- MP Inventory’s YTD Efficiency Towards Trade, Sector & S&P 500

- MP’s Efficiency vs. Power Fuels & Lynas

- Strategic Partnerships Gasoline MP’s Development Prospects

- MP Reviews Strong Manufacturing Numbers

- MP’s Earnings Estimates See Downward Revision Exercise

- MP Supplies Inventory Trades at a Premium

- MP Supplies Poised Nicely within the Lengthy Run

- Our Remaining Tackle MP Inventory

- Free Report: Making the most of the 2nd Wave of AI Explosion

MP Supplies MP shares have soared 98.9% previously six months, far outpacing the trade’s 11.8% progress, the Zacks Primary Supplies sector’s 11.8% rise and the S&P 500’s acquire of 15.9%.

The inventory’s rally has been pushed by main developments throughout this era. This contains the settlement with the USA Division of Battle (DoW), previously generally known as the Division of Protection, to speed up a home uncommon earth magnet provide chain, a long-term deal to produce Apple AAPL with recycled uncommon earth magnets, in addition to back-to-back stable manufacturing numbers within the second and third quarters of 2025.

MP Inventory’s YTD Efficiency Towards Trade, Sector & S&P 500

Picture Supply: Zacks Funding Analysis

Whereas MP Supplies has outshone one other participant within the uncommon earths house, Lynas Uncommon Earths Restricted LYSDY, which gained 49.5% previously six months, it has lagged Power Fuels UUUU, which has gained 175.6% in the identical time-frame.

MP’s Efficiency vs. Power Fuels & Lynas

Picture Supply: Zacks Funding Analysis

Whereas this rally might tempt traders, it is very important assess the underlying drivers and their sustainability, in addition to the corporate’s progress prospects and potential dangers, earlier than making any funding determination.

Strategic Partnerships Gasoline MP’s Development Prospects

In July, MP Supplies introduced a landmark long-term settlement to produce Apple with uncommon earth magnets manufactured in the USA, solely from recycled supplies. Apple and MP Supplies have collaborated over the previous 5 years to develop superior recycling know-how that allows recycled uncommon earth magnets to be processed into materials that meets Apple’s rigorous requirements. Additionally, in July, MP Supplies entered right into a partnership with the DoW that can fast-track the event of a home uncommon earth magnet provide chain.

In November, MP Supplies additionally introduced it has partnered with the DoW to ascertain a strategic three way partnership with the Saudi Arabian Mining Firm (Maaden) to develop a uncommon earth refinery within the Kingdom. This may leverage Saudi Arabia’s aggressive power base, stable infrastructure and the untapped uncommon earth sources.

MP Reviews Strong Manufacturing Numbers

MP Supplies is demonstrating robust progress in uncommon earth manufacturing, with back-to-back stable quarterly performances to date this 12 months. Manufacturing of neodymium and praseodymium (NdPr) reached 721 metric tons within the third quarter, a 51% surge from the year-ago quarter. This outscored MP Supplies’ earlier document NdPr manufacturing of 597 metric tons within the second quarter.

The corporate’s NdPr manufacturing quantities to 1,881 MT for the primary 9 months of 2025, 114% increased than the prior 12 months. MP has already surpassed its 2024 NdPr manufacturing of 1,294 MT. The corporate has been ramping up its NdPr manufacturing because it began manufacturing within the fourth quarter of 2023.

Uncommon Earth Oxide (REO) manufacturing was down 4% 12 months over 12 months to 13,254 metric tons (MT) within the third quarter. Regardless of this, it was the second-highest quarter on document within the firm’s historical past. MP Supplies had reported REO manufacturing of 13,145 metric tons within the second quarter of 2025.

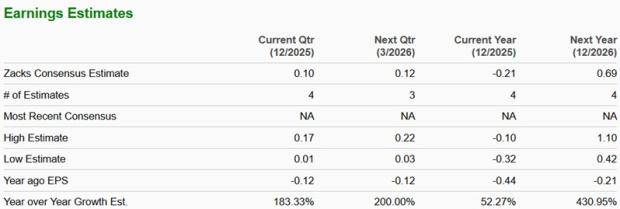

MP’s Earnings Estimates See Downward Revision Exercise

The Zacks Consensus Estimate for MP Supplies’ revenues is projected to develop 13.66% 12 months over 12 months in 2025, and additional 79% in 2026.

The consensus estimate for 2025 earnings is at present pegged at a lack of 21 cents per share. The estimate for 2026 stands at earnings of 69 cents per share, implying a possible turnaround.

Picture Supply: Zacks Funding Analysis

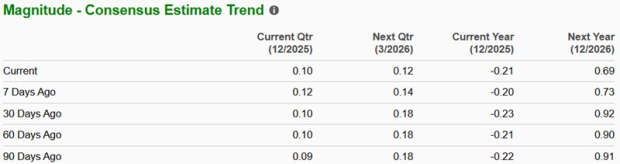

The Zacks Consensus Estimate for MP’s fiscal 2025 and 2026 earnings has moved south over the previous 90 days.

Picture Supply: Zacks Funding Analysis

MP Supplies Inventory Trades at a Premium

MP is buying and selling at a ahead 12-month worth/gross sales a number of of 25.41X, a big premium to the trade’s 1.44X. It has a Worth Rating of F.

Picture Supply: Zacks Funding Analysis

Power Fuels is buying and selling increased at 40.39X whereas Lynas is relatively a less expensive possibility, buying and selling at 11.11X.

MP Supplies Poised Nicely within the Lengthy Run

MP Supplies operates the Mountain Cross Uncommon Earth Mine and Processing Facility, the one uncommon earth mining and processing web site of scale in North America. These supplies are important for a variety of current and rising clean-tech applied sciences, together with electrical automobiles, wind generators, robotics, drones and protection programs. With China dominating the worldwide provide, the USA is more and more prioritizing the event of home uncommon earth capabilities.

The multibillion-dollar funding bundle and long-term commitments from DoW present MP Supplies the chance to capitalize on this. MP will assemble the second home magnet manufacturing facility (the 10X Facility), which can take complete U.S. uncommon earth magnet manufacturing capability to 10,000 metric tons and cater to each the protection and business sectors. Additionally, the $500 million settlement with Apple marks a transformative step for MP, launching its recycling platform and scaling up its magnet manufacturing enterprise.

Our Remaining Tackle MP Inventory

MP Supplies’ unmatched positioning within the U.S. provide chain, efforts to ramp up operations and premium partnerships with Apple and the DoW point out a sturdy progress runway. Traders holding MP shares ought to proceed to take action to learn from the stable long-term fundamentals.

Nevertheless, new traders can look ahead to a greater entry level, contemplating the premium valuation and the downward estimate revision exercise in earnings. MP inventory at present carries a Zacks Rank #3 (Maintain). You may see the entire checklist of immediately’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Free Report: Making the most of the 2nd Wave of AI Explosion

The following part of the AI explosion is poised to create important wealth for traders, particularly those that get in early. It would add actually trillion of {dollars} to the economic system and revolutionize practically each a part of our lives.

Traders who purchased shares like Nvidia on the proper time have had a shot at big features.

However the rocket experience within the “first wave” of AI shares might quickly come to an finish. The sharp upward trajectory of those shares will start to degree off, leaving exponential progress to a brand new wave of cutting-edge firms.

Zacks’ AI Growth 2.0: The Second Wave report reveals 4 under-the-radar firms that will quickly be shining stars of AI’s subsequent leap ahead.

Entry AI Growth 2.0 now, completely free >>

Apple Inc. (AAPL) : Free Inventory Evaluation Report

MP Supplies Corp. (MP) : Free Inventory Evaluation Report

Power Fuels Inc (UUUU) : Free Inventory Evaluation Report

Lynas Uncommon Earths Restricted – Sponsored ADR (LYSDY) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.