Over the trailing six-month interval, MELI shares have declined 18.5%, whereas JD shares have fallen 8.7%. MELI’s considerably weaker efficiency displays investor issues about margin compression from aggressive investments in free delivery subsidies and promotional spending to defend market share. JD.com’s extra modest decline suggests better investor confidence in its balanced progress strategy that sustains profitability enchancment alongside income growth. The efficiency divergence signifies market choice for JD.com’s disciplined execution, sustaining margin growth over MercadoLibre’s margin-sacrificing market share protection technique.

MELI vs. JD Value Efficiency

Picture Supply: Zacks Funding Analysis

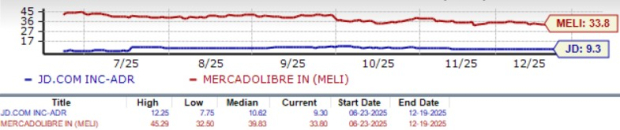

MercadoLibre trades at 33.8x ahead earnings in comparison with JD.com’s 9.3x a number of, a premium reflecting expectation for superior long-term progress from Latin American market growth potential. JD.com’s substantial valuation low cost seems disconnected from working fundamentals, given constant retail margin growth and accelerating market revenues. JD.com’s low cost seems engaging given its potential to maintain double-digit progress whereas bettering profitability, supporting stronger risk-adjusted returns than MercadoLibre’s growth-at-any-cost strategy inside intensifying aggressive dynamics.

MELI vs. JD Valuation

Picture Supply: Zacks Funding Analysis

Conclusion

JD.com’s disciplined strategy, balancing progress with margin growth, positions it favorably towards MercadoLibre’s profitability-sacrificing technique. The corporate’s accelerating market revenues and vertically built-in logistics assist ongoing profitability enchancment, whereas MercadoLibre faces persistent margin compression from aggressive aggressive investments. With a extra modest worth decline over the trailing six-month interval and buying and selling at lower than one-third of MercadoLibre’s ahead a number of, JD.com holds an edge for rising market e-commerce publicity. Each shares presently carry a Zacks Rank #3 (Maintain).

You may see the entire listing of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

5 Shares Set to Double

Every was handpicked by a Zacks professional as the favourite inventory to realize +100% or extra within the months forward. They embody

Inventory #1: A Disruptive Pressure with Notable Progress and Resilience

Inventory #2: Bullish Indicators Signaling to Purchase the Dip

Inventory #3: One of many Most Compelling Investments within the Market

Inventory #4: Chief In a Crimson-Scorching Business Poised for Progress

Inventory #5: Fashionable Omni-Channel Platform Coiled to Spring

A lot of the shares on this report are flying below Wall Avenue radar, which gives an ideal alternative to get in on the bottom flooring. Whereas not all picks will be winners, earlier suggestions have soared +171%, +209% and +232%.

Obtain Atomic Alternative: Nuclear Vitality’s Comeback free right now.

MercadoLibre, Inc. (MELI) : Free Inventory Evaluation Report

JD.com, Inc. (JD) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.