A brand new report from State Road reveals that institutional buyers are steadily growing their publicity to Bitcoin and different crypto belongings.

Particularly, the report discovered that fifty% of the surveyed corporations plan to increase their crypto allocations over the following 12 months, whereas one other third intend to preserve their positions unchanged.

In the meantime, almost seven in ten establishments anticipate to spice up their holdings inside 5 years, and 1 / 4 of them plan main will increase. Notably, this pattern reveals how crypto belongings are turning into extra acceptable in international funding methods.

Asset Managers and House owners Rising Publicity to Crypto

The report notes that crypto belongings at the moment make up 7% of institutional portfolios, however the quantity may greater than double to 16% inside three years.

Apparently, asset managers are main the pattern, taking larger positions than asset homeowners. Particularly, 14% of managers maintain between 2% and 5% of their portfolios in Bitcoin, in comparison with 7% of homeowners.

Managers are additionally 3 times extra prone to make investments 5% or extra of their belongings in Ethereum. Furthermore, 6% of managers maintain at the very least 5% in smaller cryptocurrencies, meme cash, or NFTs, in comparison with simply 1% of homeowners.

Additional, tokenized belongings are gaining floor. Per the report, asset managers have greater publicity to tokenized private and non-private belongings, coming in at 6% and 5% respectively, whereas homeowners sit at 1% and a pair of%.

Managers additionally maintain extra digital money at 7%, in comparison with 2% for homeowners. In the meantime, regardless of expressing warning, greater than half of all respondents anticipate between 10% and 24% of all investments to be made by digital or tokenized belongings by 2030.

Bitcoin and Crypto Delivering Spectacular Returns

In accordance with State Road, the respondents are seeing spectacular returns from crypto belongings. Expectedly, Bitcoin delivers the best positive aspects for 27% of respondents, and 1 / 4 anticipate it to keep on prime for the following three years.

Notably, Ethereum follows carefully, with 21% saying it’s at the moment their finest performer and 22% anticipating it to stay so. Nonetheless, tokenized private and non-private belongings ship smaller returns, about 13% and 10%, however nonetheless play an essential position in diversified portfolios.

As well as, establishments additionally consider mainstream adoption is approaching. For example, 68% anticipate digital investments to turn into customary inside ten years, greater than double final yr’s 29%.

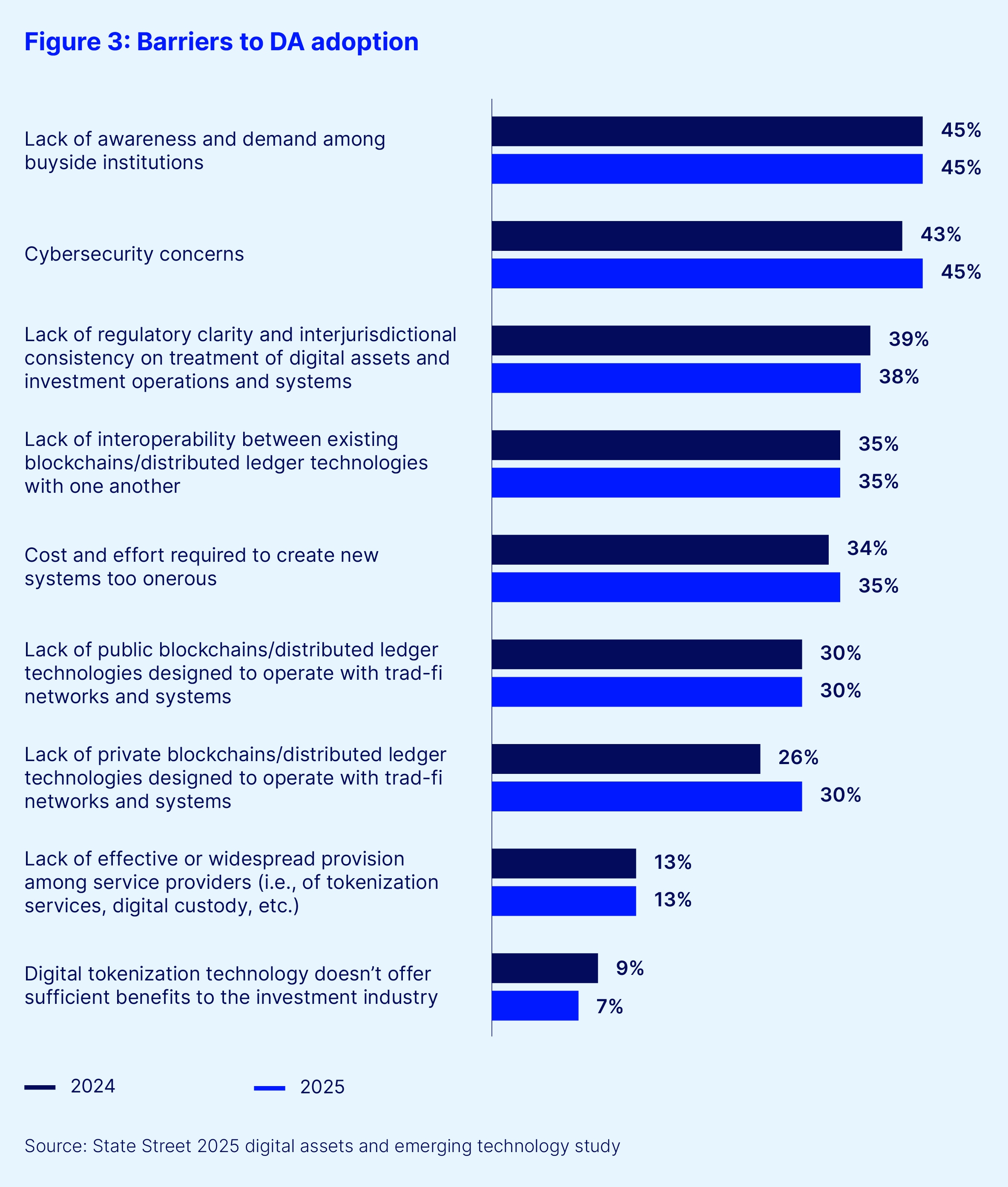

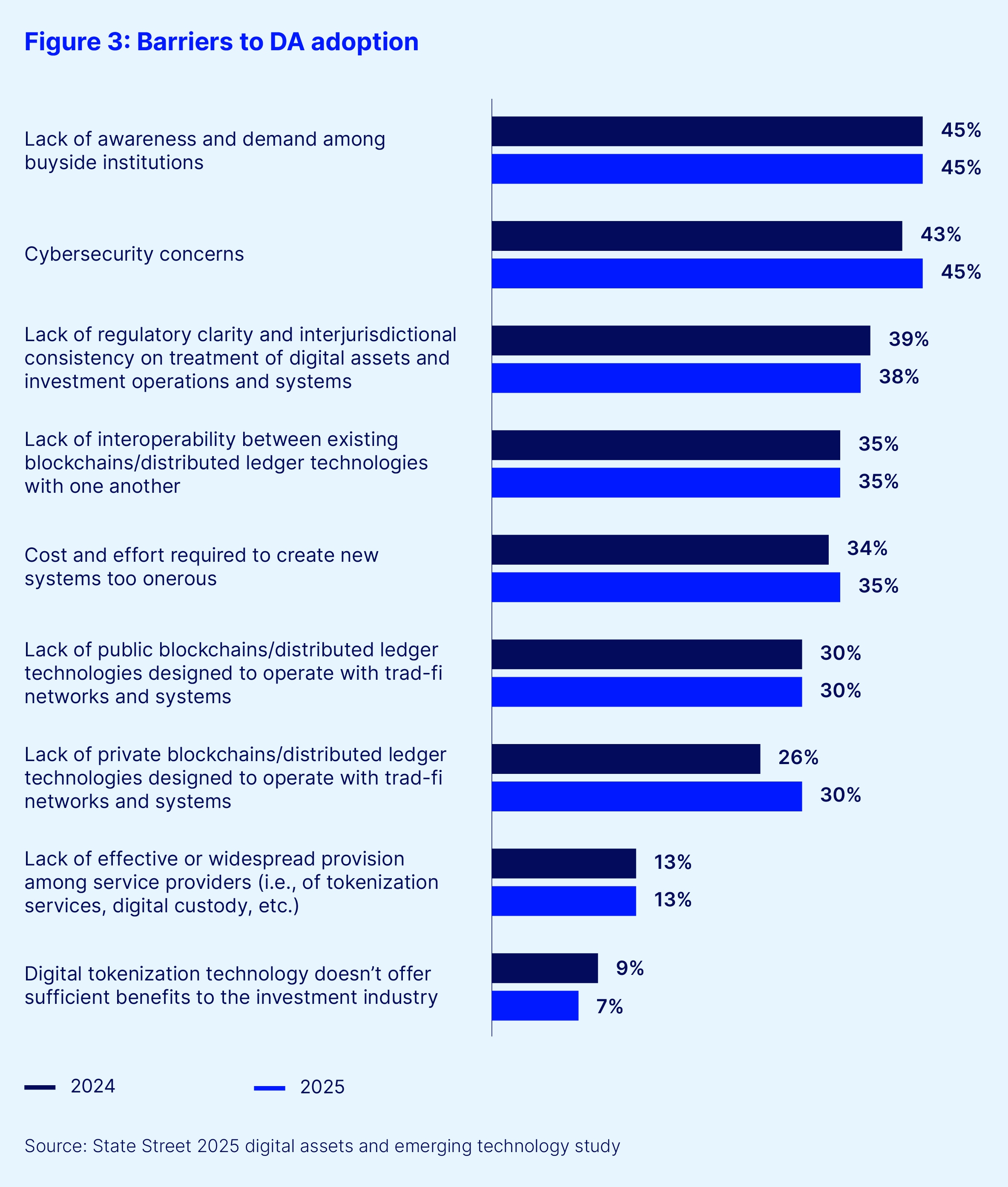

Whereas most respondents cited challenges round cybersecurity, regulation, and training, they see crypto belongings as long-term development drivers. Respondents anticipate funding returns to enhance by as much as a 3rd and anticipate price financial savings between 23% and 37% as they embody blockchain, automation, and AI into their operations.

World Surge in Institutional and Retail Crypto Adoption

Apparently, these institutional traits align with exterior knowledge displaying accelerating crypto adoption worldwide. For one, a September 2025 report from Chainalysis discovered that belongings in tokenized funds jumped from $2 billion in August 2024 to over $7 billion a yr later.

In the US, institutional confidence stays sturdy amid favorable insurance policies. A June 2025 examine from Coinlaw.io reported that 80% of U.S. institutional buyers deliberate to extend crypto publicity in 2024, whereas partnerships between banks and crypto corporations have grown by 52% since 2022.

Chainalysis additionally revealed that North America dealt with $2.3 trillion in crypto transaction worth between July 2024 and June 2025, with 26% of world exercise coming from institutional trades akin to ETF flows and portfolio rebalancing.

Importantly, retail buyers are displaying the identical momentum. A January 2025 analysis article from Safety.org discovered that 28% of U.S. adults now personal crypto, up from 27% the earlier yr.

Crypto.com’s February 2025 report estimated that international crypto possession reached 659 million by the tip of 2024, a 13% bounce from the yr earlier than. JPMorgan Chase Institute knowledge by Could 2025 confirmed that 17% of energetic checking account holders moved funds into crypto accounts, up two proportion factors from early 2024.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article could embody the creator’s private opinions and don’t mirror The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary will not be liable for any monetary losses.