GitLab GTLB and Atlassian TEAM sit on the middle of the enterprise DevSecOps and software-workflow panorama. Each platforms assist engineering groups plan, construct, safe and ship software program at scale, and each have grow to be important as AI reshapes how code is created and managed. GitLab delivers a unified end-to-end DevSecOps platform that integrates supply code, CI/CD, safety and compliance right into a single workflow. Atlassian presents a broad suite of developer-workflow instruments, anchored by Jira, Confluence and Bitbucket, that streamline planning, collaboration and code administration. Their overlap lies squarely in orchestrating software program lifecycles, coordinating developer workflows and embedding automation and safety into on a regular basis improvement.

Per Analysis Nester, the DevSecOps market is valued at $10 billion in 2025 and is projected to achieve $37 billion by 2035, witnessing a 14% CAGR as enterprises speed up safe software program supply and AI-driven improvement pipelines. That shift suggests how rapidly safe, built-in, automation-heavy DevOps tooling is turning into foundational fairly than non-obligatory. Each GitLab and Atlassian stand to learn as firms modernize improvement practices, automate code workflows and undertake AI-enhanced engineering fashions.

Let’s delve deep to find out which one is a greater funding now.

The case for GTLB

GitLab stands out by delivering a unified, security-native DevSecOps platform that brings supply code, CI/CD automation, vulnerability scanning, coverage enforcement and deployment into one end-to-end setting. Its structure eliminates the multi-tool sprawl that many enterprises face, permitting improvement, safety and operations groups to work from a single system of file. This contrasts with Atlassian’s broader collaboration suite and has appealed to organizations prioritizing secure-by-default pipelines and tighter governance throughout software program lifecycles.

GitLab’s benefit has expanded with deeper AI integration throughout the DevSecOps chain. GitLab Duo now helps agentic automation, contextual code solutions and AI-driven safety remediation straight inside CI/CD pipelines. These capabilities scale back handbook steps, strengthen compliance and speed up safe releases with out requiring extra instruments or integrations. The platform’s design embeds AI on the level the place code adjustments meet safety and operational controls, a important differentiator as enterprises modernize towards AI-assisted improvement.

Adoption patterns mirror this shift towards built-in, security-heavy DevSecOps. Enterprises in banking, telecom, public sector and extremely regulated industries proceed consolidating onto GitLab to unify developer productiveness with embedded safety and governance. The Zacks Consensus Estimate for GTLB’s fiscal 2026 EPS is pegged at 83 cents, indicating a 12.16% year-over-year enhance, reflecting confidence in GitLab’s seat growth and rising demand for built-in DevSecOps automation.

GitLab Inc. Value and Consensus

GitLab Inc. price-consensus-chart | GitLab Inc. Quote

The case for TEAM

Atlassian participates within the DevSecOps panorama from a distinct however complementary angle to GitLab. Whereas GitLab delivers an end-to-end, security-embedded pipeline, Atlassian anchors the coordination, governance and workflow-orchestration layer that surrounds these pipelines. Jira constructions planning, compliance monitoring and alter governance; Bitbucket gives supply management, code assessment and pipeline automation; and Confluence centralizes documentation and security-relevant information. Collectively, these instruments body the operational setting during which DevSecOps practices are deliberate, audited and executed, offering the oversight that enhances GitLab’s built-in execution mannequin.

Atlassian’s current AI enhancements strengthen this positioning. Automated problem detection, clever escalation, workflow optimization and improved auditability assist groups floor dangers earlier and keep governance throughout fast-moving improvement cycles. As AI accelerates coding and will increase the amount of adjustments flowing by CI/CD, Atlassian’s coordination layer turns into extra vital for sustaining cross-team accountability, safety sign-offs and coverage adherence, areas the place GitLab focuses on embedded controls and Atlassian focuses on visibility and structured alignment.

Cloud migrations have accelerated as enterprises search a unified setting for monitoring safe improvement actions and coordinating DevSecOps governance. The Zacks Consensus Estimate for TEAM’s fiscal 2026 EPS is pegged at $4.70, up 13% over the previous 30 days and indicating a 27.72% year-over-year enhance, reinforcing confidence in Atlassian’s function because the workflow and governance spine inside fashionable DevSecOps applications.

Atlassian Company PLC Value and Consensus

Atlassian Company PLC price-consensus-chart | Atlassian Company PLC Quote

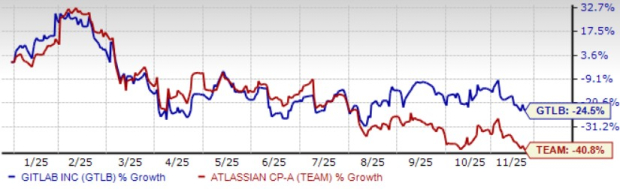

Value Efficiency and Valuation of GTLB and TEAM

Within the year-to-date (YTD) interval, GTLB shares have declined 24.5%, whereas TEAM has plunged 40.8%. Atlassian’s deeper pullback displays the volatility of its broader collaboration suite, whereas GitLab’s smaller decline factors to steadier demand for security-native DevSecOps platforms. Even in a softer software program tape, GitLab’s deal with safe CI/CD and embedded governance has confirmed comparatively extra resilient than Atlassian’s wider, multi-product footprint.

GTLB vs TEAM YTD Efficiency

Picture Supply: Zacks Funding Analysis

GitLab trades at 6.5X ahead twelve-month price-to-sales, barely above Atlassian’s 5.64X. This modest premium aligns with GitLab’s tighter deal with end-to-end DevSecOps, stronger AI monetization potential inside CI/CD and extra concentrated publicity to mission-critical safety workflows. Atlassian’s decrease a number of displays its broader suite and extra distributed development drivers, making GitLab the cleaner technique to seize core DevSecOps demand.

GTLB vs TEAM Valuation

Picture Supply: Zacks Funding Analysis

Conclusion

Each GTLB and TEAM profit from rising DevSecOps adoption, however GitLab aligns extra straight with the safe, automation-heavy workflows enterprises are prioritizing. Atlassian stays invaluable for coordination and governance, but its wider product combine and sharper YTD decline make its outlook extra delicate to spending cycles. GitLab’s unified structure, deeper AI integration and extra resilient positioning give it an edge at this stage. Gitlab and Atlassian presently carry a Zacks Rank #2 (Purchase) every.

You’ll be able to see the entire listing of in the present day’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Atlassian Company PLC (TEAM) : Free Inventory Evaluation Report

GitLab Inc. (GTLB) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.