Be a part of Our Telegram channel to remain updated on breaking information protection

Tom Lee and BitMine Immersion Applied sciences are below hearth from short-seller Kerrisdale Capital, which says the corporate’s ETH treasury technique is a “relic on the verge of extinction.”

The agency criticized BitMine for issuing billions in new shares to fund Ethereum purchases, arguing the method erodes investor worth and not justifies a premium inventory worth.

BitMine’s market worth is converging with the underlying worth of its ETH holdings, chipping away on the firm’s attraction to buyers, it added.

“In order for you ETH, simply purchase it straight, stake it, or make investments via one of many new ETFs,” it mentioned. “BitMine’s intermediary pitch has run its course.”

BitMine’s Inventory Gross sales To Fund ETH Purchases No Longer Justified

The criticism comes after BitMine transitioned from an organization primarily targeted on Bitcoin mining to an Ethereum treasury agency earlier this 12 months.

Since performing that pivot, BitMine has turn into the biggest company holder of ETH, amassing billions of {dollars} value of the token within the course of.

🧵

BitMine supplied its newest holdings replace for Oct 6, 2025:$13.4 billion in complete crypto + “moonshots”

– 2,830,151 ETH at $4,535 per ETH token

– 192 $BTC cash

– $113 million Eightco stake (NASDAQ-$ORBS)

– unencumbered money $456 millionTicker: $BMNR…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 6, 2025

To develop its holdings and enhance the quantity of ETH per share that it gives buyers, the corporate employed a tactic that has been pioneered by Michael Saylor’s Technique to purchase extra Bitcoin. This includes promoting fairness and utilizing the proceeds to purchase extra crypto.

Kerrisdale estimated that BitMine presently gives 9 ETH per 1,000 shares. Nevertheless, it accused BitMine of extreme inventory dilution in pursuit of its ETH accumulation, pointing to $10 billion in new share choices over simply the previous three months.

“Each rally is met with extra provide,” it mentioned, earlier than including that the corporate’s $365 million increase in September was nothing greater than “a reduced giveaway disguised as a premium deal.”

Lee Lacks Saylor’s Cult-Like Following

The agency additionally mentioned that Lee, who chair’s BitMine, lacks the cult-like following that Saylor and Technique possess.

To ensure that BitMine’s mannequin to succeed, Kerrisdale mentioned the corporate “wants shortage, charisma, and innovation – none of which it presently gives.”

The short-seller mentioned that its criticism of BitMine isn’t a guess towards the Ethereum community and its native ETH token, however moderately “towards the notion that buyers ought to pay a premium for publicity” that may be simply replicated.

BitMine Inventory Takes A Breather From Its Rally

Prior to now, Kerrisdal has issued comparable warnings for buyers shopping for shares in Riot Platform and Technique.

Riot dismissed Kerrisdale’s criticism and mentioned the agency’s findings had been “unsound.” Saylor’s Technique ignored the report utterly.

Kerrisdale’s criticism of BitMine was adopted by a greater than 3% drop in its share worth pre-market buying and selling.

BitMine share worth (Supply: Google Finance)

That’s after the inventory climbed over 1% within the newest buying and selling day, in response to Google Finance knowledge. Within the final six months, the Ethereum treasury agency’s shares have exploded by greater than 16,500%.

Institutional Demand For ETH Soars

The report from Kerrisdale comes amid hovering institutional demand for Ethereum. Treasury companies and ETFs (exchange-traded funds) now maintain over 12.48 million ETH, which equates to roughly 10.31% of the token’s complete provide.

BitMine itself holds round 2.83 million ETH, in response to knowledge from StrategicETHReserve. That is significantly greater than the next-biggest Ethereum treasury, SharpLink Gaming, with its holdings of roughly 838.73K ETH.

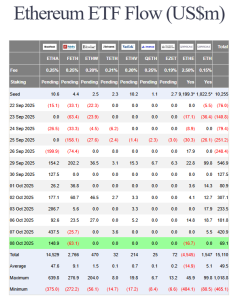

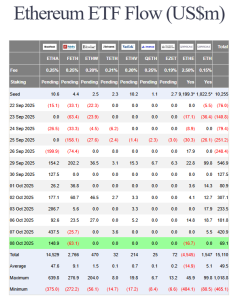

US spot Ethereum ETFs are additionally presently on a multi-day inflows streak. Knowledge from Farside Traders exhibits buyers poured $69.1 million into the merchandise yesterday, extending the constructive flows streak to eight days.

US spot ETH ETF flows (Supply: Farside Traders)

BlackRock’s ETHA fund was the one US spot ETH ETF to file inflows on the day, with $148.9 million added to its reserves. In the meantime, Constancy’s FETH and Grayscale’s ETHE recorded respective web day by day outflows of $63.1 million and $16.7 million. The remaining funds recorded no new flows.

That demand has not translated to ETH’s worth within the final 24 hours. Throughout this era, the crypto shed over 3% of its worth to commerce at $4,340.25 as of 5:10 a.m. EST, knowledge from CoinMarketCap exhibits.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection