The crypto market simply witnessed a serious shake-up: Plume, a public blockchain purpose-built for RWA, offering infrastructure for tokenization, compliance, and yield technology, has been permitted by the U.S. Securities and Alternate Fee (SEC) to grow to be the primary on-chain switch agent, paving the best way to convey the trillion-dollar U.S. securities market onto blockchain and paving the best way for conventional U.S. shares to be absolutely included with blockchain know-how.

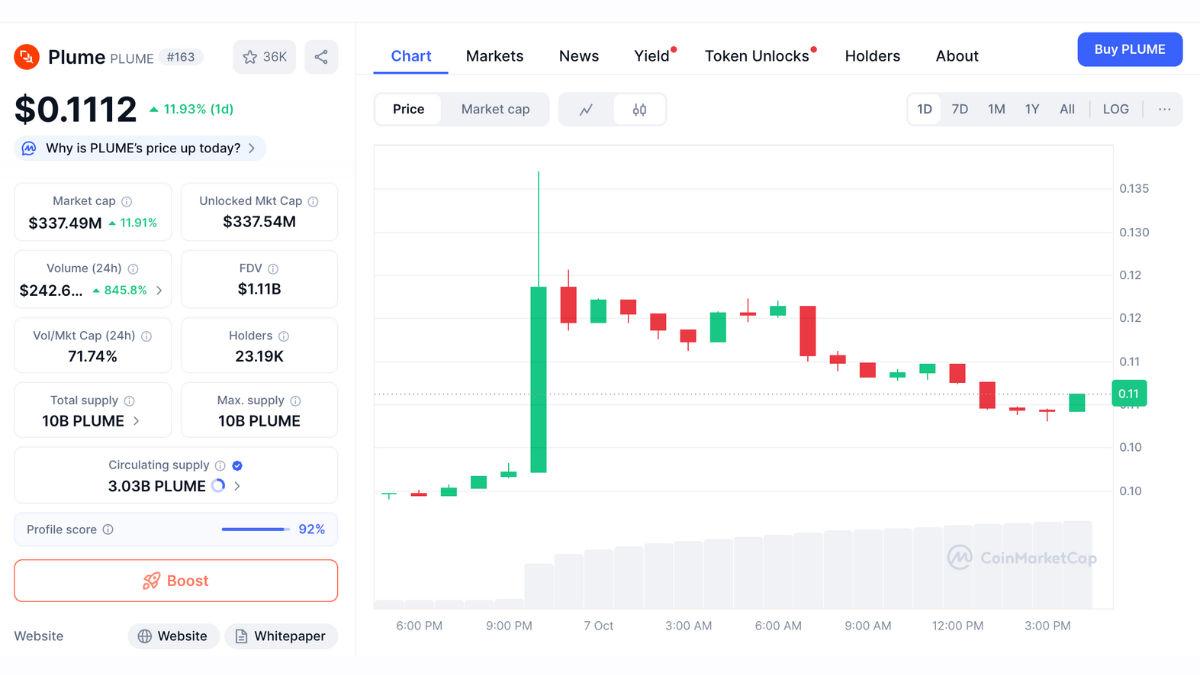

The announcement rocked the crypto neighborhood, sending Plume’s native token, PLUME, up over 25% in hours as commerce volumes reached all-time highs.

Plume Bridges DeFi and Conventional Finance

Plume Bridges DeFi and Conventional Finance – Supply: Coinmarketcap

SEC Approval Positions Plume on the Heart of Blockchain Integration in U.S. Capital Markets. The SEC’s approval of Plume marks a serious milestone in advancing blockchain adoption throughout regulated U.S. markets.

As the primary on-chain switch agent, Plume will join conventional capital markets with decentralized finance (DeFi), creating new pathways for compliant on-chain transactions. Trade analysts see the choice as a transparent endorsement of the Actual World Asset (RWA) motion — one of many fastest-growing sectors within the crypto house — that seeks to tokenize trillions of {dollars} in conventional belongings on-line.

Inside hours of the announcement, PLUME’s buying and selling quantity spiked over 800%. Traders interpreted the approval as an indication of rising institutional and regulatory confidence in tokenized securities and blockchain-based monetary infrastructure.

Venture Particulars & Expertise

Venture Particulars & Expertise – Supply: Plume Community

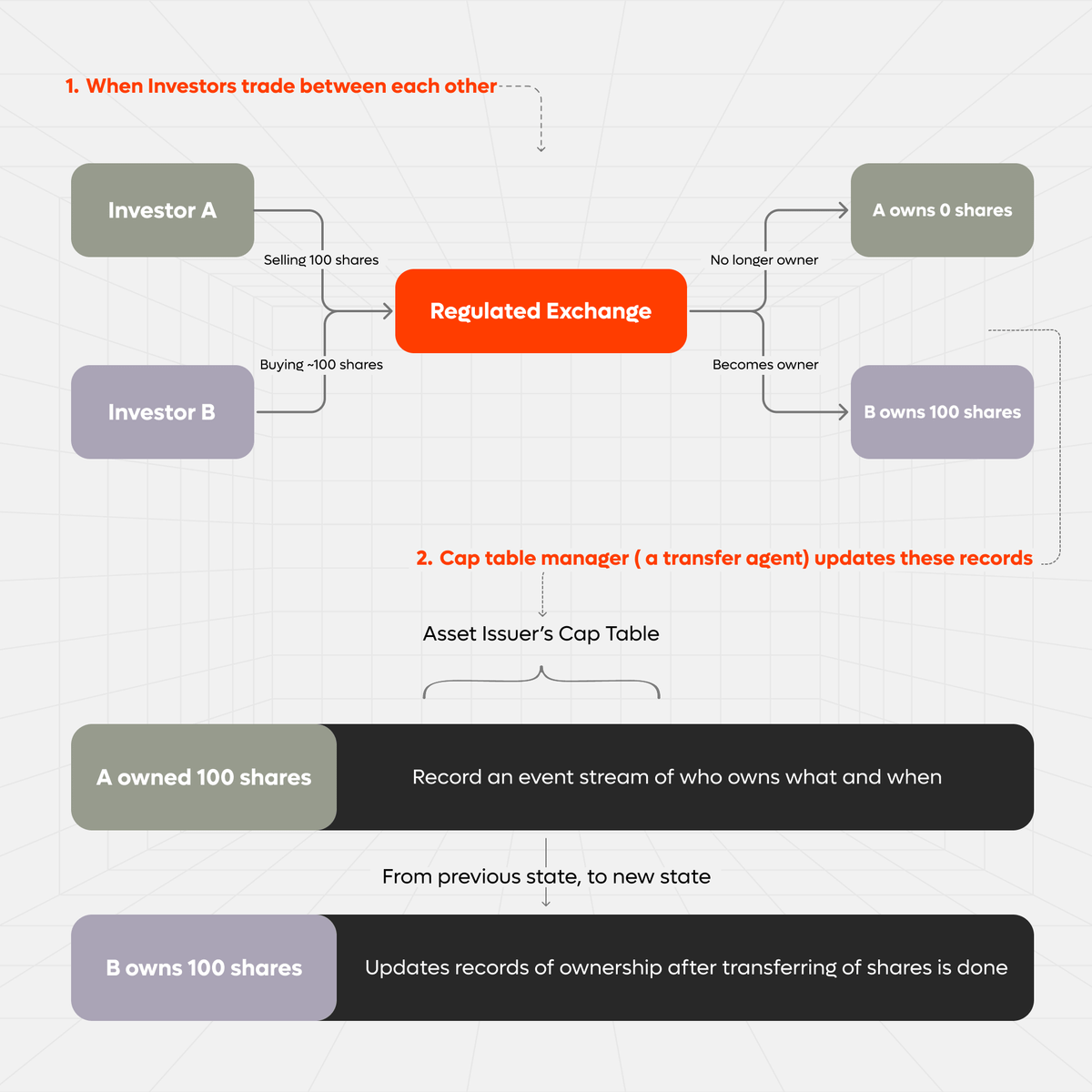

Based on Plume official X announcement, the corporate will migrate the complete legacy of switch agent infrastructure to blockchain – administration of shareholder data, monitoring transactions, and fee of dividends.

In contrast to conventional corporations that make use of inner databases, the platform of Plume data each exercise on-chain, reporting routinely to DTCC and the SEC through sensible contracts. This gives end-to-end transparency, real-time compliance, and vital price and time discount for each regulators and issuers.

In a matter of simply three months, Plume onboarded greater than 200,000 actual asset traders and tokenized belongings price over $62 million on its NestCredit platform – demonstrating the rising urge for food for compliant blockchain-based asset administration.

Be taught extra: Plume listing Binance…

The SEC license is a large leap for the tokenized asset sector – verifying RWA and bringing the imaginative and prescient of RWAfi to life: a safe, compliant, and clear monetary system. Plume would be the go-between that TradFi can’t dwell with out between decentralized finance (DeFi) and conventional finance (TradFi).