USDT dominance is eroding as Circle and different stablecoin rivals struggle for a share of the pie.

Abstract

- USDT dominance fell under 60% for the primary time since 2023

- Circle’s USDC is its main competitor, nearing 30% dominance

- The passage of the US GENIUS Act is making the market extra aggressive

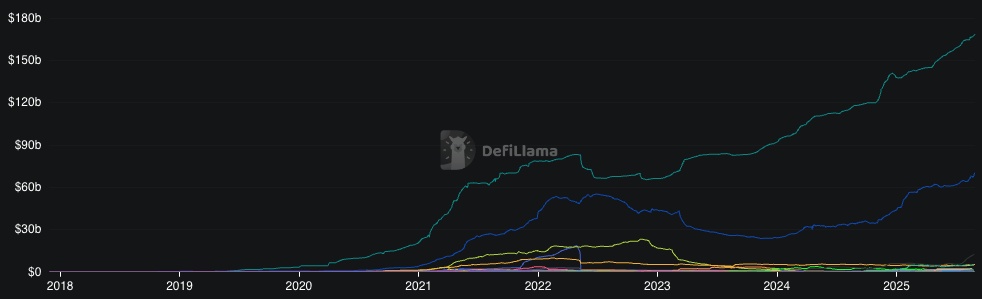

Competitors amongst stablecoin issuers is rising. On Friday, August 29, USDT dominance fell to 59.45%, in accordance with knowledge from DeFiLlama. This was the primary time the important thing determine fell to those ranges since March 2023, indicating that Tether could also be dropping its grip available on the market.

Notably, within the first half of 2024, USDT dominance hovered round 70%. On the identical time, Tether’s primary competitor, Circle’s USDC, managed simply 18% of the market, a determine which is now near 30%. Alternatively, DAI’s dominance fell in that interval, from round 3.5% to its present stage of 1.86%.

One standout performer this yr is Ethena’s USDe. Launched in December 2024, already reached 4.34% in dominance and a market cap of $12.275 billion. Alternatively, Trump World Liberty Monetary’s USD1 controls 0.88% of the market.

Tether faces regulatory points in Europe, the U.S.

Tether is not only dealing with elevated competitors. With extra international locations issuing stricter guidelines on stablecoins, its USDT is at a drawback. Thus far, Tether has declined to adjust to Europe’s MiCA stablecoin framework, resulting in its delisting on main exchanges.

Tether could quickly face the identical difficulty in the US, which just lately handed the GENIUS Act, which requires extra transparency from stablecoin issuers. Nonetheless, regardless of a shift in market positioning, main gamers, together with Tether, are on the rise. Each USDT and USDC are at report ranges, at $168.43 billion and $70.378 billion, respectively.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.