Annaly Capital Administration, Inc. NLY shares touched a brand new 52-week excessive of $22.80 throughout Wednesday’s buying and selling session. Nevertheless, the inventory closed the session slightly decrease at $22.67.

Over the previous three months, NLY shares have gained 7% outperforming the business’s development of 0.2%. Additional, it fared higher than its shut friends, Invesco Mortgage Capital Inc. IVR and Two Harbors Funding Corp. TWO.

Value Efficiency

Picture Supply: Zacks Funding Analysis

Elements Fueling NLY Momentum

Easing Mortgage Charges: The Federal Reserve has diminished coverage charges twice in 2025 and has remained cautious about delivering a possible third minimize by year-end. Given this, mortgage charges are easing. Per a Freddie Mac report, the typical price on a 30-year fixed-rate mortgage was 6.23% as of Nov. 26, 2025, down from 6.26% within the earlier week and 6.81% in the identical week a 12 months in the past.

Given the decline in mortgage charges, buy originations are seemingly to enhance within the upcoming interval. Refinance volumes are additionally anticipated to rise as a result of gradual fall in borrowing prices.

It will more likely to enhance web curiosity unfold, enhancing the portfolio’s total yield, supporting the financials of NLY within the upcoming interval.

Prudent Funding Technique: The corporate follows a disciplined funding technique, specializing in cautious asset choice and efficient capital allocation to realize steady and constant returns. It primarily invests in conventional Company mortgage-backed securities (MBSs), which provide draw back safety, whereas additionally focusing on non-agency and credit-focused asset courses to reinforce total returns. Its scaled mortgage servicing rights (MSR) platform advantages from a low prepayment atmosphere, and the corporate continues to strengthen this platform by means of strategic partnerships. In October 2025, Annaly entered a long-term subservicing and MSR buy settlement with PennyMac Monetary Companies, leveraging PennyMac’s strong servicing infrastructure and recapture capabilities to increase scale and enhance operational efficiencies. As of Sept. 30, 2025, Annaly’s whole funding portfolio stood at $97.8 billion, reflecting a balanced and diversified strategy designed to help long-term development.

Company MBS Publicity Offers Draw back Safety: Annaly advantages from a major allocation to Company MBS, backed by government-sponsored enterprises, which ensures principal and curiosity funds and makes these investments comparatively safer. Administration stays optimistic concerning the 2025 outlook, noting that Company MBS at the moment gives enticing relative returns in contrast with funding prices. As of Sept. 30, 2025, $87.3 billion of Annaly’s portfolio consisted of extremely liquid Company MBS, most of which carry an precise or implied ‘AAA’ ranking, supporting enticing risk-adjusted returns within the fixed-income markets and reinforcing the corporate’s defensive positioning.

First rate Liquidity Place: Annaly continues to prioritise liquidity and prudent leverage administration to navigate market volatility successfully. As of Sept. 30, 2025, the corporate held $8.8 billion in whole property out there for financing, together with $5.9 billion in money and unencumbered Company MBS, offering ample liquidity throughout antagonistic market situations. This respectable liquid place equips Annaly to maintain its operations and capitalize on alternatives, even amid durations of financial stress and financial-market uncertainty, reinforcing its total monetary resilience.

Sustainable Capital Distribution: Annaly has demonstrated a continued concentrate on shareholder returns by means of disciplined capital administration. On Jan. 31, 2025, the corporate’s board permitted a brand new frequent share repurchase program, authorizing as much as $1.5 billion in buybacks by means of Dec. 31, 2029. Whereas no shares have been repurchased underneath this plan but, this system gives important flexibility.

Other than the share repurchase program, the corporate pays common dividends. In March 2025, NLY raised its money dividend by 7.7% to 70 cents per share. Over the previous 5 years, the corporate has raised its dividend as soon as. Its present dividend yield stands at 12.3%, barely above the business common of 12.1%, whereas Invesco Mortgage and Two Harbors Funding supply yields of 16.7% and 13.3%, respectively.

Dividend Yield

Picture Supply: Zacks Funding Analysis

What’s Hurting NLY’s Progress

Market Volatility: NLY’s working efficiency is intently tied to broader monetary markets and macroeconomic situations. Volatility in mortgage markets, interest-rate swings, and antagonistic shifts within the yield curve might have an effect on its investments. Regardless of the Federal Reserve decreasing coverage charges, elevated mortgage charges proceed to stress fixed-income property and widen spreads. Consequently, near-term advantages could also be muted, and the corporate’s efficiency may stay constrained underneath persistent market and macroeconomic uncertainties.

Portfolio Changes Amid Market Volatility: The corporate actively adjusts its funding portfolio to navigate evolving monetary situations. With a hedge ratio of 92% as of the third quarter of 2025, the corporate prioritizes danger and liquidity administration. Consequently, within the brief time period, sturdy returns might stay restricted, and e-book worth could possibly be affected, reflecting a cautious strategy to present market volatility.

NLY’s Estimates and Valuation Evaluation

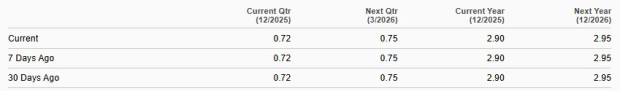

Analysts preserve a impartial stance on the corporate’s earnings development potential. Over the previous month, the Zacks Consensus Estimate for earnings for 2025 and 2026 has remained unchanged. The projected determine implies a development of seven.4% for 2025 and 1.5% for 2026.

Estimates Revision Development

Picture Supply: Zacks Funding Analysis

From a valuation perspective, NLY seems costly. The corporate’s 12-month trailing value to e-book (P/B) ratio of 1.17X is above the business’s 0.97X. In the meantime, Invesco Mortgage has a trailing P/B ratio of 0.90X whereas Two Harbors Funding is buying and selling at 0.91X.

Value-to-E book TTM

Picture Supply: Zacks Funding Analysis

Parting Ideas on NLY Inventory

Annaly’s new 52-week excessive displays enhancing sentiment round mortgage charges, stronger portfolio stability, and ongoing strategic enhancements in its MSR platform and Company MBS allocation. The corporate’s disciplined funding posture, ample liquidity, and dedication to shareholder returns add to its enchantment, particularly for income-focused traders.

Nevertheless, valuation stays stretched relative to the business, and heightened market volatility may restrain near-term efficiency. With earnings estimates holding regular and macro uncertainty nonetheless in play, NLY might supply enticing long-term defensiveness however restricted short-term upside. As such, traders ought to weigh the corporate’s stable fundamentals towards broader interest-rate dangers earlier than making new allocations at present ranges.

NLY at the moment carries a Zacks Rank #3 (Maintain). You may see the whole listing of at the moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Radical New Know-how May Hand Traders Enormous Good points

Quantum Computing is the subsequent technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and shifting quick. Giant hyperscalers, reminiscent of Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Cook dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s huge potential again in 2016. Now, he has keyed in on what could possibly be “the subsequent large factor” in quantum computing supremacy. Right this moment, you’ve gotten a uncommon likelihood to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

Two Harbors Investments Corp (TWO) : Free Inventory Evaluation Report

INVESCO MORTGAGE CAPITAL INC (IVR) : Free Inventory Evaluation Report

Annaly Capital Administration Inc (NLY) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.