Be part of Our Telegram channel to remain updated on breaking information protection

JPYC, a fintech agency primarily based in Tokyo, has launched Japan’s first yen-backed stablecoin in addition to a platform to concern the brand new token.

The stablecoin, with the ticker “JPYC,” went reside in the present day and is backed 1:1 by financial institution deposits and authorities bonds. It additionally has a 1:1 alternate fee with the yen, based on an announcement by the corporate. The stablecoin’s issuer mentioned that it’s going to not cost a transaction payment, and can as an alternative generate income from curiosity on its holdings of the Japanese authorities bonds.

Companies Present Curiosity In Integrating With JPYC Stablecoin

Talking at a latest press convention, JPYC President Noriyoshi Okabe mentioned that his firm’s stablecoin is a “main milestone within the historical past of the Japanese forex,” in accordance to a report from Enterprise Insider Japan.

ついに、日本円建初のステーブルコインJPYCが!

JPYCの発行償還が開始されました。https://t.co/X3gLEVRFs7【開発者向け】

コントラクトアドレスは契約前準備書面をご覧ください。https://t.co/hHpY0HIyCW— 岡部典孝 JPYC代表取締役 (@noritaka_okabe) October 27, 2025

He added that the stablecoin has attracted curiosity from seven corporations which can be planning to combine with the token.

Fintech Software program agency Densan System is growing cost programs for retail shops and e-commerce platforms incorporating the recently-launched stablecoin. In the meantime, Asteria plans so as to add performance for the token to its enterprise knowledge integration software program, which is utilized by greater than 10K corporations. HashPort, the crypto pockets, additionally plans on supporting JPYC transactions.

JPYC Can Flow into Globally

The JPYC stablecoin will have the ability to flow into globally, which is a stage of flexibility that tokens in different Asian areas don’t have. Each the Korean received and the Taiwan greenback are onshore currencies by native regulation. Conversely, Japan’s yen is freely convertible and can be utilized offshore.

That’s following reforms within the Nineteen Eighties that dismantled Japan’s postwar capital controls.

Seoul’s present coverage for the received preserves financial management. It additionally leaves little room for a world stablecoin to operate, on condition that such a token can be restricted to whitelisted Korean customers and principally home settlements.

Taiwan is in the same scenario. Whereas its greenback is technically convertible, it isn’t used offshore. What’s extra, Taipei’s stablecoin framework that was launched in June mandates full onshore reserves and central financial institution reporting. That is to forestall cross-border leakage.

JPYC Accompanied By A Platform Launch

Alongside the JPYC stablecoin, the token’s issuer has additionally launched JPYC EX. This can be a devoted platform that may facilitate the issuance and redemption of the token.

That platform shall be ruled by strict identification and transaction verification beneath the Act on Prevention of Switch of Felony Proceeds.

Customers are in a position to deposit Japanese yen into an account through a financial institution switch to obtain JPYC to a registered pockets tackle. They will additionally obtain a refund in yen to a withdrawal account.

US Stablecoins Nonetheless Dominate The Market

JPYC’s launch comes amid a stablecoin growth. A latest report confirmed that stablecoin cost settlements have grown roughly 70% prior to now six months, from round $6 billion in February this 12 months to $10 billion by August.

A portion of that progress comes after US President Donald Trump signed the GENIUS Act into regulation in July. This act gave the trade some much-needed regulatory readability, and has established a framework for stablecoin corporations trying to concern their tokens within the US to observe.

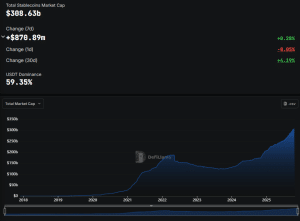

Stablecoins pegged to the US greenback nonetheless dominate the market, which has a capitalization of greater than $308 billion, based on knowledge from DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

The most important stablecoins by market cap are Tether’s USDT and Circle’s USD Coin (USDC), which have respective capitalizations of greater than $183.15 billion and $75.81 billion.

After USDT and USDC, the next-biggest stablecoins are Ethena’s USDe and Sky Greenback, with their complete capitalizations standing at over $10.36 billion and $5.31 billion, respectively.

In the meantime, tokens pegged to the Japanese yen at present have a mixed capitalization of round $7.82 million, the DefiLlama knowledge reveals.

Nonetheless, yen-backed stablecoins might quickly take up extra market share as JPYC says its plan is to concern 10 trillion yen, roughly $65.4 billion, of its token inside three years. The corporate additionally plans to broaden the variety of blockchains that assist the token in addition to enter into collaborations with extra companies.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection