Rebounding additional off its multi-year lows, Lululemon LULU inventory spiked as a lot as +14% in Friday’s buying and selling session after delivering stronger-than-expected Q3 outcomes yesterday night and offering favorable steering.

Nonetheless buying and selling greater than 50% from a 52-week excessive of $423 a share, Lululemon’s Q3 report helped to calm fears of slower demand in its core U.S. market, together with tariff and inflation-related pressures which have squeezed margins.

Additional boosting investor confidence relating to its long-term worth, the retail attire chief licensed a $1 billion inventory repurchase plan. Lululemon additionally introduced its present CEO, Calvin McDonald, will step down by January, with the succession plan being welcomed after a difficult yr.

Picture Supply: Zacks Funding Analysis

Worldwide Growth Drives Sturdy Q3 Outcomes

Pushed by sturdy worldwide development, Lululemon’s Q3 gross sales elevated 7% yr over yr to $2.56 billion, exceeding estimates of $2.48 billion by 3%. Asia and Europe fueled the expansion particularly, exhibiting Lululemon’s model energy exterior North America, with worldwide markets income growing 33% whereas seeing 18% comparable retailer gross sales development.

Americas phase gross sales dipped 2%, with comparable retailer gross sales down 5%. Nevertheless, one other constructive spotlight included international digital gross sales of $1.1 billion, a 13% improve from Q3 2024, and contributing to 42% of whole income for the quarter.

On the underside line, Q3 EPS of $2.59 got here in 16% above expectations of $2.22 regardless of declining from $2.87 per share a yr in the past.

Lululemon’s Raised Steering

Elevating its full-year steering, Lululemon now expects annual gross sales at $10.96-$11.05 billion, up from prior forecasts of $10.85-$11 billion and above the present Zacks Consensus of $10.95 billion or 3% development. EPS targets have been elevated to a spread of $12.92-$13.02, from earlier steering of $12.77-$12.97 and above consensus estimates of $12.91, or a 12% lower.

Monitoring Lululemon’s Operational Effectivity

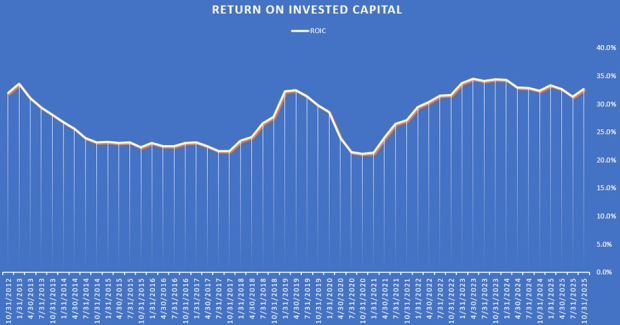

Lululemon’s working margins slipped to 17%, down from 20.5% within the comparative quarter. That stated, Lululemon’s retailer enlargement correlates with its excessive return on invested capital (ROIC) of 32%. Lululemon opened 14 new shops throughout Q3, bringing its whole retailer rely to 730 globally.

Lululemon’s ROIC has wavered in recent times, however the total uptick from a 20% ROIC in 2021 additionally signifies the corporate has continued to make use of its capital very effectively to generate income.

Picture Supply: Zacks Funding Analysis

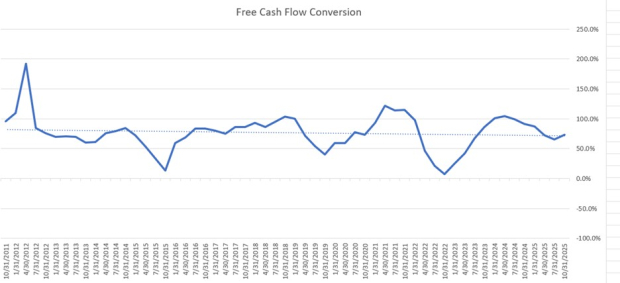

It is very important be aware, although, that Lululemon’s free money stream conversion price has fallen under the popular vary of 80% or greater (72.9%), making its money technology look weak relative to its web revenue. The decrease FCF conversion alerts that reported income aren’t absolutely translating into money and is commonly seen in corporations which might be increasing quickly and have money tied up in receivables, stock, or capital expenditures.

Picture Supply: Zacks Funding Analysis

Conclusion & Last Ideas

Following its stronger-than-expected Q3 report, Lululemon’s inventory lands a Zacks Rank #3 (Maintain). Whereas Lululemon hasn’t set the alarm off relating to liquidity considerations and has a comparatively sturdy stability sheet, the attire chief is not within the high tier of high quality corporations when it comes to operatinal effectivity.

Nonetheless, the growing ROIC is promising, and hopefully, Lululemon’s worldwide and digital gross sales enlargement will assist the corporate get again on observe to the stellar development that captivated buyers up to now. At present ranges, Lululemon’s affordable valuation of 14X ahead earnings is engaging to long-term buyers as nicely, even when higher shopping for alternatives are forward after the post-earnings rally.

Zacks’ Analysis Chief Picks Inventory Most Prone to “At Least Double”

Our consultants have revealed their High 5 suggestions with money-doubling potential – and Director of Analysis Sheraz Mian believes one is superior to the others. After all, all our picks aren’t winners however this one may far surpass earlier suggestions like Hims & Hers Well being, which shot up +209%.

See Our High Inventory to Double (Plus 4 Runners Up) >>

lululemon athletica inc. (LULU) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.