As decentralized finance (DeFi) continues to develop, the query of the right way to generate sustainable returns has grow to be a serious and protracted problem that has but to be solved. Falcon Finance has emerged as a next-generation DeFi protocol, aiming to rebuild the inspiration of yield technology one that isn’t based mostly on hypothesis, however on collateral effectivity, interoperability, and real-world utility.

So, what precisely is Falcon Finance, and why is it gaining traction among the many myriad of DeFi tasks, hailed as a paradigm shift in DeFi infrastructure?

What’s Falcon Finance?

The interval of quick time period, hyped Defi tasks and unsustainable yields is over. Not too long ago, the market has begun to welcome many tasks that promise longevity and actual yields, opening a brand new chapter for the Defi world.

At its core, Falcon redefines what “yield” means in decentralized finance. As an alternative of counting on inflated token rewards or non permanent farming incentives, Falcon introduces a real-yield mannequin powered by sensible collateralization mechanisms and data-driven methods. This enables customers to unlock the total incomes potential of their digital belongings – securely, transparently, and effectively.

The challenge’s mission is summed up clearly in its mantra: “Your Asset, Your Yields.”

Falcon’s structure is designed so customers at all times retain possession of their belongings whereas collaborating in a system that maximizes returns by way of clever, sustainable mechanisms relatively than hypothesis.

Behind the protocol is a group of consultants with intensive expertise in blockchain, monetary engineering, and quantitative evaluation, and the assist of AI to calculate and make selections shortly and promptly, conserving your belongings secure and on the lowest danger attainable. Their focus lies in reaching a fragile stability between efficiency and reliability, making certain Falcon can act as a trusted layer for world liquidity and yield technology.

Falcon is not only about expertise, the Protocol goals to rebuild belief in DeFi by integrating transparency into each layer from how belongings are collateralized and deployed to how yields are generated and distributed.

At its core, Falcon Finance is not only a DeFi platform that guarantees returns; it’s a sustainable monetary system the place person management, accountability, and actual efficiency metrics exchange the hype cycles of the previous, all clear.

How Falcon Finance Works

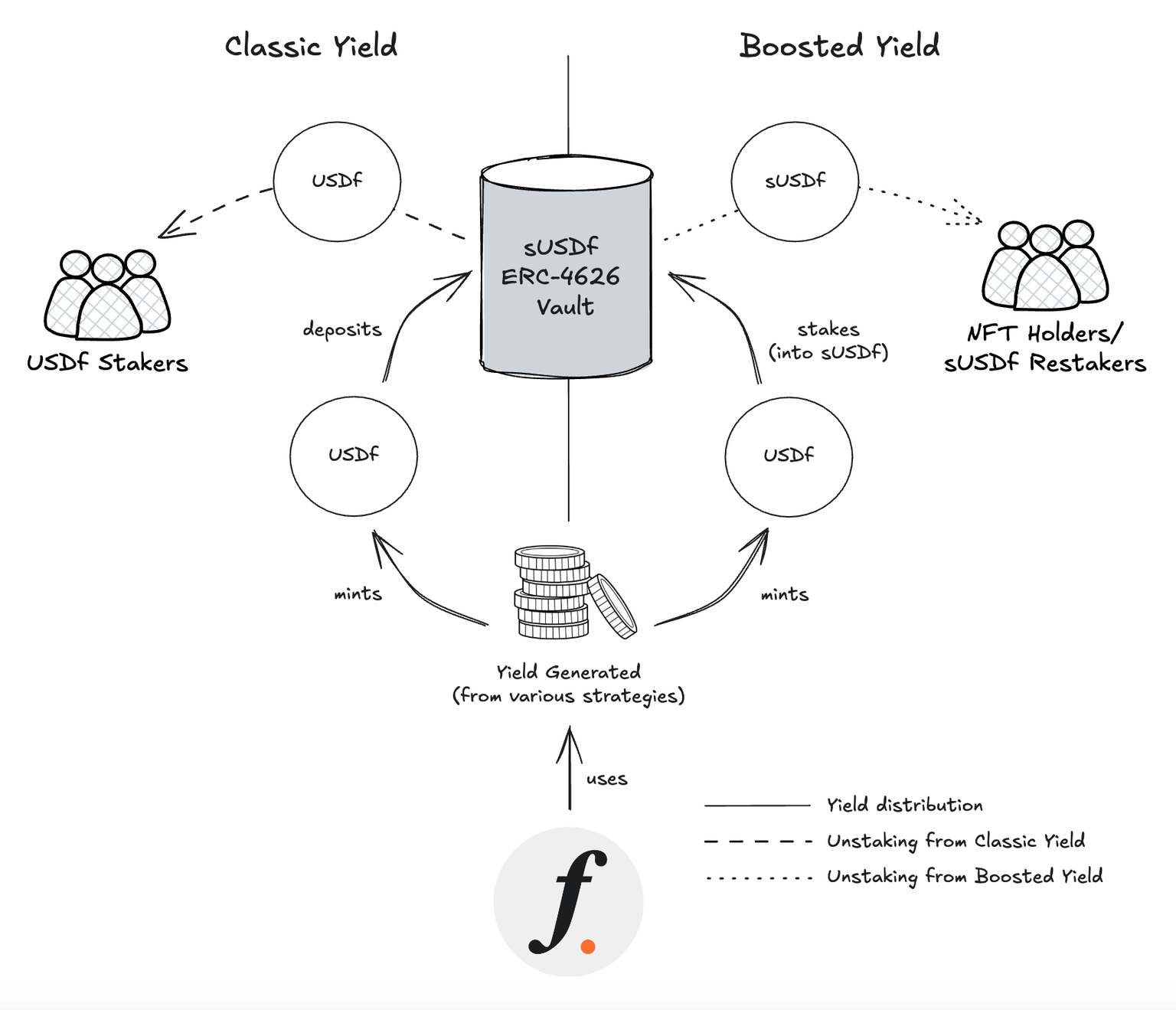

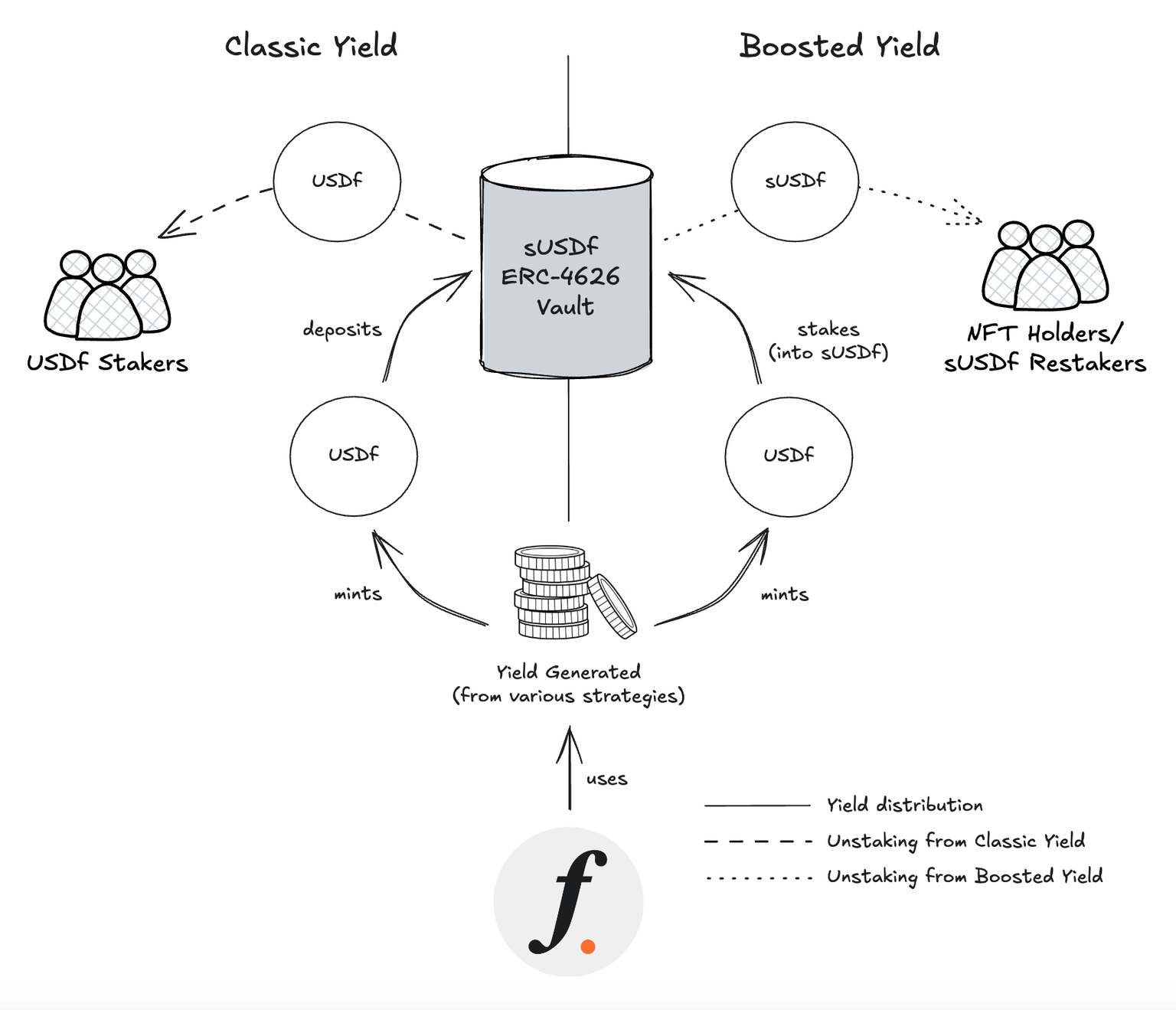

How Falcon Finance Works – Supply: FalconFinance

Falcon Finance combines collateralization, artificial belongings, and AI powered allocation to create a sustainable, clear, and automatic yield system. Each step, from person deposit to yield technology, all is designed to guard person possession whereas unlocking the productive potential of idle belongings.

Person Deposit Course of

When customers deposit their belongings (similar to ETH, USDC, or BNB) into Falcon, they don’t seem to be merely “locking” funds – they’re activating capital in a sensible, self-sustaining system.

Right here’s the way it works:

- Deposit: Customers join their wallets and deposit supported crypto belongings into Falcon Vault. In return, once they collateralize their belongings, customers obtain an equal quantity of USDf tokens.

- Collateral: Belongings are deposited to a 3rd get together that makes use of multi-sig and multi-party computation (MPC), making certain security, transparency, and safety from unlawful misappropriation. These collaterals kind the spine of Falcon’s lending and yield methods.

- AI Threat Evaluation: Falcon’s AI-driven danger administration engine evaluates real-time market knowledge – value actions, liquidity depth, and protocol security – to find out secure collateralization ratios and yield targets.

- Yield Deployment: As soon as validated, the system deploys these collaterals throughout chosen DeFi methods (centralized exchanges (CEXs), liquidity swimming pools, or staking swimming pools) to generate sustainable yield.

- Transparency & Management: All actions are recorded on-chain. Customers can monitor their positions, collateral ratios, and yield efficiency by way of the Falcon dashboard.

This ensures full transparency, safety, and composability – customers at all times retain possession and visibility of their belongings.

USDf – The Artificial Greenback

When collateralizing, Falcon creates an artificial steady asset known as USDf, which serves because the protocol’s inner liquidity and accounting unit. Falcon Finance maintains the soundness of the USDf peg by way of a mix of delta-neutral and market-neutral methods.

USDf is Falcon Finance’s over-collateralized artificial greenback, minted when customers deposit eligible collateral, together with stablecoins (e.g., USDT, USDC, DAI) and non-stablecoin belongings (e.g., BTC, ETH, and a few altcoins).

Customers can simply mint USDf by collateralizing belongings as described within the “Person Deposit Course of” part. If USDf has a hard and fast value <1USD, a KYC person can purchase USDf at market value and trade them for 1USD price of collateral, the person eats the distinction.

In brief, USDf represents the steady, collateralized platform on which Falcon’s yield economic system is constructed.

sUSDf – Yield Token

sUSDf is the yield model of USDf. When customers deposit belongings and obtain USDf, the system routinely points a yield model of USDf, known as sUSDf (Staked USDf). Moreover, sUSDf could be minted when USDf is deposited and staked in Falcon’s ERC-4626 repository.

Right here’s the way it works:

- Whenever you stake USDf, you’ll obtain sUSDf in return.

- sUSDf routinely accumulates yield over time because the protocol generates yield from deployed methods.

- The worth of sUSDf will increase relative to USDf – that means the variety of tokens you maintain will increase even when the variety of tokens stays the identical.

- You possibly can redeem sUSDf at any time to obtain the bottom USDf plus the gathered yield.

Mainly, sUSDf = USDf + Precise Yield Accumulation.

This mannequin eliminates the necessity for guide compounding or energetic administration. By merely holding sUSDf, customers will constantly earn yield in a clear and on-chain method.

sUSDf – Yield Token – Supply: FalconFinance

Falcon distributes yield pretty and transparently by calculating and verifying the each day returns throughout all energetic methods. It then mints new USDf based mostly on the entire yield generated.

A portion of this newly minted USDf goes straight into Falcon’s sUSDf ERC-4626 Vault, growing the vault’s USDf-to-sUSDf ratio over time. The remainder converts into sUSDf, which continues to accrue yield. Customers obtain this yield by way of Boosted Yield NFTs, introducing a gamified layer of participation and rewards.

By linking USDf and sUSDf in a unified system, Falcon Finance turns idle digital belongings into productive, yield-generating devices. This integration builds a resilient and modular yield infrastructure designed for the following technology of decentralized finance.

Tokenomics

The native token (let’s denote it as FF) serves because the financial and governance anchor of the ecosystem. Past governance, staking or holding FF tokens grants customers enhanced financial advantages throughout the Falcon ecosystem – together with increased APY when staking USDf, decrease overcollateralization necessities throughout minting, and lowered swap charges. These incentives are designed to encourage energetic participation and long-term alignment with the protocol’s development.

- Whole Provide: 10B FF

- Circulating Provide: 2.34B FF

- Market Cap: 334.26M

- Max Provide: 10B FF

- Unlock Market Cap: 333.58M

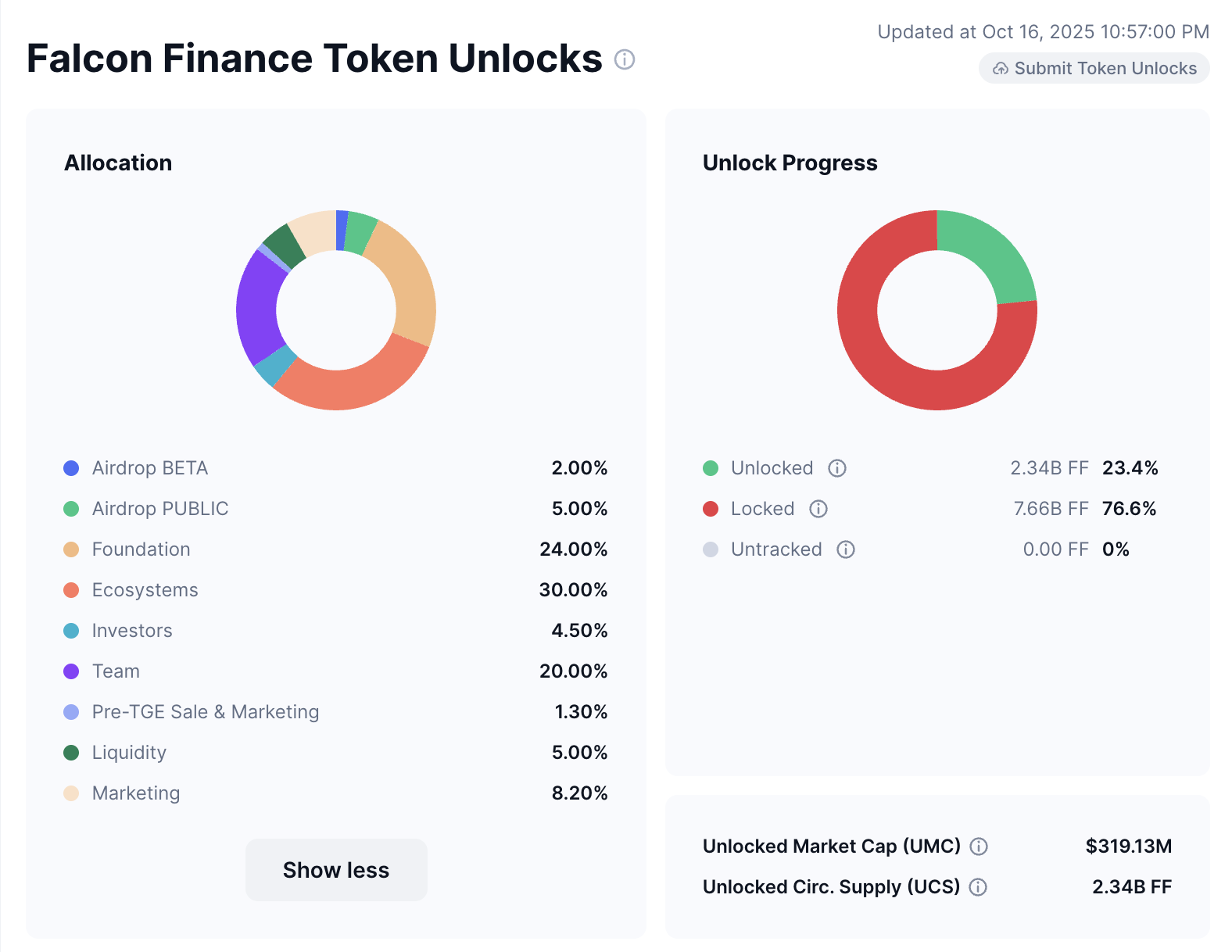

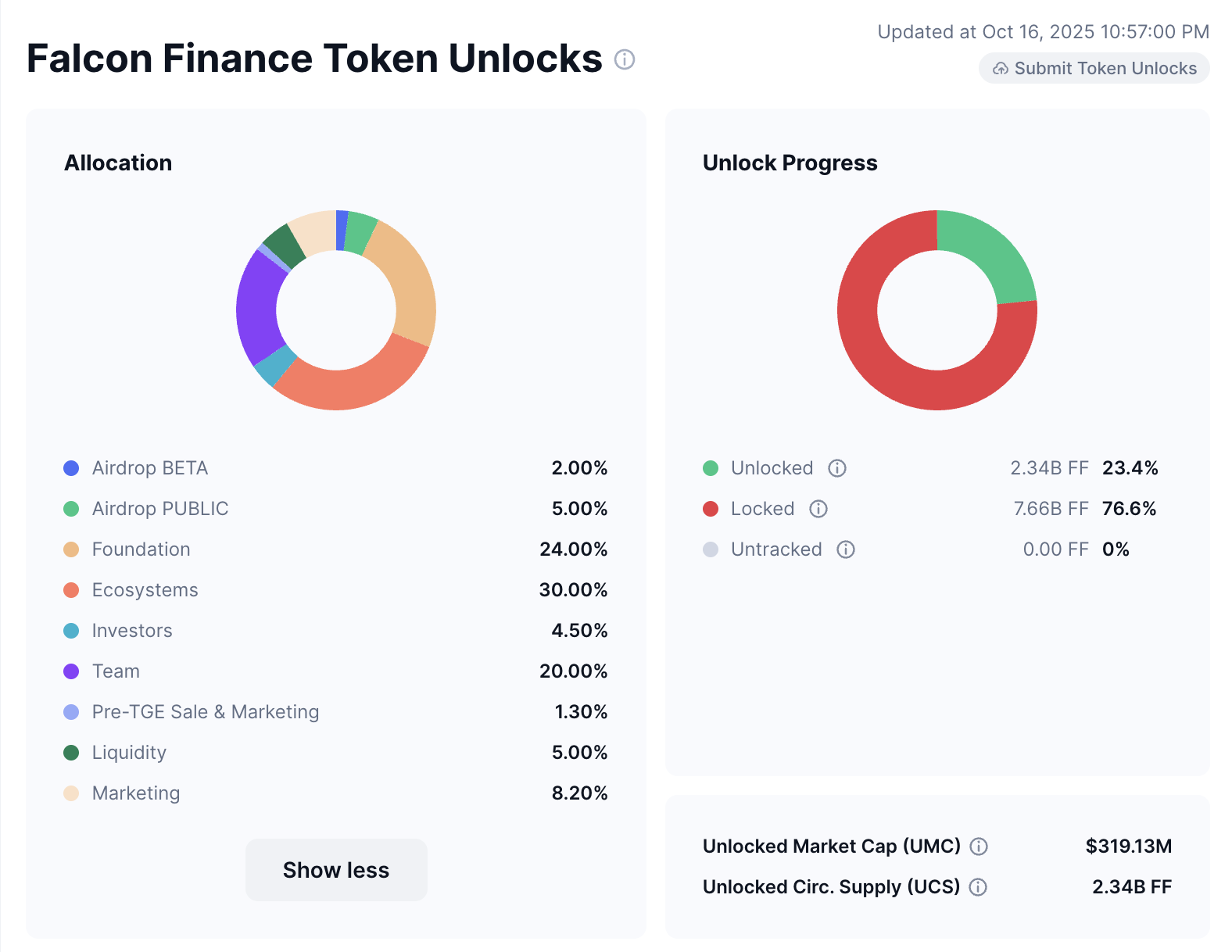

Falcon Finance Token Unlocks

Falcon Finance Token Unlocks – Supply: FalconFinance

- Airdrop BETA: 2%

- Airdrop PUBLIC: 5%

- Basis: 24%

- Ecosystems: 30%

- Investor: 4.5%

- Staff: 20%

- Pre-TGE Sale & Advertising: 1.3%

- Liquidity: 5%

- Advertising: 8.2%

Learn how to purchase FF

The FF token is Falcon Finance’s native asset powering governance, staking rewards, and financial incentives throughout the ecosystem. You possibly can simply buy FF on main centralized exchanges (CEX) by following the steps under.

Create an Account on a Centralized Alternate

- Select a good trade that lists FF, similar to Binance, OKX, KuCoin, Bybit, or MEXC.

- Go to the trade’s official web site or app and join utilizing your e mail or cell quantity.

- Full the KYC verification to allow buying and selling, deposits, and withdrawals.

Swap Your USDT for Falcon USD (USDf)

For higher compatibility, it’s advisable to begin with a stablecoin similar to USDT or USDC, cryptocurrencies pegged to the U.S. greenback and accepted in most swaps.

- Within the trade’s Spot Buying and selling part, kind “FF” within the search bar.

- You’ll see out there pairs similar to FF/USDT or FF/USDC.

- Click on on the pair you like to begin buying and selling.

Place Your Purchase Order

Resolve how a lot you’d wish to buy and choose your order kind:

- Market Order: Executes immediately on the present market value.

- Restrict Order: Executes solely when the token reaches your chosen value.

Enter the quantity of FF you want to purchase and make sure the order. As soon as stuffed, the tokens will seem in your Spot Pockets.

At all times double-check that you’re buying and selling the official FF token by confirming the contract tackle and itemizing announcement from Falcon Finance’s official channels.

Keep away from unofficial hyperlinks or unverified listings to make sure the protection of your belongings.

FAQ

What’s Falcon Finance?

Falcon Finance is the primary common mortgage infrastructure protocol that creates sustainable yield alternatives.

How does Falcon generate yield?

Falcon’s AI engine allocates person collateral into low danger, actual yield methods similar to lending, liquidity provisioning, and institutionalgrade DeFi markets. The yield is generated from real on-chain actions not from inflationary token emissions or unsustainable farming rewards.

What occurs if markets crash or yields fall?

Falcon’s AI danger administration and collateral safety controls assist mitigate losses by routinely adjusting publicity, rebalancing portfolios, or withdrawing from dangerous swimming pools. Yields might fall during times of excessive volatility, however customers’ capital is protected by overcollateralization and insurance coverage.

How is Falcon totally different from conventional DeFi platforms?

Falcon focuses on actual yields, collateral safety, and absolute institutional readiness and transparency. The platform introduces a common cross-chain collateral mechanism, integrates AI-based governance, and emphasizes compliance and transparency, bridging the hole between DeFi and conventional finance.

Why is Falcon targeted on sustainability?

As a result of long-term returns require actual financial exercise, not short-term hypothesis or hype, Falcon sees the necessity for sustainability within the many tasks on the market. Falcon’s design prioritizes steady returns, danger administration, and transparency, paving the way in which for a DeFi ecosystem that may scale globally whereas sustaining person belief and monetary integrity.