- RYAAY’s Raised Visitors Outlook for Fiscal 2026

- Elements Working in Favor of RYAAY Inventory

- Lengthy-Time period Debt to Capitalization

- RYAAY’s Value Efficiency Soars

- RYAAY Inventory YTD Value Comparability

- Headwinds Weighing on RYAAY Inventory

- Wrapping Up

- Zacks’ Analysis Chief Picks Inventory Most Prone to “At Least Double”

European provider, Ryanair Holdings RYAAY, has unveiled its raised visitors outlook for fiscal 2026, concurrent with its second-quarter fiscal 2026 earnings launch on Nov. 3, 2025. As we all know, greater visitors means extra passengers and with journey bookings rising throughout the trade, passenger revenues at Ryanair also needs to enhance, thereby contributing to the corporate’s top-line progress.

A raised steering all the time acts as a constructive indicator of the corporate’s prospects. Given this backdrop, the query that naturally arises is: Ought to traders purchase, maintain, or promote RYAAY inventory now? A extra in-depth evaluation is required to make that willpower. Earlier than diving into RYAAY’s funding prospects, let’s take a look at its monetary numbers.

RYAAY’s Raised Visitors Outlook for Fiscal 2026

Ryanair now expects its fiscal 2026 visitors to develop by greater than 3% to 207 million passengers (prior view: 206 million), owing to sooner than anticipated Boeing (BA) deliveries and strong demand throughout the first half of fiscal 2026. Unit prices carried out effectively within the first half of fiscal 2026 and, as beforehand guided, RYAAY anticipates solely modest unit price inflation throughout fiscal 2026 as B-8200 deliveries, gasoline hedging and efficient price management assist offset elevated air visitors management (ATC) fees, greater environmental prices and the roll-off of final yr’s modest supply delay compensation.

Though ahead bookings of the third quarter of fiscal 2026 are barely forward of the earlier yr, particularly throughout the October mid-term and Christmas peaks, RYAAY prefers to remain cautious throughout the second half of fiscal 2026. The third-quarter fare final result can be decided by close-in Christmas and New Yr bookings.

RYAAY just isn’t offering any revenue after tax steering for fiscal 2026. Nonetheless, the corporate is hopeful of recovering all of final yr’s 7% full-year fare decline, which ought to result in cheap web revenue progress in fiscal 2026. The ultimate fiscal 2026 final result stays uncovered to opposed exterior developments, which embrace battle escalation in Ukraine and the Center East, macro-economic shocks, and any additional influence of repeated European ATC strikes & mismanagement.

Elements Working in Favor of RYAAY Inventory

With journey bookings rising throughout the trade, Ryanair’s passenger revenues are additionally rising. Due to this air-travel demand power, RYAAY’s visitors grew 9% to 183.7 million passengers in fiscal 2024. Additional, we want to remind traders that Ryanair carried 200.2 million passengers (visitors up 9% yr over yr) in its fiscal yr ending March 2025, positioning itself as the primary European airline to succeed in 200 million passengers in a single yr. Because of this, RYAAY is now the world’s main low-fare airline by way of passenger visitors, with low fares and diminished prices performing as the first catalyst. Through the first half of fiscal 2026, RYAAY’s visitors grew 3% yr over yr to 119 million passengers.

Ryanair’s fleet-modernization initiatives to cater to the development in journey demand are encouraging. The inclusion of contemporary planes in its fleet and the retirement of the outdated ones align with its environmentally pleasant method. Between March 1999 and March 2025, Ryanair took supply of 532 Boeing 737NG plane, one Boeing 737-700 plane and 176 new Boeing 737-8200s underneath its contracts with Boeing and disposed of 122 Boeing 737NG plane, together with 77 lease hand-backs. Throughout fiscal 2025, Ryanair took supply of 30 new Boeing 737-8200 plane. The newest inclusions, other than having all fundamental facilities, end in improved gasoline effectivity.

As of the tip of October 2025, 204 of the 210 Boeing 737-8200 plane (to be bought underneath the 2014 contract) had been delivered. The remaining six plane are anticipated to be delivered forward of the summer time season of fiscal 2026, which inspires the corporate to anticipate 4% visitors progress to 215 million passengers throughout fiscal 2027.

In Could 2023, 300 new Boeing 737-MAX-10 plane orders had been positioned for supply between 2027 and 2033. Ryanair expects these fuel-efficient MAX jets to generate substantial progress.

RYAAY has a strong stability sheet. The low-cost provider ended second-quarter fiscal 2026 with money and money equivalents of $3.58 billion, a lot greater than the present debt stage of $1.40 billion. This means that the corporate has adequate money to fulfill its present debt obligations. RYAAY’s efforts to repay its money owed are encouraging as effectively. As of Sept. 30, 2025, RYAAY made €1.2 billion in debt repayments.

Lengthy-Time period Debt to Capitalization

Picture Supply: Zacks Funding Analysis

RYAAY can be lively on the share buyback entrance. Throughout fiscal 2025, Ryanair bought and canceled 7% of its issued share capital, comprising greater than 77 million shares, and has now retired nearly 36% of its issued share capital since 2008. In April 2025, RYAAY repurchased practically 1 million shares, finishing the €800 million share buyback program. In Could 2025, RYAAY’s board accepted a follow-on €750 million share buyback program. As of Sept. 30, 2025, RYAAY had bought (and canceled) greater than 7 million shares (nearly 25% of the programme) for €188 million.

RYAAY’s Value Efficiency Soars

Shares of RYAAY have had fun on the bourses of late, enhancing in double digits to date this yr. The encouraging value efficiency resulted in RYAAY outperforming the Zacks Airline trade within the mentioned timeframe. Moreover, RYAAY’s value efficiency is favorable to that of different airline operators like Alaska Air Group, Inc. (ALK) and Allegiant Journey Firm (ALGT) in the identical timeframe.

RYAAY Inventory YTD Value Comparability

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Headwinds Weighing on RYAAY Inventory

Manufacturing delays at Boeing have been hurting the fleet-related plans of most airline firms, and it’s no totally different for RYAAY. RYAAY is actively in talks with Boeing management to hurry up plane deliveries and has additionally visited Seattle at first of January. Though B737 manufacturing is recovering from Boeing’s strike in late 2024, it’s nonetheless sluggish to ship adequate plane forward of the summer time season of fiscal 2026.

RYAAY anticipates the remaining six Gamechangers of the 210 orderbook are prone to be delivered earlier than the summer time of 2026. Moreover, Boeing expects the MAX-10 to be licensed in mid-2026, adopted by the supply of the primary 15 MAX-10s in Spring 2027 (with 300 of those fuel-efficient plane supply due by March 2034).

Escalating working bills attributable to excessive workers prices and better air visitors management charges are hurting Ryanair’s backside line. Through the first half of fiscal 2026, workers prices elevated 3% yr over yr attributable to greater sectors and agreed pay will increase. Airport and dealing with fees rose 4% yr over yr owing to visitors progress, greater touchdown, floor air visitors management, and dealing with charges. Because of this, complete working bills grew 4% yr over yr, owing to greater workers and different prices, which had been partly attributable to Boeing supply delays. This was partially offset by gasoline hedge financial savings. Excessive prices naturally put strain on margins.

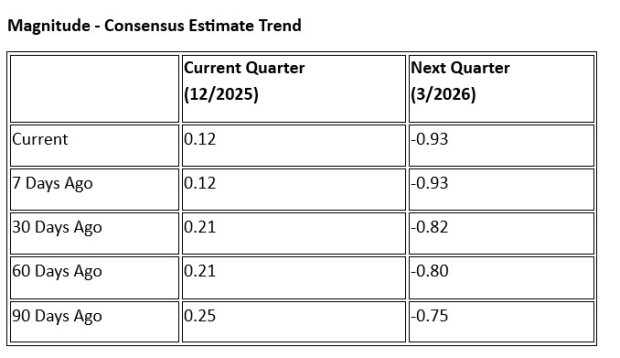

Given these headwinds surrounding the inventory, earnings estimates have been southbound, as proven under.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Wrapping Up

It’s understood that RYAAY’s high line continues to learn from the resurgent journey state of affairs. RYAAY’s raised visitors outlook for fiscal 2026 is an encouraging transfer, which is prone to impress traders. RYAAY’s measures to increase its fleet, to cater to the rising journey demand, look encouraging. A strong stability sheet permits RYAAY to reward its shareholders within the type of share buybacks and dividend funds. Regardless of these positives, we advise traders to not purchase RYAAY shares now attributable to headwinds just like the manufacturing delays at Boeing, excessive workers prices and escalated air visitors management charges.

We advise traders to attend for a greater entry level. For many who already personal the inventory, it is going to be prudent to remain invested. The corporate’s present Zacks Rank #3 (Maintain) justifies our evaluation. You’ll be able to see the whole record of at this time’s Zacks #1 Rank (Robust Purchase) shares right here.

Zacks’ Analysis Chief Picks Inventory Most Prone to “At Least Double”

Our consultants have revealed their High 5 suggestions with money-doubling potential – and Director of Analysis Sheraz Mian believes one is superior to the others. After all, all our picks aren’t winners however this one might far surpass earlier suggestions like Hims & Hers Well being, which shot up +209%.

See Our High Inventory to Double (Plus 4 Runners Up) >>

Ryanair Holdings PLC (RYAAY) : Free Inventory Evaluation Report

Alaska Air Group, Inc. (ALK) : Free Inventory Evaluation Report

Allegiant Journey Firm (ALGT) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.