The Bitcoin market has skilled a big value correction in the previous couple of hours, with costs dropping to round $110,000 as the commerce battle between the US and China could but recommence. Earlier than this decline, the crypto market chief led a robust rally to set a brand new all-time excessive of $126,198.17 on October 6, 2025. Curiously, latest information on the Bitcoin Choices market indicated a wave of cautious positioning amongst institutional buyers amid this value surge forward of the present market downturn.

Establishments Step Again As Bitcoin’s Rally Turns Euphoric – Glassnode

In an X submit on October 10, blockchain analytics agency Glassnode lays out some attention-grabbing insights in its weekly choices market replace. Notably, Glassnode analysts report that whereas Bitcoin costs surged greater than 10% within the latest ascent to a brand new all-time excessive, institutional merchants seem to have maintained a peaceful market strategy, opting to lock in income and shield draw back moderately than chase the rally.

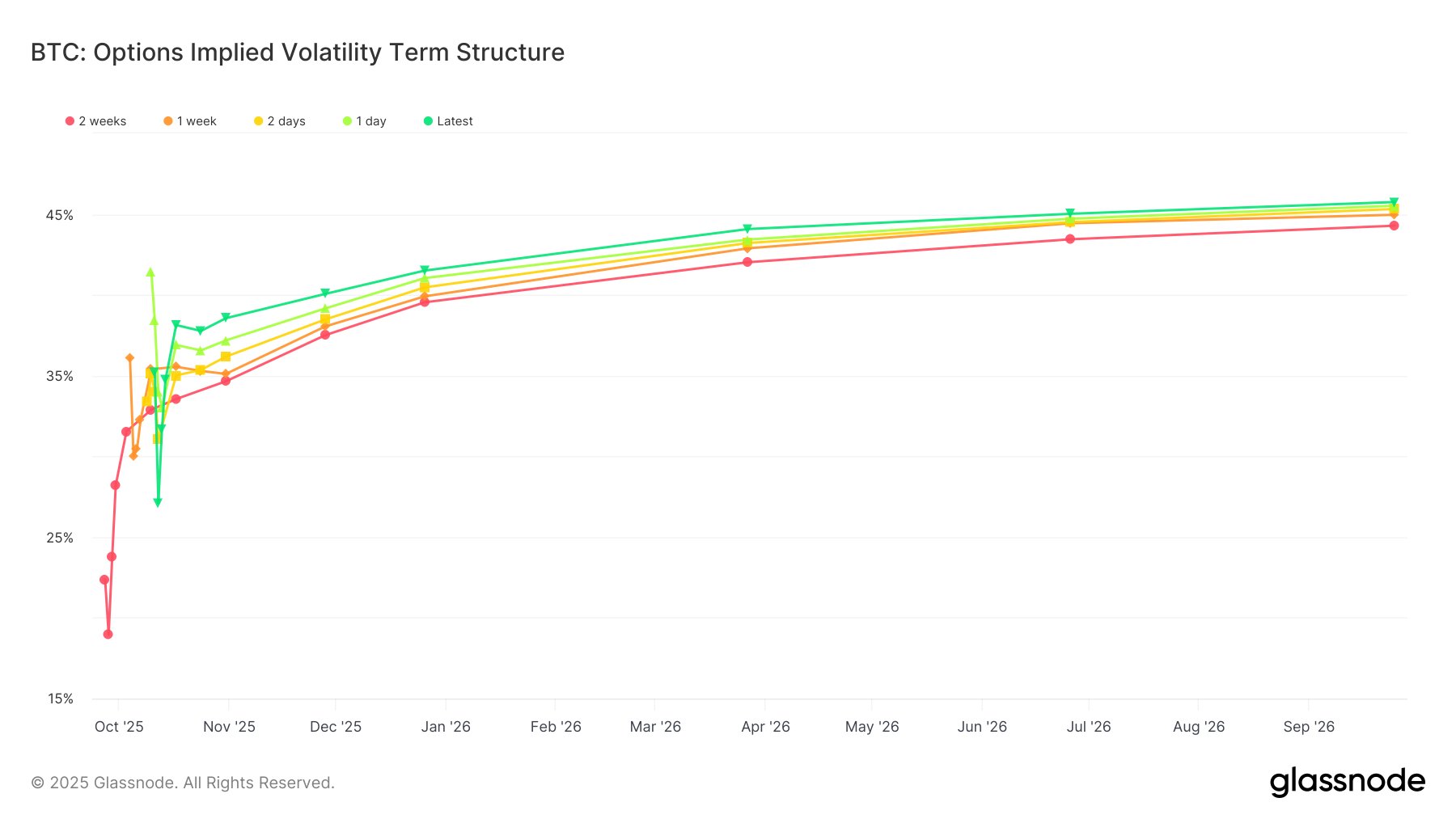

Regardless of the steep transfer larger, implied volatility, i.e., a gauge of anticipated value swings, barely budged, hovering round 38–40%. Usually, a rally of that dimension would push volatility larger as merchants hurriedly name and amplify their publicity. Nonetheless, the silent response suggests composure from institutional buyers who had been already positioned for the transfer or just unwilling to pay up for extra upside.

Glassnode analysts additionally draw consideration to a different refined however telling check in possibility skew. Even on the top of the rally, demand for put choices remained robust, maintaining the market elevated. This means that many giant gamers had been promoting calls, successfully capping potential upside, by the choices market, whereas sustaining insurance coverage in case the market reversed.

As well as, the put-call ratio additionally reinforces this cautious sample amongst establishments. Amidst the choice expiry on Friday, October 9, the ratio climbed above 1.0, indicating extra places traded than calls as merchants had been busy hedging positions forward of the present downturn moderately than chasing momentum and locking in latest features.

Typically, Glassnode describes the Bitcoin market as having adopted a unique habits this cycle, pushed by institutional self-discipline moderately than surging volatility and retail exuberance as seen in earlier cycles. The dominance of institutional funding pushed by spot ETFs and the latest creation of crypto treasury corporations could have added a thick layer of maturity to the $2 trillion market.

BTC Market Overview

On the time of writing, Bitcoin is buying and selling at $110,805 after a 7.54% decline up to now 24 hours. In the meantime, each day buying and selling quantity has surged 150.37%, indicating an increase in market exercise as merchants react to the sharp pullback.

Featured picture from Flickr, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.