Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum is starting the identical “supercycle” that despatched Bitcoin hovering 100x, in response to BitMine Chairman Tom Lee.

However Lee, who additionally a co-founder of Fundstrat World Advisors, mentioned the trail increased for Ethereum can be risky and urged his 559.8k followers on X to “HODL.”

“The principle takeaway from Bitcoin’s run is that to learn from a 100X cycle, you needed to abdomen existential actions to HODL,” Lee mentioned, including that “crypto costs are discounting a large future,” and that ”doubts create volatility.”

He mentioned that since he first advisable Bitcoin to traders 8.5 years in the past, BTC has seen 9 substantial value drops, six of them with declines of greater than 50% and three of greater than 75%.

Bitcoin is a risky asset.

We first advisable Bitcoin to Fundstrat purchasers in 2017 (1%-2% allocation)

– Bitcoin 2017 ~$1,000Since then (previous 8.5 years), $BTC:

– 6 declines > -50%

– 3 declines > – 75%2025, Bitcoin 100x from our first suggestion

TAKEAWAY:

To have… pic.twitter.com/xtIRGLdnWM— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 16, 2025

Lee’s feedback come at a troublesome time for ETH, which has plummeted 11% prior to now week and greater than 19% within the final month. CoinMarketCap information reveals it’s down 1.2% prior to now 24 hours to commerce at $3,127 as of 10:34 a.m. EST.

BitMine Reportedly Buys The ETH Dip

BitMine is the biggest company holder of ETH and it seems to be backing Lee’s phrases with motion by shopping for the dip.

Citing on-chain information from Arkham Intelligence, the X account Whale Insider mentioned yesterday that the agency purchased one other 67,021 ETH for $234.47 million from Galaxy Digital, FalconX, and Coinbase.

JUST IN: Prior to now week, Bitmine Immersion purchased one other 67,021 $ETH ($234.47 million) from Galaxy Digital, FalconX and Coinbase – Arkham. pic.twitter.com/d7ipQYHykx

— Whale Insider (@WhaleInsider) November 16, 2025

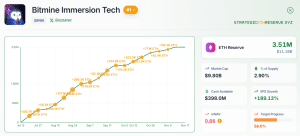

In keeping with information from StrategicETHReserve, BitMine holds 3.51 million ETH on its steadiness sheet valued at roughly $11.16 billion.

BitMine ETH holdings overview (Supply: StrategicETHReserve)

BitMine says its purpose is to accumulate 5% of ETH’s whole provide as a part of its “Alchemy of 5%” technique, and the agency is already midway there.

The StrategicETHReserve information reveals that BitMine presently holds round 2.90% of the altcoin’s provide, which is 58% of its goal.

Lengthy Time period Accumulators’ ETH Balances Have Grown

Amid the ETH value drop, CryptoQuant contributor Burak Kesmeci mentioned in a current be aware that long-term ETH holders have “chosen accumulation over panic” this 12 months.

The analyst mentioned that round 17 million ETH has flown into “accumulation addresses” up to now in 2025.

Kesmeci additionally mentioned that the altcoin is simply 8% away from touching the “accumulation realized value degree,” which “represents the typical value foundation of long-term accumulators.”

The analyst mentioned that in its whole historical past, ETH has solely dropped beneath that degree as soon as. This was in the course of the April 2025 Trump tax-tariff disaster, which the analyst mentioned was “one of many highest worry intervals in trendy market historical past.”

“Traditionally, this zone has been one of many strongest long-term accumulation alternatives in Ethereum’s market construction,” the CryptoQuant contributor wrote. “My private view: Even when ETH briefly dips beneath $2,900, it’s unlikely to remain there for lengthy.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection