Buyers ought to observe that 2026 is shaping up as a pivotal yr for Chevron Company (CVX) and Suncor Power (SU). Each corporations have outlined detailed operational plans and capital priorities that may outline their monetary and strategic trajectories. For buyers weighing these two built-in Oil/Power names, the matchup comes all the way down to progress momentum, cash-flow predictability, capital effectivity and publicity to commodity-price swings.

Beneath is a comparability designed to assist buyers navigate these variations.

The Case for Chevron Inventory

Chevron’s 2026 plan is anchored by a collection of main upstream catalysts. The Tengizchevroil (TCO) enlargement is predicted to function at full manufacturing charges, contributing significant volumes and money move. Gulf of America deepwater tasks proceed to ramp up, and administration has highlighted that the Permian Basin is on monitor to succeed in 1 million barrels of oil equal per day, marking a key milestone for the portfolio. The finished Hess integration provides scale and improves long-term cash-generation potential, supported by roughly $1.5 billion in focused synergies.

These catalysts feed instantly into Chevron’s outlook for robust free-cash-flow progress. The corporate expects about $12.5 billion of extra annual free money move by 2026, supported by disciplined capital spending and a resilient asset base.

Chevron is concentrating on $3 to $4 billion in structural price reductions, with greater than 60% anticipated from effectivity positive factors. The Hess transaction additionally drives significant operating-cost enhancements. Collectively, these initiatives improve unit economics throughout Chevron’s world portfolio.

Chevron maintains probably the most constant shareholder-return frameworks within the sector, prioritizing regular dividend progress and versatile buybacks. Administration plans to repurchase $10 to $20 billion in shares yearly, adjusted for commodity costs.

Chevron’s diversified asset base throughout North America, Asia and Africa reduces publicity to any single market or commodity stream. Low-breakeven barrels and a robust stability sheet help sturdiness in downcycles.

The Case for Suncor Inventory

Suncor’s structural benefit lies in its very low company decline fee and the steadiness of its long-life oil sands property. Mining and upgrading operations present near-zero decline, and the corporate has mixed this with report reliability throughout the upstream and downstream community. In 2024, utilization hit report highs throughout a number of property, and refinery utilization has not too long ago averaged 101% to 102%, underscoring sustained operational execution.

Suncor’s enterprise mannequin helps predictable free-funds-flow era even in mid-$60 WTI environments. Its 2026 plan maintains this stability by combining disciplined sustaining capital with focused financial investments, together with in situ nicely pads, Fort Hills improvement and downstream optimization.

Suncor approaches effectivity from a distinct angle, emphasizing operational turnaround efficiency and breakeven reductions. Administration has executed best-ever turnaround durations at a number of property, lowered its WTI breakeven by $7 per barrel in 2024, and now operates at price ranges which might be higher than many friends. Its 2026 plan continues this momentum with focused investments to enhance flexibility and sturdiness throughout the oil sands community.

Suncor’s capital-return technique is extra assertive. With web debt already at its C$8 billion goal, the corporate has shifted to returning at or close to 100% of extra funds to its shareholders. This contains each buybacks and a dividend focused to develop 3-5% yearly. Suncor’s monitor report of excessive retail and downstream margins helps reinforce the reliability of those returns.

Suncor is extra concentrated in oil sands, which ties efficiency extra tightly to heavy-oil differentials and refining-market power. Nonetheless, its money move sensitivities stay manageable, and its built-in community of mining, in situ, and downstream property helps cushion worth volatility.

Value Efficiency

12 months-to-date worth motion favors Suncor, with SU shares up 24.2%, considerably outperforming Chevron’s 4.1% achieve. This divergence displays enhancing sentiment round Suncor’s operational execution and capital-return profile, whereas Chevron’s efficiency has been tempered by current estimate revisions and a extra measured manufacturing ramp. For momentum-focused buyers, Suncor at present holds the sting.

Picture Supply: Zacks Funding Analysis

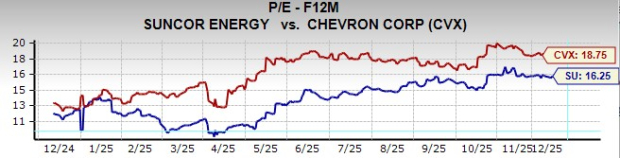

Valuation Comparability

From a valuation standpoint, Suncor additionally screens extra attractively. On a ahead 12-month price-to-earnings foundation, Chevron trades at roughly 19X, whereas Suncor trades simply above 16X. For value-oriented buyers, this a number of hole makes Suncor comparatively interesting.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

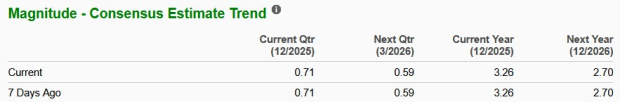

EPS Estimates

Earnings estimate momentum offers one other differentiator. On this entrance as nicely, Suncor at present holds a relative benefit.

Over the previous week, the Zacks Consensus Estimates for Chevron’s 2025 and 2026 EPS have moved decrease, reflecting near-term uncertainties round integration timing, capital spend and commodity sensitivities.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

However, Suncor’s EPS estimates have remained unchanged, highlighting higher stability in anticipated outcomes as the corporate enters 2026 with enhancing reliability and a low-decline manufacturing base.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Conclusion

Whereas each Chevron and Suncor keep a Zacks Rank #3 (Maintain), the near-term setup tilts in Suncor’s favor. The corporate’s stronger YTD inventory efficiency, extra enticing valuation and steadier earnings estimates complement its structural benefits, particularly low decline charges, report reliability and strong free-funds-flow sturdiness heading into 2026.

Chevron nonetheless provides compelling long-term attributes, together with world diversification, main mission catalysts and constant shareholder returns. Nonetheless, current estimate revisions and a premium valuation mood its relative enchantment within the present surroundings.

Buyers looking for worth, operational stability and better capital returns could discover Suncor higher positioned at this stage of the cycle, whereas Chevron stays a reliable selection for these prioritizing diversification and long-duration progress drivers.

You possibly can see the entire record of as we speak’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Zacks’ Analysis Chief Picks Inventory Most Prone to “At Least Double”

Our consultants have revealed their High 5 suggestions with money-doubling potential – and Director of Analysis Sheraz Mian believes one is superior to the others. In fact, all our picks aren’t winners however this one may far surpass earlier suggestions like Hims & Hers Well being, which shot up +209%.

See Our High Inventory to Double (Plus 4 Runners Up) >>

Chevron Company (CVX) : Free Inventory Evaluation Report

Suncor Power Inc. (SU) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.