Ten p.c from its 52-week and all-time excessive of $1,341 a share, Netflix NFLX inventory is sitting on spectacular beneficial properties of greater than +30% this 12 months.

Holding down the title of subscriber king forward of Amazon’s AMZN Prime Video and Disney’s DIS Disney+, market sentiment has remained excessive for NFLX, with Netflix now boasting over 300 million paid subscribers worldwide.

Identified for having sharp post-earnings swings in both course, buyers might surprise if Netflix inventory is poised to achieve new heights or if a selloff might be within the playing cards as its Q3 report approaches on Tuesday, October 21.

Picture Supply: Zacks Funding Analysis

Strategic Growth & Blazing Advert Development

Embarking on new monetization avenues, Netflix has continued to diversify its streaming providers with stay sports activities and promoting.

Extra intriguing, Netflix is making a push into the $100+ billion gaming market by interactive cloud gaming and TV integration. Turning its streaming service right into a gaming console, Netflix now permits customers to play video games immediately on their TV screens. Netflix’s preliminary gaming technique contains party-style video games designed to boost social engagement by group play.

Advert-Tech: Investing closely in generative AI to streamline and personalize sport creation, Netflix has additionally modularized its AI advert codecs, which has helped double its advert income whereas lowering reliance on value hikes. These immersive AI advertisements seem immediately inside hit reveals like Stranger Issues and Wednesday with Netflix utilizing gen AI to create deeper model integration with out conventional product placement.

Netflix’s extra reasonably priced ad-supported tier has grown to almost 100 million subscribers and now accounts for 50% of its new subscriptions. Moreover, Netflix’s advert income has already soared over 120% this 12 months to greater than $3 billion after greater than doubling in 2024 as effectively.

Worldwide Audiences: Rising its presence in Asia-Pacific and Europe, Netflix has constructed its cultural relevance by leveraging native storytelling to enchantment to various audiences with regional hit reveals like Tokyo Ghoul and Delhi Crime.

Netflix’s Q3 Expectations

Zacks’ projections name for Netflix’s Q3 gross sales to be up 17% to $11.52 billion in comparison with $9.82 billion within the prior 12 months quarter. Benefiting from its top-line enlargement, Netflix’s earnings are anticipated to climb 27% to $6.89 per share versus EPS of $5.40 in Q3 2024.

NFLX Worth Goal

Reflecting robust confidence in its development trajectory, analysts have remained reasonably bullish on Netflix inventory, with the present Common Zacks Worth Goal of $1,338 suggesting 13% upside for NFLX. Notably, the street-high value goal of $1,600 suggests 35% upside, whereas the low of $800 displays 32% draw back.

Picture Supply: Zacks Funding Analysis

What the Zacks Rank Suggests

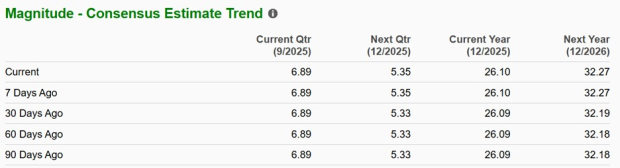

Most influential to Zacks’ proprietary rating system is the pattern of earnings estimate revisions (EPS), with NFLX at present touchdown a Zacks Rank #3 (Maintain). During the last quarter, EPS estimates for NFLX have remained optimistic, however the needle hasn’t moved a lot for fiscal 2025 or FY26 projections.

That mentioned, Netflix’s annual earnings are actually anticipated to soar 31% in FY25, with FY26 EPS projected to spike one other 23% to $32.27.

Picture Supply: Zacks Funding Analysis

Conclusion & Ultimate Ideas

Netflix’s huge earnings potential does justify its premium to the broader market at a ahead P/E a number of of 45X. Though Netflix has continued to develop into what was a a lot loftier valuation, its Q3 report might want to reconfirm the corporate’s attractive outlook.

Contemplating the YTD beneficial properties for NFLX and that it’s now up almost +400% within the final three years, a selloff might be spurred by any disappointment or revenue taking if the outcomes usually are not overwhelming. Then again, if Netflix wows with monetary outcomes, NFLX may actually see a post-earnings rally and even hit new heights on promising steering that displays its compelling strategic enlargement.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to achieve +100% or extra within the coming 12 months. Whereas not all picks might be winners, earlier suggestions have soared +112%, +171%, +209% and +232%.

Many of the shares on this report are flying beneath Wall Avenue radar, which gives an excellent alternative to get in on the bottom ground.

At present, See These 5 Potential House Runs >>

Netflix, Inc. (NFLX) : Free Inventory Evaluation Report

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

The Walt Disney Firm (DIS) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.