- What’s Lombard Finance (BARD)?

- How Does Lombard Work?

- What’s the BARD token?

- Lombard Expertise: Core Merchandise

- What’s the Protocol Structure of Lombard Crypto?

- What’s Lombard Lux & how does it work?

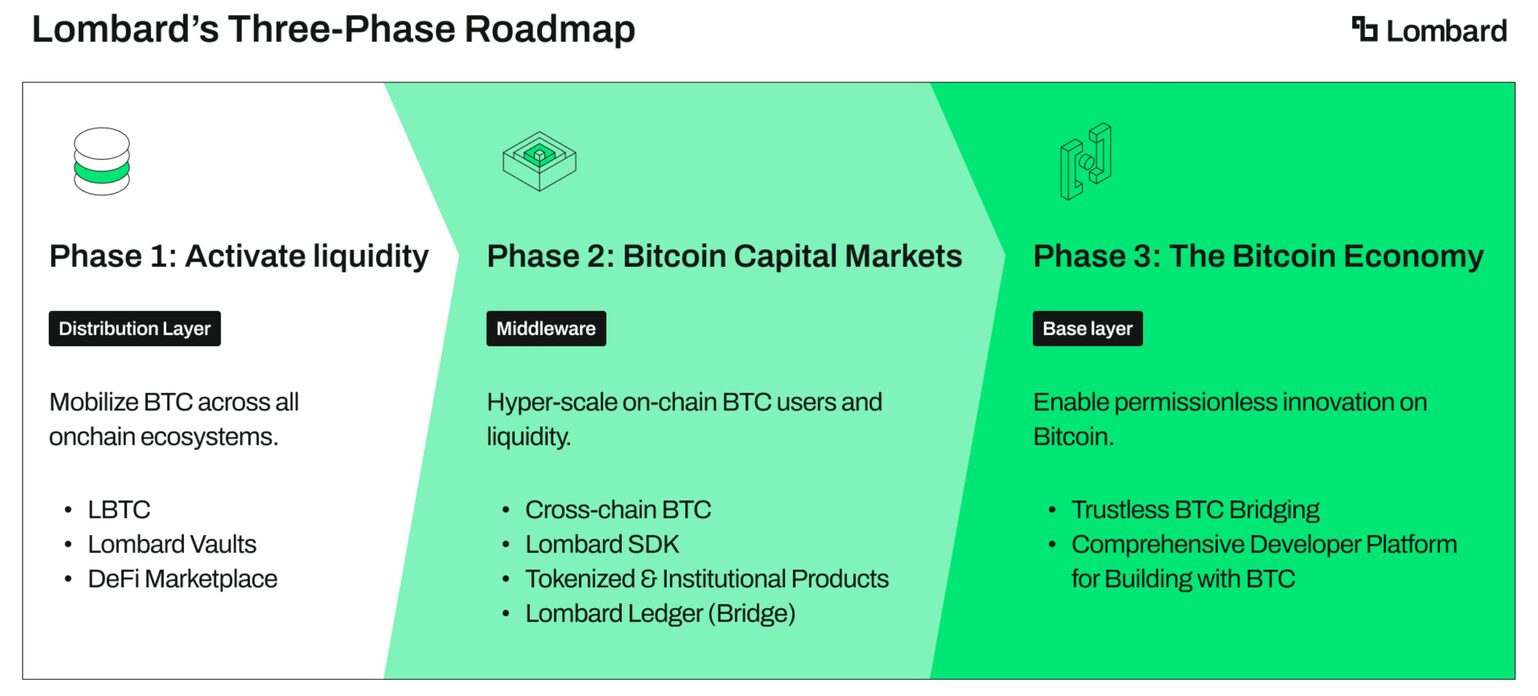

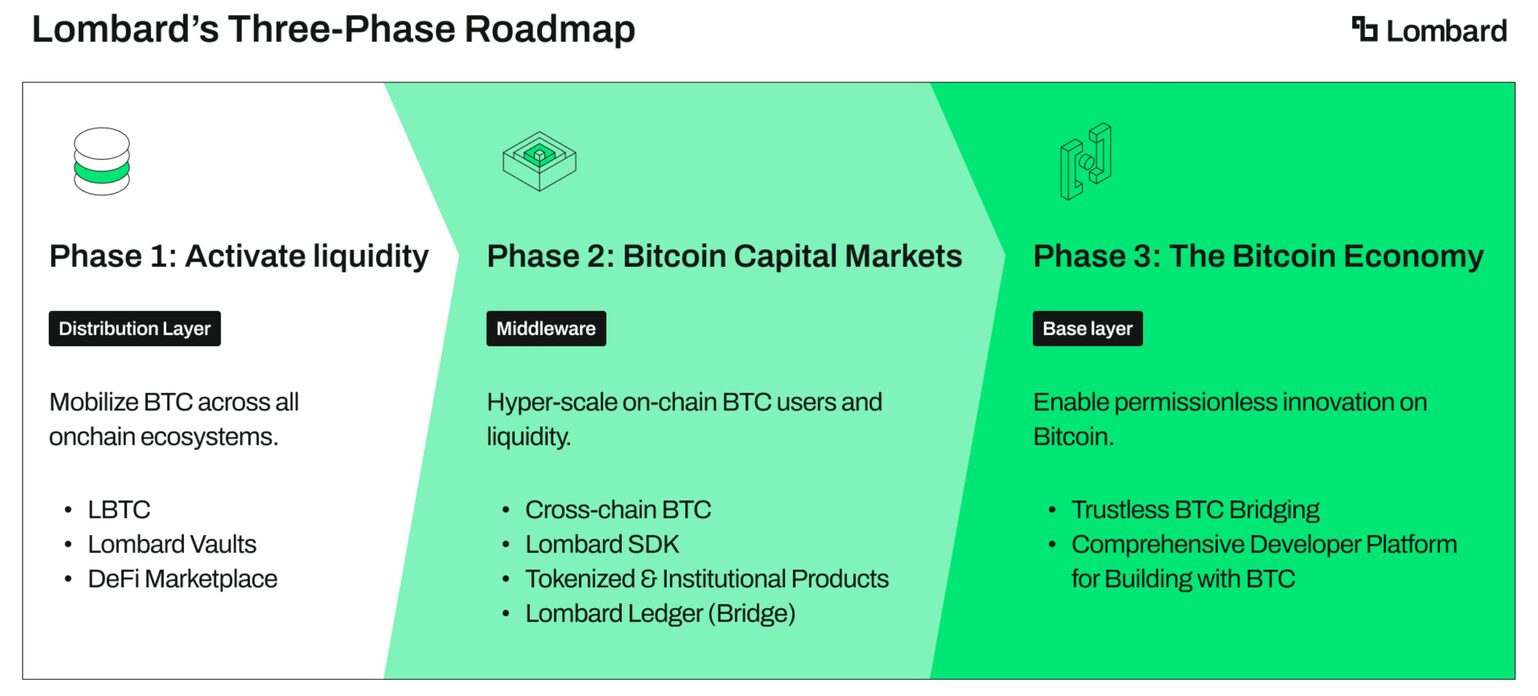

- The Way forward for Lombard

- FAQs

- Who’s the group behind Lombard?

- Who backs Lombard?

- What are the main achievements of Lombard Finance since its launch?

- What’s the position of the Safety Consortium?

- How is LBTC completely different from Bitcoin?

- What’s LBTC?

- What dangers are related to utilizing LBTC?

- Can I withdraw my BTC from Lombard?

Do you could have an excellent crypto portfolio and in search of an opportunity to money out with out promoting your digital property? Then your reply lies with Lombard Finance. However what’s Lombardfi? This text explores Lombard Finance (BARD) and brings you all of the solutions.

What’s Lombard Finance (BARD)?

Lombard Finance is a cryptocurrency platform aiming to extend Bitcoin’s utility by integrating BTC with decentralized finance (DeFi). Lombard intends to rework Bitcoin right into a dynamic monetary software, one which goes past being a dormant retailer of worth with stagnant market capitalization. The protocol seeks to attain this utilizing LBTC, the liquid Bitcoin token that’s utilized in staking actions.

With the yield-bearing LBTC, Bitcoin holders can stake their crypto property and nonetheless keep their liquidity. The identical is made attainable by a partnership between Lombard and the Babylon ecosystem, which gives a non-custodial staking protocol. Customers can stake their Bitcoin by way of Lombard to obtain an equal quantity of LBTC, which they will then commerce and use on DeFi platforms. Bitcoin holders can take part in DeFi actions like lending and loans, and nonetheless earn staking rewards from their authentic Bitcoin.

Execs

- Allow Bitcoin holders to earn passive earnings within the type of staking rewards.

- LBTC unlocks Bitcoin’s DeFi potential, permitting LBTC customers to leverage their staked Bitcoin.

- The protocol expands Bitcoin’s utility and use circumstances past a retailer of worth and fee software.

Cons

- The brand new expertise might be difficult for customers who aren’t tech-savvy or new to the crypto house.

- There’s the chance of sensible contract vulnerabilities just like different DeFi functions.

- Rewards can fluctuate primarily based on risky crypto market situations.

How Does Lombard Work?

Whereas DeFi actions are related to Ethereum, Bitcoin’s utility lagged as a result of lack of composability and staking mechanisms. Now, Lombard permits holders to stake their Bitcoin by restaking throughout the Babylon protocol, using a brand new Bitcoin-secured Proof-of-Stake (PoS) system. Babylon permits BTC to safe L2 rollups and nonetheless generate a local staking yield.

Upon staking their Bitcoin, customers obtain LBTC, a yield-bearing liquid asset that’s backed 1:1 by their Bitcoin deposit. LBTC is a cross-chain token that may be utilized throughout all DeFi platforms and actions, together with buying and selling, borrowing, lending, and yield farming. A multi-party group of impartial validators oversees the staking, minting, burning, and safety checks. The Non-Custodial Safety Consortium ensures decentralization, minimizes belief, and eliminates a single level of failure.

How does Lombard work with Babylon?

Lombard operates by issuing LBTC, a yield-bearing liquid staked token representing the Bitcoin deposited into the Babylon staking platform. The LBTC holder can earn a yield on their Bitcoin holdings whereas sustaining liquidity, enabling them to take part in DeFi actions.

The way it Works

- A Bitcoin holder deposits their BTC into Babylon by way of the Lombard protocol.

- Lombard points the yield-bearing LBTC, a liquid staked token within the place of staked Bitcoin.

- Traders can use LBTC to earn staking rewards from Babylon on their BTC holdings.

- The liquid LBTC can act as collateral on DeFi protocols for actions like DeFi loans, and so forth.

- LBTC maintains a 1:1 worth with BTC, which ensures its core worth stays secure.

What’s the BARD token?

Lombard (BARD) is the utility and governance token of the Lombard Finance Bitcoin DeFi protocol. The Ethereum-based token is designed to embody the next values and utility:

- Liquidity: Unlocks Bitcoin’s potential by way of LBTC

- Safety: Secures the LBTC Bridge and platform’s integrity by way of BARD staking.

- Group: Allows holders to take part within the protocol’s governance

Along with Bitcoin’s ethos of decentralization, BARD additionally introduces BTC to the DeFi business, aiming to create a sustainable, reliable, and collaborative ecosystem. BARD additionally secures staking, unlocks liquid Bitcoin yield, and bridges operations, positioning itself because the core of next-gen Bitcoin-native DeFi.

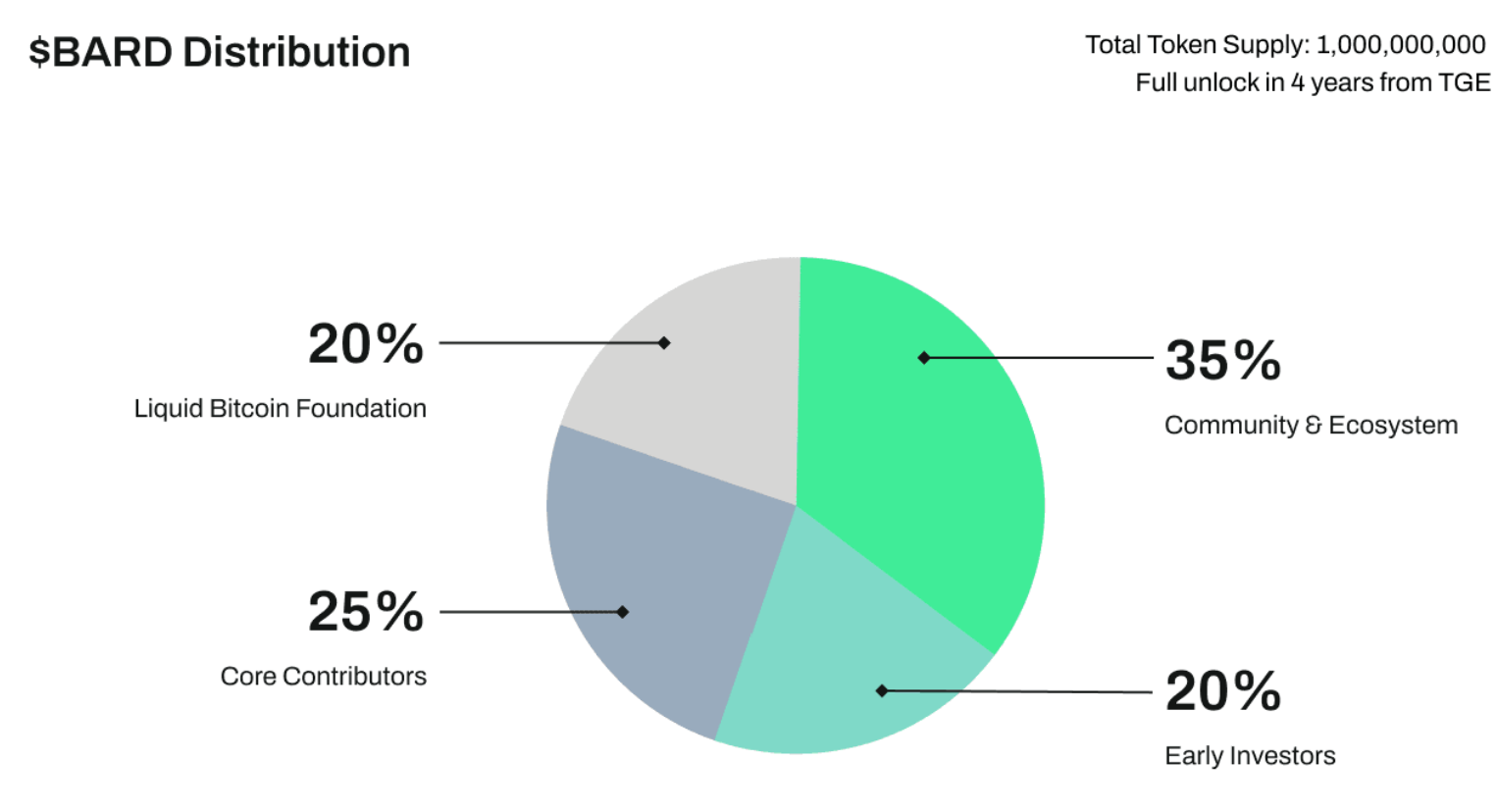

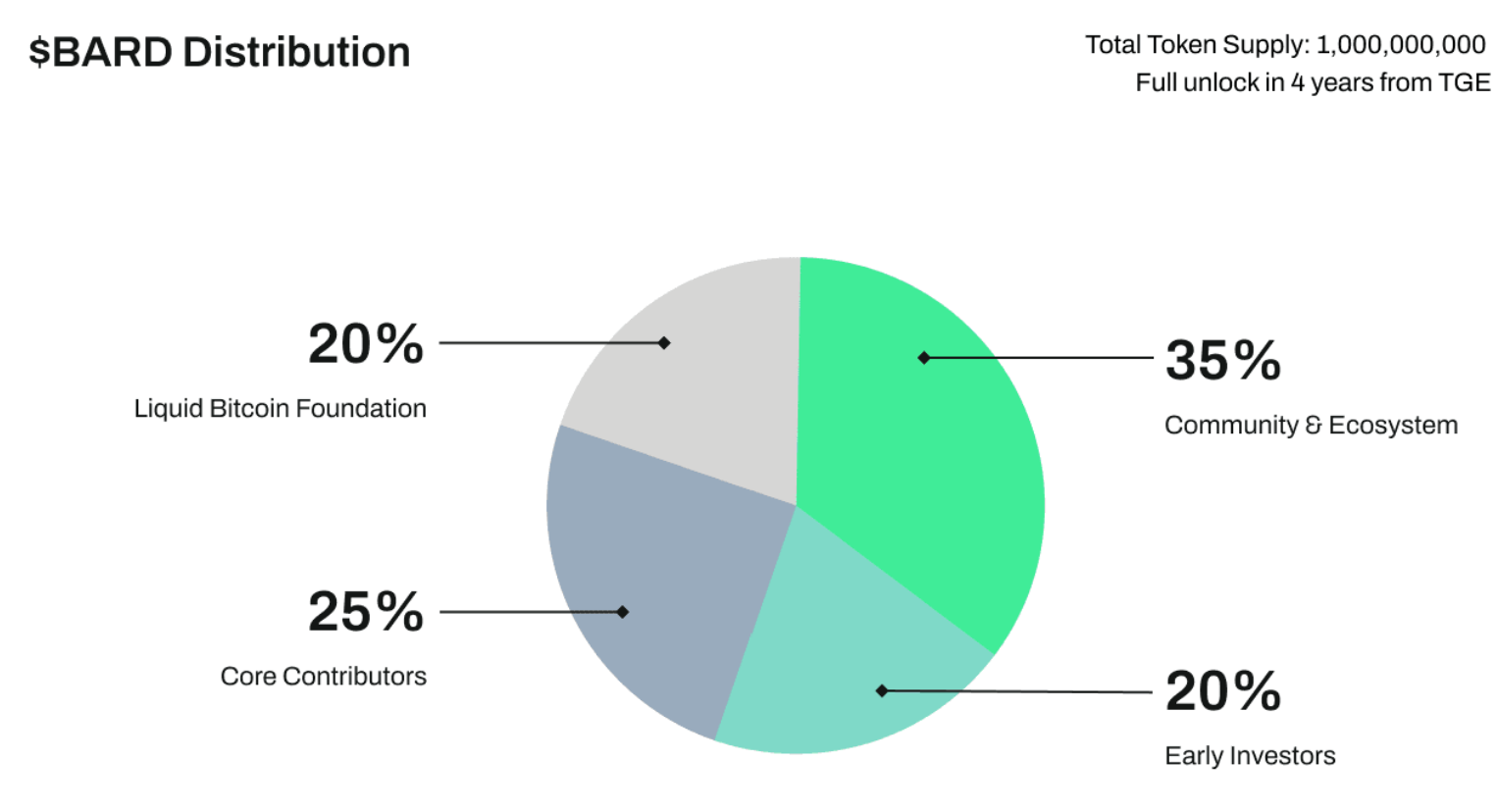

BARD tokenomics

- Token Identify: Lombard Token (BARD)

- Whole Provide: 1,000,000,000 BARD

- Max Provide: 1,000,000,000 BARD

- Circulating Provide: 225,000,000 BARD (22.50% of max provide)

Token Distribution

- Liquid Bitcoin Basis: 20%

- Group and Ecosystem: 35%

- Core Contributors: 25%

- Early Traders: 20%

Lombard Expertise: Core Merchandise

1. Liquid Staked Bitcoin (LBTC)

LBTC is the first product of Lombard Finance that customers obtain once they deposit their BTC. LBTC earns customers a yield from staking by the Babylon protocol, whereas remaining liquid, which means holders can use it throughout numerous DeFi platforms.

2. DeFi Market

This can be a devoted market for a variety of decentralized finance (DeFi) providers. It will embody a spread of actions, from lending to buying and selling, the place members can make the most of LBTC to earn further yields and generate utility.

3. Bitcoin Staking

Bitcoin staking at Lombard refers to a protocol by the platform that converts Bitcoin right into a liquid staked token, LBTC. LBTC makes use of the Babylon community to facilitate Proof-of-Stake (PoS) safety, enabling customers to earn staking rewards.

4. Lombard SDK

The software program growth equipment permits customers to combine Bitcoin deposits and yield into completely different chains, protocols, wallets, or exchanges.

5. DeFi Vaults

Lombard’s DeFi Vault refers to an automatic yield administration system that helps to maximise ROI in Bitcoin throughout the DeFi ecosystem. Customers can deposit tokenized Bitcoin like LBTC or WBTC to realize entry to completely different DeFi methods with out manually managing positions. The DeFi vaults simplify the method by eradicating technical complexities related to associated investments.

6. Cross-Chain Bitcoin (Coming quickly)

Lombard is pioneering a system that may safe cross-chain Bitcoin transfers. This modern creation will be certain that customers’ LBTC tokens are safeguarded throughout transitions between completely different blockchains.

7. Lombard Ledger (Coming quickly)

Lombard Ledger is a Byzantine Fault-Tolerant (BFT) blockchain that may report all actions and supply transparency and verifiable data.

8. Structured & Tokenized Merchandise (Coming quickly)

Lombard Finance additionally plans to introduce a wide selection of structured and tokenized merchandise. Based on the corporate’s roadmap, it will embody choice vaults, foundation commerce vaults, staking ETPs and ETFs, and treasury administration instruments. Moreover, their yield market will encompass choices, arbitrage methods, and options for company treasuries.

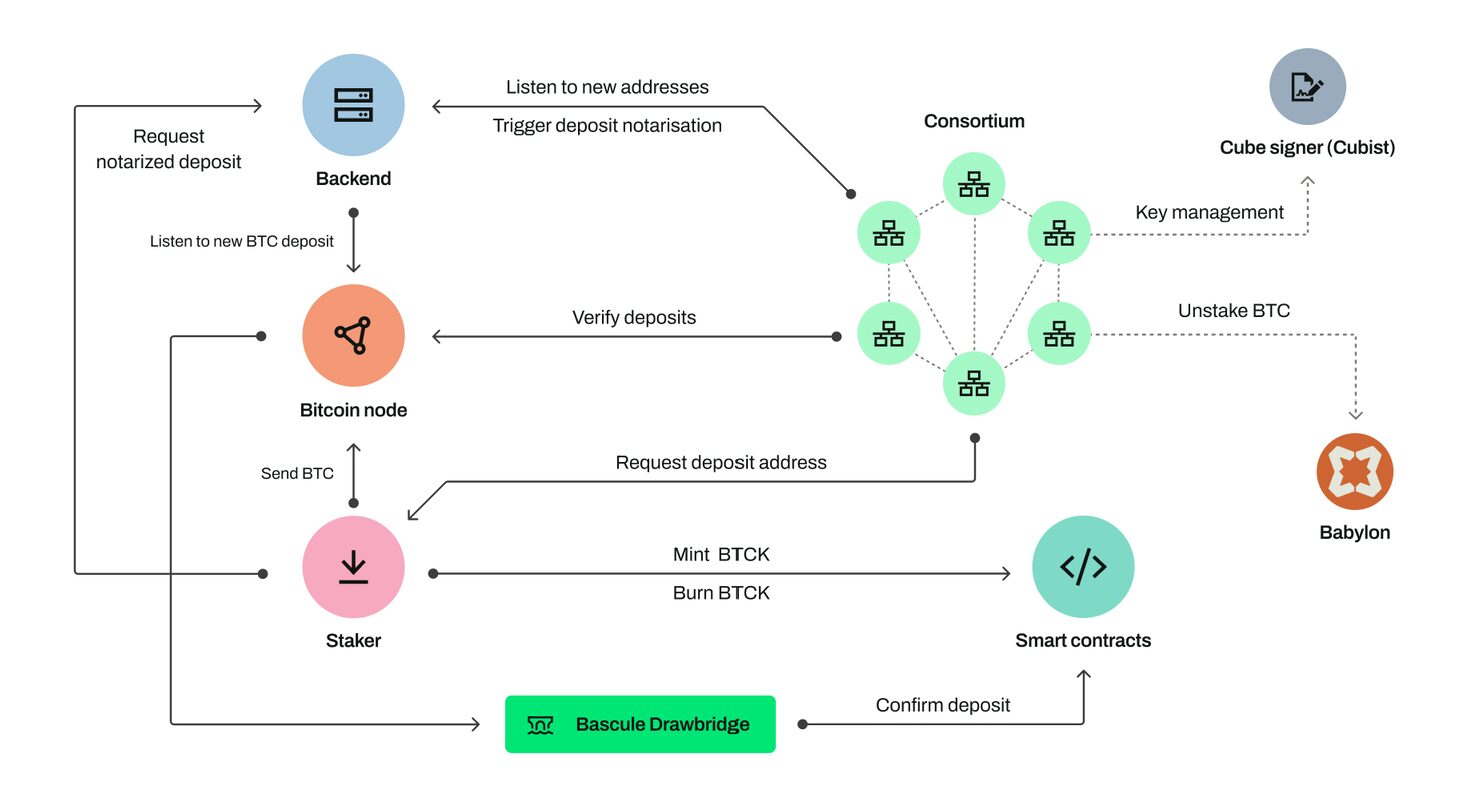

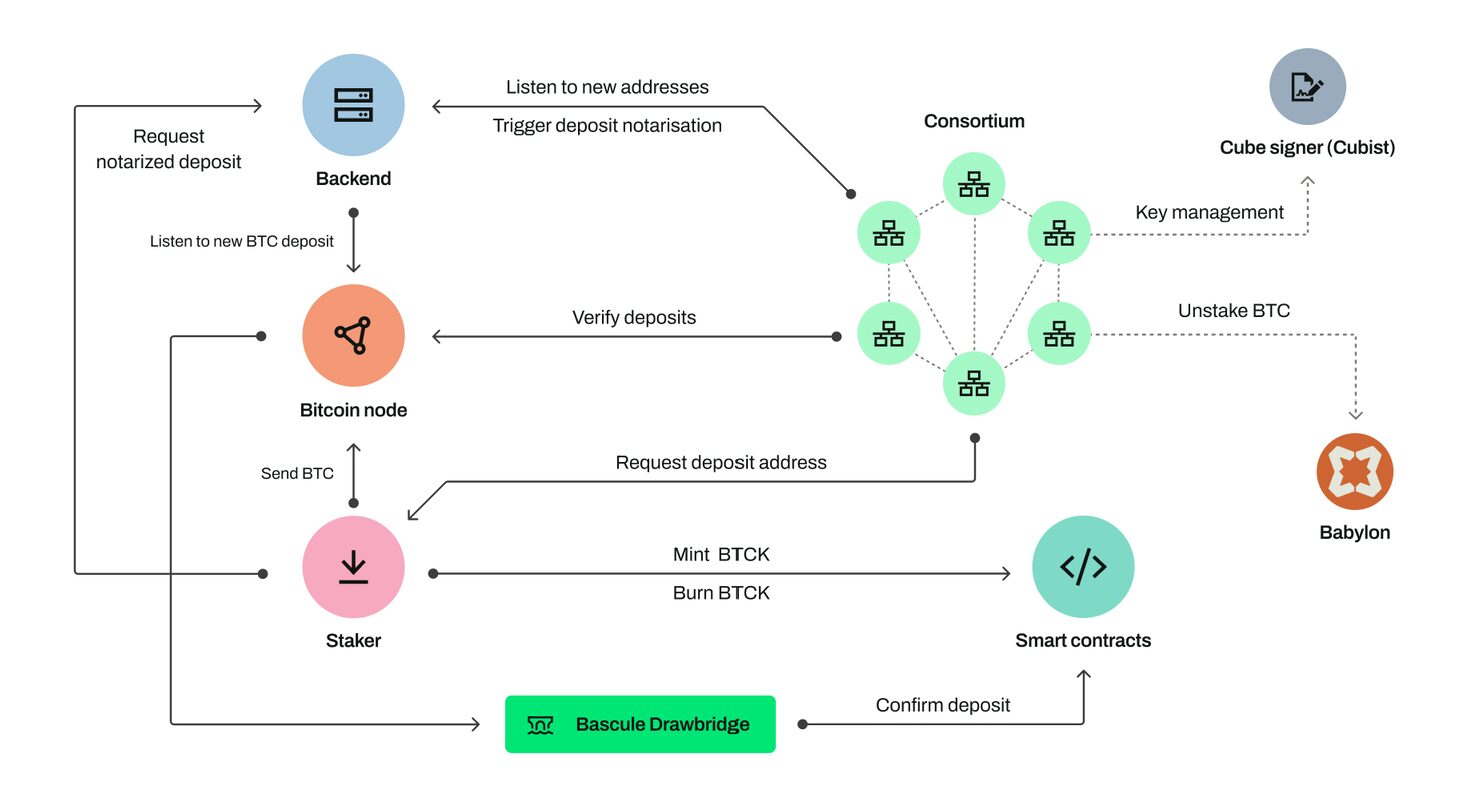

What’s the Protocol Structure of Lombard Crypto?

Lombard Crypto’s protocol structure gravitates round integrating Bitcoin with the DeFi ecosystem. The platform makes use of a multi-layered operational and safety construction with the next core parts:

- LBTC (Liquid Staked Bitcoin): A liquid staking token pegged 1:1 to Bitcoin, enabling customers to earn yield, take part in DeFi functions, and keep liquidity.

- Babylon Protocol: Lombard’s Bitcoin staking program is facilitated by Babylon to safe Proof-of-Stake (PoS) blockchains, enabling customers to earn staking yields

- Safety Consortium: A gaggle of 14 crypto-based establishments that validate and notarize transactions like staking, unstaking, burning, minting, and bridging.

What’s Lombard Lux & how does it work?

Lombard Lux is a reward system operated by the Lombard crypto undertaking that’s designed to encourage customers to make use of and promote LBTC. This system incentivizes customers to stake BTC or maintain LBTC as a method of contributing to the platform’s progress.

Customers can accumulate Lux tokens by staking BTC or receiving LBTC, along with collaborating in different ecosystem initiatives. The rewards are distributed on an hourly foundation, and customers earn extra by holding their LBTC for an prolonged interval. Furthermore, there are choose actions throughout the Lombard ecosystem that act as Lux token multipliers.

Lombard Lux serves as a metric to trace a consumer’s engagement and exercise throughout the platform, however it has no financial worth. Whereas it can’t be traded or transferred, it acts because the digital illustration of 1’s participation within the LBTC ecosystem.

The Way forward for Lombard

Lombard Finance has taken a daring step that has introduced Bitcoin into the world of DeFi and rewritten the foundations of BTC staking. By using a strong multi-party-secured infrastructure and integrating LBTC by way of Babylon, it now permits BTC holders to earn yield by DeFi composability and uncompromising safety.

By way of LBTC, powered by the BARD token, Lombard has efficiently remodeled Bitcoin from a passive asset right into a monetary instrument. Lombard is now poised to propel the world’s flagship cryptocurrency right into a productive, safe asset with further advantages.

FAQs

Who’s the group behind Lombard?

The founding group of Lombard Finance contains consultants from Babylon, Polychain, Coinbase, Maple, and Argent. Among the many key founding members are Co-founder Jacob Phillips and Olivia Thet as Director of Engineering. Others embody Matthew Donovan as Head of Enterprise Improvement and Charlotte Dodds as Head of Advertising.

Who backs Lombard?

Lombard has the backing of 14 crypto asset establishments, together with buyers like Binance Labs and Polychain Capital. Others are main exchanges, crypto establishments, and DeFi protocols.

What are the main achievements of Lombard Finance since its launch?

Since its founding in 2024, Lombard Finance has achieved a number of important milestones:

- $1 billion in TVL inside 92 days, making it the quickest yield-bearing token in historical past.

- Efficiently built-in Bitcoin with DeFi actions.

- Supplied institutional-grade safety by its Safety Consortium.

- Turned the fastest-growing protocol, with 80% of LBTC remaining lively in DeFi functions.

What’s the position of the Safety Consortium?

Lombard’s safety consortium refers to a bunch of 14 digital asset establishments which might be the operational spine of the protocol. Their position is to validate and authorize transactions on the protocol, together with minting and burning LBTC, in addition to staking and unstaking Bitcoin.

How is LBTC completely different from Bitcoin?

LBTC differs from Bitcoin because it capabilities as a liquid staking spinoff that earns yield, whereas Bitcoin is a passive retailer of worth.

What’s LBTC?

LBTC is an modern liquid staking token that permits Bitcoin holders to earn staking yield whereas sustaining liquidity. The token is backed 1:1 with Bitcoin.

What dangers are related to utilizing LBTC?

Among the many dangers related to utilizing LBTC are market volatility, sensible contract vulnerabilities, and potential lack of principal. Others are regulatory uncertainty surrounding the DeFi house and potential liquidity fragmentation.

Can I withdraw my BTC from Lombard?

Sure, it’s attainable to withdraw your Bitcoin from Lombard. The method includes redeeming your LBTC earlier than you possibly can unstake it and obtain your precise BTC again. Nevertheless, the method is prolonged and requires community charges.