Be part of Our Telegram channel to remain updated on breaking information protection

White Home AI and Crypto Czar David Sacks says that the US is in an “wonderful place” to cross key crypto market construction laws, whereas Coinbase CEO Brian Armstrong believes that it’s going to advance out of the Senate by Thanksgiving.

Each Sacks and Armstrong have famous that there was bipartisan assist for the proposed laws.

Crypto Business Might Quickly Get “A lot-Wanted Regulatory Readability”

Sacks mentioned on X that he had “productive conferences with main Democratic members.” Following the assembly, he believes that the US might cross the crypto market construction laws earlier than the top of the 12 months.

I spent at this time on Capitol Hill assembly with the members of the Senate @BankingGOP and @SenateAgGOP Committees; thanks to their respective Chairmen @SenatorTimScott and @JohnBoozman for internet hosting me. I additionally had productive conferences with main Democratic members, and imagine we… pic.twitter.com/cf6GxxnydM

— David Sacks (@davidsacks47) October 23, 2025

“This may lastly convey much-needed regulatory readability to the crypto business,” he mentioned, including that it’s going to construct “on the success of the Genius Act” that was signed into regulation by US President Donald Trump.

Momentum For Market Construction Invoice At “All-Time Excessive”

Coinbase’s CEO can be optimistic concerning the crypto market construction invoice.

“DC could also be shut down, however momentum for market construction readability is at an all-time excessive,” he mentioned on X.

DC could also be shut down, however momentum for market construction readability is at an all-time excessive. I sat down with Senate Democrats and Republicans who wish to get this achieved – we’re 90% there.

Either side are working exhausting to determine the ultimate 10%, and we’re getting shut.@Coinbase is… pic.twitter.com/EI5sShFvKA

— Brian Armstrong (@brian_armstrong) October 23, 2025

He added that he had a gathering with each Senate Democrats and Republicans concerning the crypto market construction laws. Based on the Coinbase CEO, each side “wish to get this achieved.”

Armstrong then mentioned that they’re 90% achieved with finalizing the main points. “Either side are working exhausting to determine the ultimate 10%, and we’re getting shut,” he added.

Based on the Coinbase CEO, the remaining points relate to decentralized finance (DeFi). He mentioned that the aim is to guard DeFi and “all the innovation potential” that it could have.

“Centralized intermediaries like Coinbase must be regulated, and never the protocols,” he added.

Armstrong’s publish comes after Senate Democrats met with prime executives from the crypto business, together with the Coinbase CEO.

Led by Senator Kristen Gillibrand, the roundtable additionally featured Galaxy CEO Mike Novogratz, Chainlink CEO Sergey Nazarov, Kraken CEO Jesse Powell, and Solana Coverage Institute President Kristin Smith, amongst others.

“The excellent news is there may be robust bipartisan assist and can to get this market construction laws achieved,” Armstrong instructed CNBC. He then mentioned that Thanksgiving was “floated” as a doable deadline for the crypto invoice.

Massive Banks Coming For “Money Seize”

Armstrong mentioned that business executives are nonetheless preventing to guard stablecoin rewards as properly, as the large banks come for his or her “money seize.”

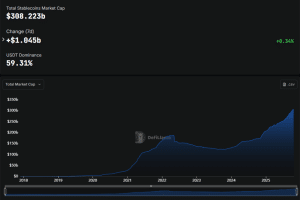

That’s after the Genius Act was signed into regulation in July this 12 months. Following the act’s signing, the stablecoin market cap soared previous $300 billion.

Stablecoin market cap (Supply: DefiLlama)

At present, the invoice bans stablecoin issuers from providing direct yields to token holders. Nevertheless, it doesn’t lengthen the ban to 3rd events or associates.

Banking lobbies have urged lawmakers to deal with the stablecoin rewards “loophole,” citing fears that it might result in a pointy lower in deposits at conventional banks and subsequently influence their capacity handy out loans.

Earlier this week, a senior govt of the American Bankers Affiliation (ABA) mentioned that stablecoins could possibly be a “detriment.”

“That is about making certain banks proceed to be ready to assist their communities and energy the financial system,” mentioned ABA’s senior vice chairman of innovation and technique, Brook Ybarra.

She added that “a detriment to that may be permitting the likes of Coinbase and Kraken to pay curiosity on fee stablecoins.”

That’s after the Financial institution Coverage Institute (BPI) estimated that rising stablecoin adoption might result in financial institution deposits dropping by roughly 10%. In the meantime, Normal Chartered estimates that as much as $1 trillion of financial institution deposits might stream into yield-bearing stablecoins in rising markets.

Whereas the pushback on yield-bearing stablecoins persists, the US Federal Reserve has signalled its intention to embrace stablecoins and different expertise that’s disrupting the funds area.

Just lately, Federal Reserve Governor Christopher Waller mentioned the central financial institution is exploring a “skinny” grasp account for crypto-native companies.

These new accounts would give the companies entry to the Federal Reserve’s fee and settlement infrastructure, with some restrictions and limitations. Nevertheless, it’ll additionally streamline the method for these crypto corporations that don’t want all the “bells and whistles” that include a full Fed grasp account.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection