- VRT Inventory’s Efficiency

- VRT Advantages From Strategic Acquisitions

- Vertiv Advantages From Increasing Portfolio

- Vertiv Advantages From Wealthy Accomplice Base

- VRT Raises 2025 Steerage

- VRT’s Earnings Estimates Revisions Are Regular

- Vertiv Inventory is Buying and selling at a Premium

- VRT Valuation

- Conclusion

- Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

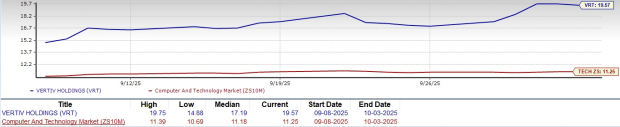

Vertiv VRT shares have gained 31.5% in a month, outperforming the broader Zacks Laptop and Expertise sector’s enhance of 5.7%.

Vertiv’s shares have additionally outperformed its friends, which embody Tremendous Micro Laptop SMCI and Hewlett-Packard Enterprise HPE, each of that are increasing their capabilities to serve hyperscale and enterprise AI information heart deployments. Hewlett-Packard and Tremendous Micro Laptop shares have gained 3.9% and 29.8%, respectively, previously month.

The outperformance will be attributed to VRT’s intensive product portfolio, which spans thermal programs, liquid cooling, UPS, switchgear, busbars, and modular options, a notable function.

Within the trailing 12 months, natural orders grew roughly 11%, with a book-to-bill of 1.2 occasions for the second quarter of 2025, indicating a powerful prospect. Backlog grew 7% sequentially and 21% 12 months over 12 months to $8.5 billion.

VRT Inventory’s Efficiency

Picture Supply: Zacks Funding Analysis

VRT Advantages From Strategic Acquisitions

Vertiv is a number one supplier of thermal and energy administration options for information facilities that devour immense quantities of energy. The growing complexity of AI {hardware} and edge computing additional will increase the demand for energy. Vertiv’s energy-efficient energy and cooling options play a important position on this facet.

Acquisitions have performed an essential position in additional increasing Vertiv’s footprint. In August, Vertiv acquired Waylay NV, a Belgium-based firm identified for its hyperautomation and generative AI software program.

This transfer goals to enhance its AI-driven monitoring and management applied sciences for energy and cooling programs. The acquisition boosts Vertiv’s capability to offer good infrastructure options that optimize vitality use, enhance uptime, and improve operational intelligence in information facilities worldwide.

The corporate additionally accomplished its $200 million acquisition of Nice Lakes Knowledge Racks & Cupboards, broadening its rack, cupboard, and built-in infrastructure choices for important digital infrastructure.

Vertiv Advantages From Increasing Portfolio

Vertiv’s increasing portfolio has been a serious development driver for its success. In August, Vertiv introduced the worldwide launch of Vertiv OneCore. This can be a scalable, prefabricated information heart resolution that mixes energy, thermal and IT infrastructure into one factory-assembled system.

OneCore is designed to hurry up high-density deployments. It simplifies set up, reduces on-site complexity, and helps versatile, energy-efficient setups for AI and enterprise functions.

Vertiv Advantages From Wealthy Accomplice Base

Vertiv’s wealthy companion base, which incorporates Ballard Energy Techniques, Compass Datacenters, NVIDIA NVDA, Oklo, Intel, ZincFive, and Tecogen, has been noteworthy.

In June 2025, Vertiv introduced its energy-efficient 142KW cooling and energy reference structure for the NVIDIA GB300 NVL72 platform. Vertiv options can be found as SimReady 3D belongings within the NVIDIA Omniverse Blueprint for AI manufacturing unit design and operations.

VRT Raises 2025 Steerage

Vertiv is benefiting from its robust portfolio and wealthy companion base, which is able to proceed to profit the corporate’s top-line development.

For 2025, revenues are actually anticipated to be between $9.925 billion and $10.075 billion. Natural web gross sales development is predicted to be between 23% and 25%.

VRT expects 2025 non-GAAP earnings between $3.75 and $3.85 per share.

For third-quarter 2025, revenues are anticipated to be between $2.510 billion and $2.590 billion. Natural web gross sales are anticipated to extend within the 20% to 24% vary.

VRT expects third-quarter 2025 non-GAAP earnings between 94 cents and $1.00 per share.

VRT’s Earnings Estimates Revisions Are Regular

The Zacks Consensus Estimate for third-quarter 2025 earnings is presently pegged at 99 cents per share, which has remained unchanged over the previous 30 days. The determine signifies a year-over-year enhance of 30.26%.

The Zacks Consensus Estimate for Vertiv’s 2025 revenues is pegged at $9.98 billion, suggesting development of 24.55% 12 months over 12 months.

The Zacks Consensus Estimate for 2025 earnings is presently pegged at $3.83 per share, which has elevated by a penny over the previous 30 days. This means a 34.39% enhance from the 2024 reported determine.

Vertiv Holdings Co. Value and Consensus

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Vertiv Inventory is Buying and selling at a Premium

Vertiv is presently overvalued, as advised by a Worth Rating of D.

By way of the trailing 12-month Value/E book, Vertiv is presently buying and selling at 19.57X, in contrast with the broader Laptop and Expertise sector’s 11.25X, Tremendous Micro Laptop’s and Hewlett Packard’s 4.90X and 1.32X, respectively.

VRT Valuation

Picture Supply: Zacks Funding Analysis

Conclusion

Vertiv is benefiting from its robust portfolio and wealthy companion base, that are driving order development. These elements justify the corporate’s premium valuation.

Vertiv inventory presently carries a Zacks Rank #2 (Purchase) and has a Development Rating of A, a good mixture that gives a powerful funding alternative, per the Zacks Proprietary methodology. You’ll be able to see the entire checklist of immediately’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our staff of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime decide is a little-known satellite-based communications agency. Area is projected to change into a trillion greenback business, and this firm’s buyer base is rising quick. Analysts have forecasted a serious income breakout in 2025. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Hims & Hers Well being, which shot up +209%.

Free: See Our High Inventory And 4 Runners Up

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Tremendous Micro Laptop, Inc. (SMCI) : Free Inventory Evaluation Report

Hewlett Packard Enterprise Firm (HPE) : Free Inventory Evaluation Report

Vertiv Holdings Co. (VRT) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.