Bristol Myers BMY has a sturdy oncology portfolio, together with the blockbuster immune-oncology medication, Opdivo, Opdivo Qvantig and Yervoy, amongst others.

Opdivo is a key drug in BMY’s development portfolio that’s authorised for a number of oncology indications. The drug, authorised for quite a few oncology indications, is without doubt one of the prime income turbines for BMY.

Constant label enlargement of the drug has enabled it to keep up momentum. Opdivo gross sales have been roughly $2.5 billion within the third quarter, up 7%, pushed primarily by continued demand. U.S. gross sales are being pushed by a powerful launch in MSI-high colorectal most cancers and continued development in first-line non-small cell lung most cancers, whereas worldwide gross sales are supported by label expansions of the drug.

The approval of Opdivo Qvantig (nivolumab and hyaluronidase-nvhy) injection for subcutaneous use has bolstered Opdivo’s franchise. The preliminary uptake has been sturdy. Gross sales totaled $67 million within the third quarter, fueled by continued use throughout all indicated tumor sorts in addition to the everlasting J-Code obtained within the quarter.

The corporate now expects world Opdivo gross sales, along with Qvantig, to extend within the excessive single digit to low double-digit vary in 2025 (earlier steering: mid to excessive single-digit vary in 2025), pushed by sturdy efficiency 12 months up to now.

We notice that BMY is at present banking on the label enlargement of authorised medication and approval of recent medication to stabilize its income base, as its legacy medication (Revlimid, Pomalyst, Sprycel and Abraxane) face generic competitors.

Competitors for BMY’s Oncology Medicine

Whereas the label enlargement of Opdivo is optimistic, the immuno-oncology house is dominated by pharma big Merck’s MRK blockbuster drug Keytruda (pembrolizumab), together with Roche’s RHHBY Tecentriq.

Keytruda is authorised for a number of sorts of most cancers and alone accounts for greater than 50% of MRK’s pharmaceutical gross sales. Merck is at present engaged on totally different methods to drive long-term development of Keytruda.

Roche’s immuno-oncology Tecentriq can be authorised for varied oncology indications — early-stage (adjuvant) NSCLC, small cell lung most cancers, hepatocellular carcinoma and breast most cancers, amongst others. Along with intravenous infusion, Roche has additionally obtained approval for Tecentriq as a subcutaneous injection.

BMY’s Value Efficiency, Valuation and Estimates

Shares of Bristol Myers have misplaced 12.9% 12 months up to now towards the trade’s development of 19.5%.

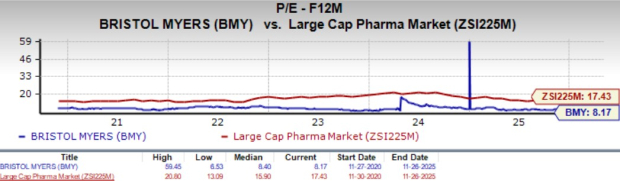

Picture Supply: Zacks Funding Analysis

From a valuation standpoint, BMY is buying and selling at a reduction to the large-cap pharma trade. Going by the value/earnings ratio, BMY’s shares at present commerce at 8.17x ahead earnings, decrease than its imply of 8.40x and the large-cap pharma trade’s 17.47X.

Picture Supply: Zacks Funding Analysis

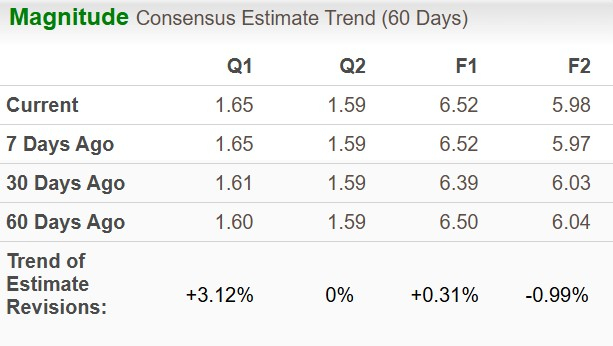

The Zacks Consensus Estimate for 2025 earnings per share has moved north up to now 60 days, whereas that for 2026 EPS has moved south.

Picture Supply: Zacks Funding Analysis

BMY at present carries a Zacks Rank #3 (Maintain). You possibly can see the whole record of at this time’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Quantum Computing Shares Set To Soar

Synthetic intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in probably the most important wealth-building alternatives of our time.

As we speak, you’ve gotten an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Past AI: The Quantum Leap in Computing Energy, you may uncover the little-known shares we consider will win the quantum computing race and ship huge positive factors to early buyers.

Roche Holding AG (RHHBY) : Free Inventory Evaluation Report

Bristol Myers Squibb Firm (BMY) : Free Inventory Evaluation Report

Merck & Co., Inc. (MRK) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.