Bitcoin is exhibiting indicators of restoration after a number of days marked by promoting stress, volatility, and worry throughout the crypto market. Following the sharp flash crash on October 10, when BTC briefly plunged to round $103,000, the value has since rebounded and is now testing provide close to the $111,000 stage. This transfer has introduced a brief sense of reduction to merchants, however on-chain knowledge means that the market continues to be underneath stress.

In line with CryptoQuant, Quick-Time period Holders (STHs) — traders who sometimes maintain Bitcoin for lower than 155 days — are actually promoting under their value foundation, a transparent signal of capitulation. Traditionally, such capitulation occasions have typically marked late levels of a correction, as weak palms exit the market whereas stronger gamers accumulate.

Whereas this might sign that Bitcoin is nearing a neighborhood backside, uncertainty stays excessive. The approaching days will decide whether or not this rebound has the power to maintain — or if the market will face renewed draw back stress as world threat sentiment stays fragile.

Quick-Time period Holders Sign Capitulation

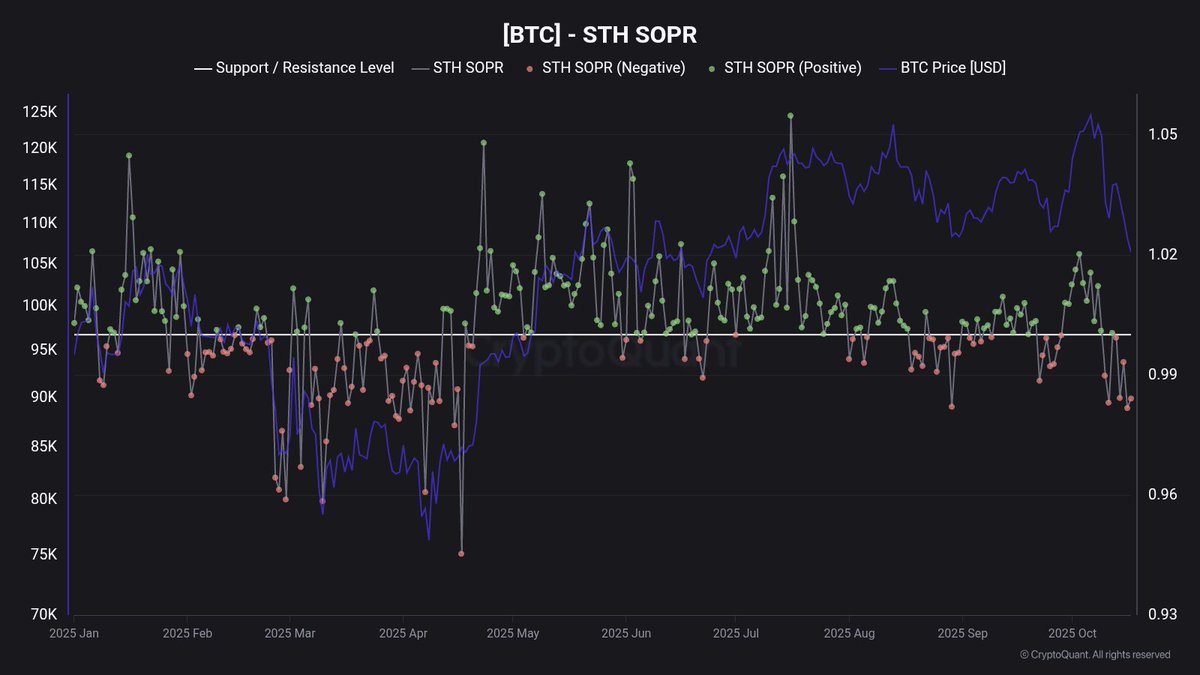

In line with CryptoQuant analyst Maartunn, the Quick-Time period Holder (STH) Spent Output Revenue Ratio (SOPR) has dropped to 0.98, marking its lowest stage since April 2025. This studying helps the development that STHs are actually promoting at a loss, an indication of capitulation inside essentially the most reactive phase of the market.

Traditionally, such declines in STH SOPR have aligned with late-stage corrections or market bottoms, as weaker palms are flushed out and cash switch to stronger holders. Throughout related phases in 2023, 2024, and early 2025, this metric has acted as a contrarian sign, typically previous main rebounds. Nonetheless, Maartunn cautions that whereas capitulation is unfolding, affirmation of a restoration nonetheless will depend on whether or not Bitcoin can maintain above its realized worth ranges and key transferring averages.

The market now finds itself at a important juncture. Bitcoin has rebounded from the $103,000 flash crash low to hover round $111,000, however momentum stays fragile. A sustained shut above the $111,500–$113,000 zone might reinforce short-term bullish construction, whereas failure to carry present assist could open the door to deeper corrections towards $100,000 or under.

If the SOPR stabilizes and begins to rise once more, it might affirm a shift from capitulation to re-accumulation — the early stage of a brand new upward development. But when promoting stress persists and sentiment weakens additional, the market dangers getting into a chronic consolidation part earlier than the following bullish leg begins. For now, Bitcoin stays on edge, caught between restoration hopes and macro-driven uncertainty.

Bitcoin Makes an attempt Quick-Time period Restoration, However Resistance Looms Forward

Bitcoin is exhibiting early indicators of a short-term rebound, recovering from the October 10 crash that despatched costs under $104,000. On the 4-hour chart, BTC is at present buying and selling close to $111,200, making an attempt to reclaim short-term transferring averages (50 and 100 SMA) after a number of days of bearish momentum. This bounce displays a shift in intraday sentiment, however the market stays cautious.

The following key resistance lies round $113,000–$114,000, the place the 200 SMA aligns with earlier assist turned resistance. A breakout above this zone might open the door to a check of $117,500, a significant liquidity space that capped rallies earlier this month. Nonetheless, if Bitcoin fails to clear this stage, it dangers falling again towards $107,000–$106,000, the place robust demand beforehand emerged.

Momentum indicators are enhancing however not but convincing. Quantity stays subdued, and funding charges proceed to hover in destructive territory — suggesting merchants nonetheless lean bearish. This setup typically precedes bigger quick squeezes, however affirmation continues to be missing.

Bitcoin’s short-term construction favors cautious optimism. Holding above $110,000 would assist the restoration narrative, whereas rejection at increased ranges might shortly set off one other retest of the latest lows. The following few periods might be decisive for confirming development route.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.