The worldwide race for essential minerals is accelerating, and two corporations — United States Antimony Company UAMY and The Metals Firm TMC — have positioned themselves at pivotal however very completely different strategic fronts. Whereas UAMY is executing a speedy revival of home antimony mining and processing, supported by operational enlargement and authorities initiatives, TMC is advancing an bold deep-sea nodules technique geared toward offering the USA with long-term independence in nickel, cobalt, manganese and copper.

Each corporations stand at inflection factors — UAMY with near-term income momentum and rising home capability, and TMC with long-dated, capital-intensive tasks concentrating on massive future payoffs.

This text examines their monetary efficiency, operational progress, and strategic milestones to evaluate how every firm is positioned within the evolving essential minerals ecosystem.

Inventory Value Efficiency of UAMY and TMC

12 months to this point, shares of United States Antimony Company and The Metals Firm have gained 425% and 227.1%, respectively.

Picture Supply: Zacks Funding Analysis

The Case for UAMY

UAMY’s efficiency via 2025 displays an organization within the midst of a cloth turnaround, pushed primarily by surging antimony demand and strengthened operations. Financially, UAMY delivered 160% year-over-year income development within the first half of 2025, reaching $17.5 million, with gross revenue rising 183% throughout the identical interval. By the third quarter, revenues for 9 months reached $26.2 million, up 182%, whereas gross margins expanded from 24% to twenty-eight% regardless of pricing strain in antimony markets. Sturdy warrant workouts and inventory gross sales boosted money and investments to $38.5 million with minimal long-term debt, giving UAMY flexibility to scale its mining and processing footprint.

Non-financially, UAMY’s most notable achievement in 2025 is the restoration of home antimony mining — an trade that has been dormant for many years. At Stibnite Hill in Montana, the corporate has begun extracting bulk samples with ore grades anticipated to exceed 10% antimony, representing the primary U.S. antimony mining in roughly 40 years.

UAMY additionally superior a number of exploration packages throughout Alaska and Ontario, together with trenching, gravity surveys, property acquisition, and assay packages concentrating on antimony, cobalt and tungsten. Though regulatory delays in Alaska slowed progress, the corporate mitigated this by buying non-public land, permitting exploration to proceed with out state or federal allowing bottlenecks.

UAMY’s processing developments are equally vital. The corporate expanded capability at its Thompson Falls facility, refurbished furnaces and elevated employees to deal with rising ore inflows and file stock ranges. Administration emphasised that UAMY stays the one home processor and producer of antimony merchandise, together with military-spec antimony trisulfide, which strengthens its alignment with U.S. protection supply-chain priorities.

Strategically, UAMY is extending its imaginative and prescient past antimony. The acquisition and analysis of the Fostung tungsten deposit and the Iron Masks cobalt property place the corporate to copy its antimony mannequin throughout extra essential minerals the place no home manufacturing at present exists.

Discussions with federal companies, such because the Protection Logistics Company (“DLA”) and the Protection Industrial Base Consortium (“DIBC”), spotlight UAMY’s rising governmental relevance, notably as the USA seeks resilient non-Chinese language sources for strategic supplies.

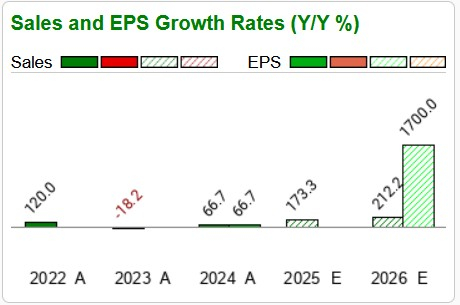

UAMY’s Earnings Progress Estimate

Picture Supply: Zacks Funding Analysis

The Case for TMC

In distinction to UAMY’s near-term manufacturing mannequin, TMC is executing a long-cycle technique centered on harvesting polymetallic nodules from the deep seabed. Whereas TMC reported no revenues within the final two quarters, its progress has been closely focused on regulatory development, mission financing and technological validation. The corporate printed two main research — a Prefeasibility Examine for the NORI-D mission and an Preliminary Evaluation (IA) for broader sources — indicating a mixed internet current worth of greater than $23 billion.

TMC’s operational milestones spotlight vital progress in each extraction and processing. The corporate detailed engineering improvements in its nodule collector system, together with Coanda nozzles, lowered sediment consumption, superior buoyancy methods, and managed plume administration — reflecting many years of technological developments for the reason that Nineteen Seventies.

TMC has additionally superior onshore processing pathways, efficiently changing nodule-derived manganese silicate into battery-grade manganese sulfate, complementing its earlier manufacturing of nickel and cobalt sulfates — an necessary step in demonstrating full precursor cathode energetic materials (pCAM) compatibility.

Regulatory momentum underneath the U.S. Deep Seabed Arduous Mineral Sources Act is central to TMC’s enterprise mannequin. All through 2025, the corporate secured full compliance for exploration functions, progressed towards allow certification and aligned its timeline with anticipated business restoration in fourth-quarter 2027. The corporate additionally strengthened partnerships with Nauru, Tonga, Allseas, and Korea Zinc — supporting offshore operations, refining capacit, and U.S. provide chain integration.

Financially, TMC reported a robust liquidity place with $165 million in money and over $400 million potential from warrants, signaling that near-term stability sheet pressures stay manageable regardless of zero revenues within the improvement section. The corporate’s long-term manufacturing mannequin envisions EBITDA margins approaching 50% by 2040 as refining operations scale.

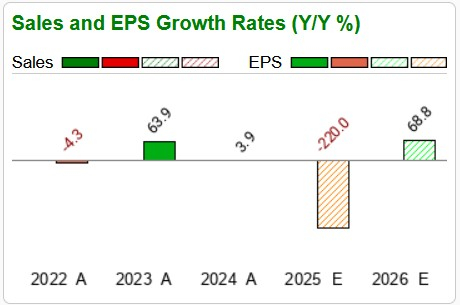

TMC’s Earnings Progress Estimate

Picture Supply: Zacks Funding Analysis

Conclusion

UAMY and TMC signify two ends of the essential minerals improvement spectrum. UAMY is executing speedy near-term development pushed by rising antimony manufacturing and increasing home mining capabilities. TMC, in the meantime, is constructing a far-reaching seabed-to-battery mineral ecosystem able to reshaping U.S. nickel, cobalt, manganese and copper provide chains. Each corporations advance strategic U.S. pursuits, however their risk-reward profiles differ — UAMY presents fast operational traction, whereas TMC guarantees huge long-term scale as soon as regulatory and technical milestones are reached.

Nonetheless, UAMY at present holds Zacks Rank #4 (Promote) and TMC carries a Zacks Rank #3 (Maintain). Though the basics of each corporations look promising, the Zacks Rank means that buyers ought to preserve their present place in The Metals Firm. Nonetheless, the correction in UAMY shares might proceed following a robust rally.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in essentially the most vital wealth-building alternatives of our time.

At the moment, you may have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we consider will win the quantum computing race and ship huge positive factors to early buyers.

United States Antimony Company (UAMY) : Free Inventory Evaluation Report

TMC the metals firm Inc. (TMC) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.