As two of essentially the most outstanding asset managers, BlackRock BLK and Goldman Sachs GS helped spotlight Tuesday’s Q3 earnings lineup after exceeding their quarterly expectations and hitting data in belongings underneath administration (AUM).

Notably, each corporations are benefiting from sturdy inflows throughout asset courses and strategic positioning in high-growth areas like passive investing and digital finance.

BlackRock shares have been properly up over +3% in as we speak’s buying and selling session, with BLK extending to year-to-date features of +18% whereas Goldman Sachs inventory dipped 2% on what seems to be some revenue taking as GS remains to be up a powerful +37% YTD.

Picture Supply: Zacks Funding Analysis

BlackRock & Goldman Sachs Q3 Outcomes

Posting Q3 gross sales of $6.5 billion, BlackRock’s high line expanded 25% from $5.19 billion within the prior yr quarter and topped estimates of $6.24 billion. BlackRock’s Q3 earnings have been up practically 1% to $11.55 per share, beating EPS expectations of $11.19 by 3%.

Pivoting to Goldman Sachs, Q3 gross sales of $15.18 billion stretched 19% from $12.69 billion a yr in the past and noticeably exceeded estimates of $14.14 billion by 7%. Extra spectacular, Goldman Sachs’ Q3 EPS climbed practically 46% to $12.25 in comparison with $8.40 per share within the comparative quarter and beat expectations of $11.11 by 10%.

BlackRock & Goldman Sachs Document AUM

Remaining the most important world asset supervisor, BlackRock’s AUM spiked 17% yr over yr to a file $13.5 trillion.

Inserting among the many high 10 largest asset managers globally, Goldman Sachs’ AUM additionally hit a brand new peak of $3.45 trillion, rising 11% YoY.

BLK & GS Valuation Comparability

Goldman Sachs’ valuation stands out at 16X ahead earnings. On this regard, GS trades at a definite low cost to the benchmark S&P 500’s 25X ahead earnings a number of, with BlackRock at 24X.

GS additionally trades close to the popular degree of lower than 2X ahead gross sales, with BLK at 8X and buying and selling at a premium to the S&P 500’s 5X.

Picture Supply: Zacks Funding Analysis

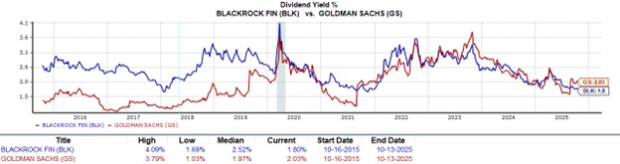

BLK & GS Dividend Comparability

Providing respectable dividends, Goldman Sachs’ present yield of two.03% edges BlackRock’s 1.8%. These yields high the S&P 500’s 1.11% common, though BlackRock’s barely trails the broader Zacks monetary sector’s 1.89%.

Picture Supply: Zacks Funding Analysis

Ought to Buyers Purchase BLK or GS Inventory?

Regardless of having the benefit in AUM, BlackRock inventory pales compared to Goldman Sachs in lots of metrics. Nonetheless, each of those outstanding finance shares have confirmed to be viable investments within the portfolio, and for now, they land a Zacks Rank #3 (Maintain), respectively.

That stated, a purchase score might definitely be on the way in which for Goldman Sachs, as earnings estimate revisions are more likely to rise within the coming weeks, given its spectacular Q3 EPS beat.

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to benefit from the subsequent development stage of this market. And it is simply starting to enter the highlight, which is precisely the place you wish to be.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

The Goldman Sachs Group, Inc. (GS) : Free Inventory Evaluation Report

BlackRock (BLK) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.