Synthetic intelligence spending is fueling the Wall Road bull market as massive tech bets massive on power-hungry AI information facilities and past. The AI hyperscalers, together with Amazon, Meta, and others, are projected to spend roughly $400 billion in capex in 2025 alone. International information heart infrastructure spending is predicted to achieve $7 trillion by 2030.

There isn’t a finish in sight to the wave of AI spending that extends to power and grid infrastructure as a result of generative AI platforms like ChatGPT use 10X the power of a median Google search.

The 2 AI-related shares we dive into at the moment should not the tech shares most related to AI, similar to Nvidia. Nonetheless, Constellation Vitality and Arista Networks profit instantly from the AI megatrend that’s poised to dominate Wall Road within the back-half of the last decade and past.

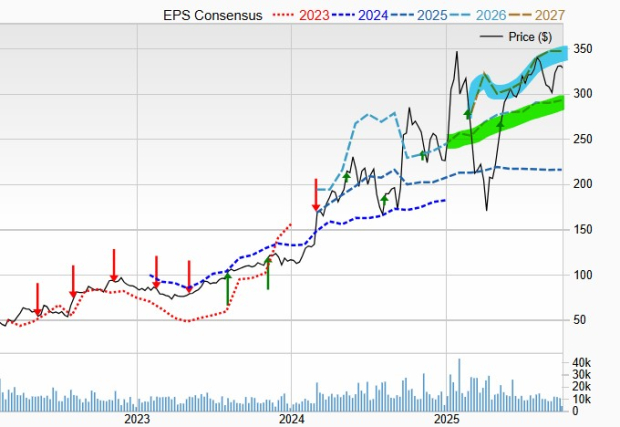

Picture Supply: Zacks Funding Analysis

Let’s dive into why buyers can buy CEG and ANET now earlier than potential breakouts in October and the fourth quarter. Each AI-boosted shares are additionally long-term buy-and-hold candidates.

Nuclear Vitality Inventory Constellation is a Should-Purchase AI Winner

Constellation Vitality CEG is on the forefront of the rising relationship between massive tech and nuclear power. CEG earned 20-year energy buy agreements with Microsoft and Meta META over the past 12 months to assist their AI growth efforts.

The most important U.S. nuclear energy plant operator is able to remodel into certainly one of the power trade titans of the AI age by Constellation’s $27 billion deal to purchase pure fuel and geothermal powerhouse Calpine.

CEG’s acquisition, which is predicted to shut in This fall, creates the most important clear power agency and expands Constellation’s footprint into power-hungry, tech-heavy Texas and California.

Constellation inventory is poised to be one of the crucial surefire long-term winners within the AI-driven power age because the U.S. authorities goals to quadruple nuclear power capability by 2050 and AI hyperscalers go all-in on nuclear and pure fuel.

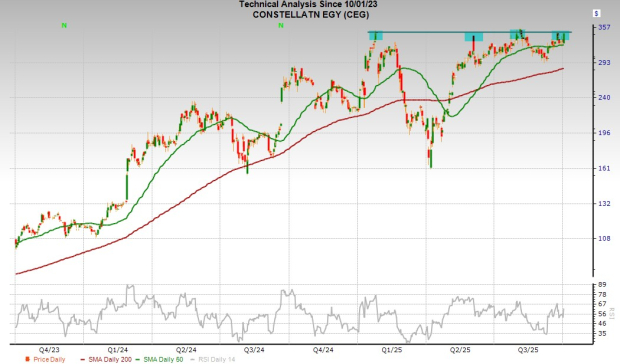

Picture Supply: Zacks Funding Analysis

It’s poised to energy giant swaths of the economic system and AI information facilities through CEG’s established portfolio of dependable 24/7 energy. Constellation can be increasing into next-gen small modular nuclear reactors (SMRs), the place it competes towards pre-revenue home-run shares similar to Oklo.

Constellation raised its dividend by 10% in 2025 and 25% in 2024 as a part of a plan to persistently enhance its payout to shareholders. The nuclear power powerhouse is predicted to develop its adjusted earnings per share (EPS) by 9% in 2025 and 27% in 2026.

Its near-term trajectory is a part of Constellation’s “seen, double-digit long-term base EPS development backed by the Nuclear Manufacturing Tax Credit score.” The chart above exhibits that CEG’s earnings revisions are trending larger.

Picture Supply: Zacks Funding Analysis

CEG inventory climbed 300% within the final three years to outpace the S&P 500’s 87%. The inventory has jumped 55% in 2025 to outpace Meta and plenty of AI hyperscalers.

Constellation trades 15% beneath its common Zacks worth goal, and it appears prepared to interrupt out into a brand new buying and selling vary in some unspecified time in the future in October or the fourth quarter. Constellation additionally trades at a 20% low cost to its highs at 29.1X ahead 12-month earnings.

Purchase Meta and Microsoft AI Companion ANET Inventory

Arista Networks ANET is a client-to-cloud networking powerhouse for big AI, information heart, campus, and routing environments. ANET’s networking infrastructure expanded quickly over the previous decade alongside the explosion of cloud computing, massive information, and most just lately, synthetic intelligence.

ANET’s merchandise assist join computer systems and servers, making certain quick and dependable information switch. Briefly, Arista helps present a number of the ‘plumbing’ that retains large-scale tech operations similar to AI operating easily.

AI hyperscalers, Microsoft MSFT and Meta, are two of Arista’s largest purchasers, highlighting to buyers that ANET’s portfolio is filled with best-in-class AI information center-focused choices.

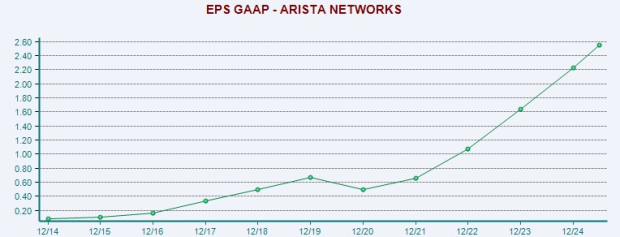

Picture Supply: Zacks Funding Analysis

ANET grew its income from $361 million in 2013 to $7 billion in 2024, boosted by 32% common gross sales development within the trailing 4 years. Arista Networks is projected to develop its gross sales by 25% in FY25 and 20% in 2026 to achieve $10.52 billion, greater than doubling its income between 2022 and 2026.

Arista’s spectacular stability sheet ($8.8 billion in money and equivalents and nil debt) ought to assist develop its attain inside AI and no matter technological revolution would possibly come subsequent. The networking infrastructure agency is projected to develop its adjusted earnings by 24% in 2025 and 14% in FY26 to increase an enormous run of bottom-line growth.

ANET’s FY25 consensus EPS estimate has jumped 10% since its Q2 launch, with its FY26 outlook 9% larger to assist it earn a Zacks Rank #1 (Sturdy Purchase). The tech firm has additionally crushed our quarterly earnings estimates for 5 years operating.

Picture Supply: Zacks Funding Analysis

ANET skyrocketed 3,700% prior to now 10 years to blow away Meta’s 680% and Tech’s 433%, together with a 415% surge over the past three years. Regardless of buying and selling close to its all-time highs, its valuation ranges mark a 28% low cost to Arista’s peaks.

The inventory skilled a bullish golden cross, the place the 50-day strikes above the 200-day, in late July. Arista inventory might be poised to cost larger in This fall after gapping above its early 2025 peaks in early August following an enormous beat-and-raise Q2 report.

Past Nvidia: AI’s Second Wave Is Right here

The AI revolution has already minted millionaires. However the shares everybody is aware of about aren’t prone to maintain delivering the largest income. Little-known AI companies tackling the world’s greatest issues could also be extra profitable within the coming months and years.

See “2nd Wave” AI shares now >>

Microsoft Company (MSFT) : Free Inventory Evaluation Report

Constellation Vitality Company (CEG) : Free Inventory Evaluation Report

Arista Networks, Inc. (ANET) : Free Inventory Evaluation Report

Meta Platforms, Inc. (META) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.