Be part of Our Telegram channel to remain updated on breaking information protection

Coinbase has urged the US Treasury Division to stay to Congress’s imaginative and prescient for the GENIUS Act, suggesting that caving in to strain from conventional monetary establishments may stifle stablecoin innovation.

In its response to the Treasury’s request for feedback, Coinbase stated regulators should keep away from “imposing any necessities that transcend what the statute instructions.”

It argued that Congress “fastidiously drafted” the GENIUS Act to advertise accountable development in stablecoins, strengthen US crypto management, and modernize funds infrastructure.

Banking teams have referred to as on regulators to shut what they view as a “yield loophole” that permits companies like Coinbase to supply returns on Circle’s USDC holdings via third events.

Coinbase says that increasing the ban on stablecoin yields would “rewrite Congress’s carefully-drawn traces,” hurting customers and curbing innovation by eradicating market incentives that decrease prices and drive adoption.

The alternate additionally urged Treasury to coordinate with different regulators to keep away from overlapping guidelines that would fragment the market.

“GENIUS is amongst a handful of federal efforts to offer readability in digital asset markets, so Treasury should be aware to not battle with ongoing efforts of Congress or different federal regulators,” Coinbase wrote.

We submitted @coinbase‘s response to @USTreasury‘s request for feedback on the implementation of the GENIUS Act. Our message is straightforward: GENIUS is landmark laws designed to make the US the undisputed world chief in crypto and stablecoins. To make that occur, the… pic.twitter.com/XLyq15u0Ov

— Faryar Shirzad 🛡️ (@faryarshirzad) November 5, 2025

Banking Foyer Teams Sad Stablecoin Companies Are Circumventing Yield Ban

The GENIUS Act offered the digital asset market with some long-awaited regulatory readability. It establishes a regulatory framework for stablecoin companies trying to difficulty their tokens within the US, and focuses on classifying “cost stablecoins,” how they could be regulated, and who could difficulty them.

One of many principal necessities listed within the GENIUS Act is that permitted issuers preserve a 100% reserve backing of excellent stablecoins with extremely liquid belongings comparable to US {dollars} or short-term US Treasuries. The companies additionally want to offer month-to-month disclosures of reserve composition, in addition to annual audited monetary statements.

There’s additionally a ban on stablecoin companies providing their token holders yield instantly, however this prohibition has not been expanded to 3rd events or associates.

That, in response to banking foyer teams, paves the best way for stablecoin companies to get across the ban, as has been the case with Coinbase providing a yield on USDC.

Coinbase USDC yield providing (Supply: Coinbase)

Regulators In Different Elements Of The World Working On Stablecoin Regulation

Because the US Treasury Division appears to be like to implement the GENIUS Act, regulators from different components of the world have signalled that they’re engaged on their very own regulatory frameworks for stablecoins.

Canada lately unveiled plans for a stablecoin regulatory framework in its 2025 federal finances. Just like the GENIUS Act, Canada’s framework would require stablecoin companies to keep up ample reserves.

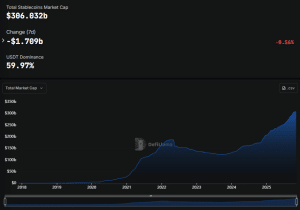

In the meantime, Financial institution of England Deputy Governor Sarah Breeden lately stated she expects the UK to maintain tempo with the US in relation to regulating the $306 billion stablecoin market.

Stablecoin market cap (Supply: DefiLlama)

She additionally pressured the significance of the US and UK synchronizing in relation to regulating the rapidly-growing sector. The Financial institution of England is reportedly anticipated to difficulty its stablecoin session paper on Nov. 10 as effectively after talking with US authorities and businesses.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection