Set to report outcomes for its fiscal fourth quarter on Thursday, November 13, momentum in Disney DIS shares has wavered for a lot of the yr. Forward of its This fall report, the media large’s inventory is up a subpar +3% in 2025 regardless of being lower than 9% away from a 52-week excessive of $124 a share.

This considerably stagnant inventory efficiency comes as Disney has moved previous the aggressive cost-cutting measures that long-term CEO Bob Iger applied when returning to the helm in 2022 after beforehand main the corporate for 15 years.

Though Disney has proven indicators of a turnaround since Iger’s return, buyers are anxious to see if the corporate’s new prioritization of long-term development over short-term price financial savings is paying off.

To that time, after reaching a $7.5 billion cost-cutting initiative as a part of management’s efforts to save cash and refocus on profitability, it’s noteworthy that Disney plans to spend $8 billion on capital expenditures this yr, in comparison with $5 billion in 2024.

Picture Supply: Zacks Funding Analysis

Disney’s This fall Expectations

Zacks’ projections name for Disney’s This fall gross sales to be up 1% to $22.88 billion. That stated, This fall EPS is predicted to dip 9% to $1.03 as a result of stress on conventional TV and sports activities broadcasting regardless of sturdy efficiency in streaming and theme parks.

General, Disney remains to be slated to spherical out fiscal 2025 with annual earnings spiking 18% to $5.87 per share and complete gross sales rising 4% to $94.84 billion.

What Wall Road will likely be in search of: With Disney’s streaming phase turning into worthwhile in Q2 2025, Wall Road will likely be looking ahead to what’s hopefully elevated profitability. Final quarter, Disney’s streaming phase generated $346 million in working revenue after posting its first revenue of $293 million in Q2.

Disney’s Strategic Refocus & Growth

Reallocating sources towards high-growth areas, Disney is aggressively investing in streaming and world theme parks whereas nonetheless slicing prices in company overhead and underperforming property, comparable to its legacy TV enterprise (ABC, FX, and different linear networks).

Moreover, Disney is tapping into the rising tourism market within the Center East, with plans to open a brand new theme park resort in Abu Dhabi as a part of its worldwide enlargement technique. Notably, Disney is investing $6 billion into its Experiences phase, which incorporates theme parks, cruises, and immersive sights.

Concerning streaming, Disney has remained targeted on content-led development, together with unifying its platforms for a greater person expertise and operational effectivity. Disney’s newest transfer was launching a brand new direct-to-consumer app for ESPN in August, providing followers unified entry to its full suite of sports activities content material without having a standard cable subscription.

Disney’s Consolidated Streaming Subscribers

When together with Disney+, which is now being merged with Hulu, Disney’s mixed 200+ million streamers are in shut competitors with Amazon’s AMZN Prime Video for probably the most world streaming subscribers behind Netflix NFLX.

Disney’s Enticing P/E Valuation

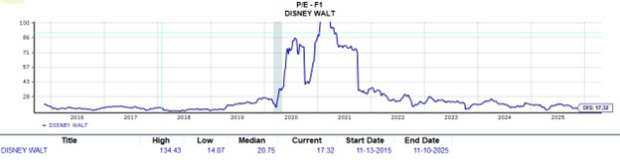

Enticing to the potential for extra long-term upside, particularly if its likelihood begins to extend, is that Disney inventory is buying and selling at an inexpensive 17X ahead earnings a number of.

This gives a nice low cost to the benchmark S&P 500’s 25X and its Zacks Media Conglomerates Business common of 22X ahead earnings. In regard to its main streaming opponents, DIS trades nicely beneath Amazon and Netflix’s ahead P/E multiples of 34X and 44X, respectively.

It’s additionally vital to notice that DIS is buying and selling far under its decade-long excessive of 134X ahead earnings and gives a slight low cost to the median of 20X throughout this era.

Picture Supply: Zacks Funding Analysis

Backside Line

Disney inventory is actually making the argument for a transfer increased, and the Common Zacks Worth Goal of $135 a share does recommend 20% upside from present ranges. Nonetheless, Disney’s This fall outcomes and steerage will likely be essential to exhibiting that the corporate’s refocused strategic enlargement will likely be rewarding.

For now, DIS lands a Zacks Rank #3 (Maintain) and has began to regain the notion of being a really viable long-term funding.

Past Nvidia: AI’s Second Wave Is Right here

The AI revolution has already minted millionaires. However the shares everybody is aware of about aren’t prone to maintain delivering the largest income. Little-known AI companies tackling the world’s greatest issues could also be extra profitable within the coming months and years.

See “2nd Wave” AI shares now >>

The Walt Disney Firm (DIS) : Free Inventory Evaluation Report

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

Netflix, Inc. (NFLX) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.