TL;DR

- The worth of Satoshi Nakamoto’s holdings fell from $137B to $95B following Bitcoin’s correction, producing over $43B in unrealized losses.

- The decline affected your complete crypto wealth ecosystem: 17 new billionaires and 254 centimillionaires noticed their fortunes shrink by greater than 30%.

- The focus of wealth in BTC additionally impacts politics, though extended corrections may restrict this affect.

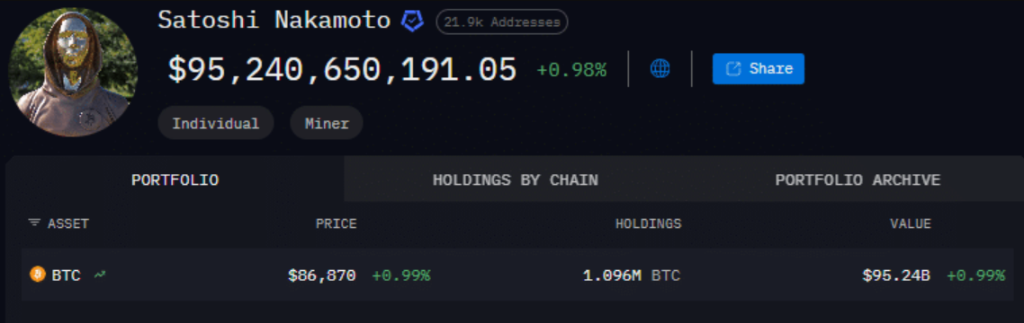

The worth of Satoshi Nakamoto’s holdings, estimated at 1.096 million Bitcoins, dropped from $137B to $95B, leading to over $43B in unrealized losses.

At this stage, Nakamoto ranks because the 18th richest particular person on the earth, simply above Mukesh Ambani ($92.5B) and under Michael Dell ($97B). The decline stems from Bitcoin’s value correction from its $126K peak to the present $89K, a drop of over 30% in only a few weeks.

BTC’s collapse comes after a 12 months of excessive wealth creation within the crypto ecosystem. From the $16K lows in the course of the 2022 crypto winter, the worth rose greater than 400%, producing 241,000 crypto millionaires by mid-2025. Over 145,000 of them attributed their wealth on to Bitcoin.

Bitcoin Dropped 30% and Pulled Down the Wealth of A number of Billionaires

Amongst them, 17 reached billionaire standing and 254 turned centimillionaires solely by holding BTC. Nonetheless, the decline over the previous month and a half minimize the wealth of many of those buyers by 30% or extra, highlighting the acute volatility attribute of the crypto market.

Wealth concentrated in BTC additionally influences politics. Traders such because the Winklevoss twins elevated their contributions to assist pro-crypto lawmakers within the U.S. midterm elections. Their objective is to guard their pursuits as crypto business laws evolve. Nonetheless, critics like Peter Schiff warn that an prolonged correction may restrict crypto donors’ affect in Congress, affecting political strain and legislative choices.

From a market perspective, Glassnode identifies key reference ranges: the True Market Imply ($81.3K) and the Realized Worth ($56K). Bitcoin’s restoration will rely on macroeconomic stability, world liquidity, and the habits of different danger belongings.

Even the biggest crypto fortunes are uncovered to volatility, and BTC holdings can expertise sudden changes, instantly impacting private wealth, institutional funding, and affect over the worldwide crypto business