- The Fed has nice sources of data even with the federal government shutdown.

- Subsequent yr is a great distance off by way of financial coverage.

- Thus far seen each labor provide and demand for employees declining at about the identical tempo.

- The breakeven price for month-to-month jobs is decrease than it was and onerous to evaluate proper now.

- Suspect the breakeven price is decrease than 75K per 30 days.

- Wouldn’t need to step on a productiveness increase

- the Fed ought to discover what productiveness progress may be.

- Muted tariff inflation up to now is a testomony to enterprise creativity in managing prices.

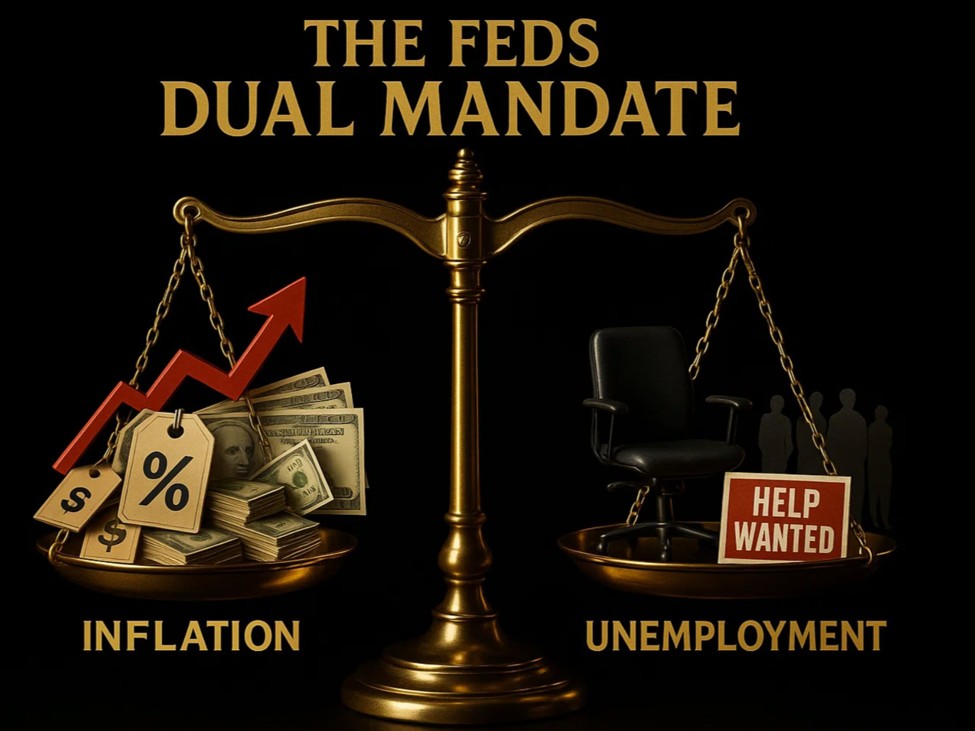

- Don’t see the kind of demand circumstances that might flip a sequence of provide shocks into persistent inflation.

- The Fed should fields strategy to the impartial price.

- Development proper now could be sturdy, however onerous to see how that’s sustained.

- If inflation exhibits a burst the Fed must react

- Market expectations are usually extra dependable than family surveys on inflation expectations.

Extra dovish feedback from Chicago Fed Pres. Paulson

This text was written by Greg Michalowski at investinglive.com.