Be a part of Our Telegram channel to remain updated on breaking information protection

JPMorgan warned that Michael Saylor’s Bitcoin treasury agency Technique faces a $12 billion menace from MSCI and different index suppliers which will delist the corporate.

The warning comes after MSCI mentioned in an Oct. 10 assertion that it’s contemplating excluding corporations whose digital asset holdings symbolize greater than 50% of their whole belongings from the MSCI International Investable Market Indexes. Its choice is due on Jan. 15.

If that occurs, JPMorgan analysts led by Nikolaos Panigirtzoglou mentioned in a word this week that Technique may even see as a lot as $2.8 billion in liquidity go away, including that billions extra would observe if different index suppliers adopted its lead.

Passive funds utilizing index-based allocations maintain some $9 billion of the Bitcoin purchaser’s inventory, it mentioned, by way of indexes together with MSCI USA and Nasdaq 100.

“Whereas lively managers aren’t obligated to observe index modifications, exclusion from main indices will surely be seen negatively by market individuals,” the analysts wrote.

MSCI mentioned in its assertion that some digital asset treasury corporations could also be extra much like funding funds that aren’t eligible for inclusion in its indexes.

Odds that MSCI does exclude Technique and different digital asset treasury corporations from its indexes are ”solidly in favor of it,” Charlie Sherry, head of finance at BTC Markets, informed CoinTelegraph. It ”solely places modifications like this into session after they’re already leaning that means,”

MARA, Metaplanet, Riot Platforms Additionally At Threat

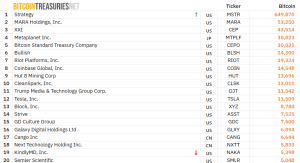

A preliminary checklist launched by MSCI reveals that 38 crypto corporations, together with Technique, may very well be affected by the choice. Among the many different corporations which might be on MSCI’s radar are SharpLink Gaming, Riot Platforms, Marathon Digital, and others.

Prime 10 largest company BTC holders (Supply: Bitcoin Treasuries)

Saylor Says Technique Is “Indestructible” As MSTR Plunges Additional

Technique is the biggest company Bitcoin holder globally. Information from BitcoinTreasuries reveals the agency at present has 649,870 BTC on its stability sheet.

However Bitcon’s dizzying 34% collapse because it hit an all-time excessive of $126,198 on Oct. 6 additionally hammered Technique’s inventory worth, which has plunged greater than 56% prior to now month, in accordance to Google Finance.

MSTR prolonged its downtrend with one other 5% drop prior to now 24 hours whereas Bitcoin plunged greater than 9% to commerce at $83,591 as of three:50 a.m. EST.

Saylor responded to considerations that Bitcoin’s slide may pile extra stress on Technique in a CNBC interview this week, arguing that Technique is the “greatest capitalized firm within the crypto financial system.”

₿etter than Ever. At this time I used to be the warm-up act for @natbrunell as we each talked Bitcoin with @cvpayne. You’ll wish to hear what she needed to say. pic.twitter.com/vDaFceyeza

— Michael Saylor (@saylor) November 18, 2025

“We have now billions of {dollars} of liquidity within the fairness on daily basis, and our credit score devices are 100 occasions extra liquid than the common most popular fairness,” he added.

He mentioned that Technique is “engineered to take an 80% to 90% drawdown” and nonetheless “carry on ticking.”

“So I believe we’re fairly indestructible,” he mentioned.

Bitcoin permabear Peter Schiff has referred to as Technique’s enterprise mannequin “a fraud,” and mentioned in an X submit earlier immediately that Saylor’s agency would “have been higher off” had it “purchased nearly some other asset.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection