The 2025 Bull Market Continues, However Refined Cracks Emerge

In traditional kind, the 2025 market is climbing the proverbial “Wall of Fear.” At present, the US authorities is experiencing its longest authorities shutdown in historical past, ad infinitum. Conversely, after a nasty correction in April, shares seem to have lastly priced in President Trump’s distinctive and daring “Liberation Tariffs.” Nevertheless, the US Supreme Court docket is presently listening to arguments on the Trump tariffs, and betting markets usually are not assured they are going to stay. Actually, Polymarket solely expects a ¼ likelihood that the Supreme Court docket guidelines the tariffs authorized.

Picture Supply: Polymarket

Although the market has been remarkably resilient to date in 2025, refined, troubling cracks are starting to emerge beneath the floor, suggesting that the market might lastly be due for a considerable pullback.

Market Breadth Sours to Worst Ranges Since April

For market watchers, it must be no shock that mega-cap “Magazine 7” shares comparable to Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOGL), and Apple (AAPL) have carried the market. In any case, the AI hype has put the wind behind these tech juggernauts for a while. Nevertheless, what’s modified up to now few days is the intense bifurcation between these shares and the remainder. Actually, final Thursday, although the market was inside shouting distance of file highs, the S&P 500 Index recorded the very best share of shares at 52-week lows. The deteriorating breadth is a chief instance of how the key indices can masks the motion in particular person shares “beneath the floor.”

Picture Supply: Zacks Funding Analysis

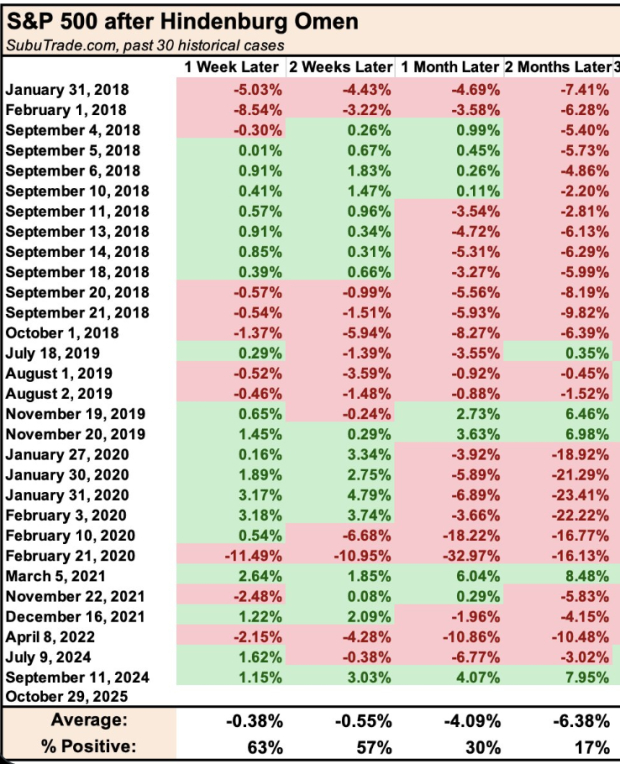

Hindenburg Omen Triggers

The “Hindenburg Omen” is a breadth sign utilized by market analysts to foretell pullbacks or market crashes. In contrast to conventional breadth indicators that solely search for poor market participation, the Hindenburg Omen is exclusive in that it measures breadth abnormality- when quite a few shares are hitting each 52-week highs and 52-week lows. In different phrases, the Hindenburg Omen acknowledges excessive market fragmentation. To set off, the market should meet the next standards:

1. New highs have to be >2.2% and new lows have to be >2.2% of the index.

2. Breadth have to be damaging (extra shares falling than rising).

3. The market have to be in an uptrend (larger than it was 50 classes in the past)

4. New highs can’t be double the variety of new lows.

Final week, the S&P 500 Index triggered a Hindenburg Omen. Although every market is exclusive and historical past doesn’t at all times repeat itself, market bears lastly have one thing to get enthusiastic about. The previous 30 occasions an S&P 500 Hindenburg Omen triggered, the market was larger two months later simply 17% of the time!

Picture Supply: SubuTrade.com

S&P 500 Index Reaches Key Fib Goal

The Fibonacci Extension is an indicator market technicians use to foretell the place a market might pause and reverse. Primarily based on a mathematical sequence typically seen in nature and artwork, technical analysts make the most of Fibs to see how far a market might prolong, notably from a significant correction. No matter whether or not the mathematical sequence itself is significant or if Fibs are merely a self-fulfilling prophecy, markets typically respect these ranges. Just lately, the S&P 500 Index reached the 261.8% Fib extension from the 2022 bear market – a degree the place it could must take a breather. Buyers want to know that long-term, multi-year Fib extension targets just like the one the market is presently experiencing, are usually extra significant than short-term Fib targets.

Picture Supply: TradingView

Backside Line

Whereas the 2025 bull market continues to push larger, refined cracks in market breadth are showing beneath the floor. Specifically, the “Hindenburg Omen” means that warning could also be warranted.

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to reap the benefits of the subsequent development stage of this market. And it is simply starting to enter the highlight, which is strictly the place you need to be.

With robust earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

Apple Inc. (AAPL) : Free Inventory Evaluation Report

Microsoft Company (MSFT) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.