Banking on the rise in demand for synthetic intelligence (AI)-powered options in 2025, Wall Avenue’s darling, NVIDIA Company’s NVDA shares have gained 40% this 12 months. Incessant demand for its Blackwell chips and CUDA software program platform has fueled NVIDIA’s progress.

Nevertheless, driving the AI increase, Micron Know-how, Inc. MU and Palantir Applied sciences Inc. PLTR have considerably outperformed NVIDIA, whose shares have soared 251.2% and 143.1%, respectively, this 12 months. These shares stay well-positioned for additional features forward, making them compelling funding choices. Let’s discover why they’re gaining momentum –

Micron Soars on HBM Demand and AI-Pushed Development

The rise in demand for Micron’s high-bandwidth reminiscence (HBM) chips has been a hidden tailwind in 2025, boosting its newest quarterly efficiency. HBM chips are in demand on account of their skill to curb energy consumption and course of massive volumes of knowledge.

For fiscal first-quarter 2026, Micron posted revenues of $13.64 billion, up 56.8% 12 months over 12 months, in response to buyers.micron.com. Micron’s gross sales surpassed analysts’ estimates of round $12.88 billion.

Micron’s all enterprise models reported a rise in gross sales, with its main cloud reminiscence enterprise section reporting a year-over-year gross sales improve of 99.5% to $5.28 billion. Moreover, Micron’s non-GAAP internet revenue reached $5.48 billion, or $4.78 per diluted share, greater than analysts’ projection of $3.94.

Whereas Micron’s CEO, Sanjay Mehrotra, believes that “the expansion in AI information heart capability is driving a big improve in demand for high-performance and high-capacity reminiscence and storage,” administration expects fiscal second-quarter 2026 revenues to return in between $18.3 billion and $19.1 billion. If Micron achieves this stage of income progress, it could almost match what the corporate achieved in the course of the dot-com bubble.

Micron additionally forecasted diluted earnings per share (EPS) of $8.22 to $8.62 for the fiscal second quarter of 2026, and with $3.9 billion in money circulate generated in fiscal first-quarter 2026, the corporate has enough assets to fund extra progress initiatives.

In the meantime, the HBM market is anticipated to develop sooner or later, which bodes properly for Micron. The HBM market is valued at $1,516.31 million in 2026, and is anticipated to see a CAGR of 25.5% to $7,721.41 million by 2035, in response to Market Development Studies. Due to this fact, Micron’s projected earnings progress price for subsequent 12 months is 26.2%. The corporate’s $31.36 Zacks Consensus Estimate for EPS is up 185.9% 12 months over 12 months.

Picture Supply: Zacks Funding Analysis

Palantir Features as AIP Fuels U.S. Business and Authorities Development

Palantir’s Synthetic Intelligence Platform (AIP) is in demand amongst each U.S. industrial and authorities shoppers. It’s because AIP can seamlessly combine AI with real-world complicated information and workflow, which helps in quicker decision-making.

In consequence, Palantir has carried out properly this 12 months, with revenues for the third quarter coming in at $1.18 billion, up 63% from the identical interval a 12 months in the past and 18% sequentially, as talked about on buyers.palantir.com.

Authorities section revenues have been $486 million, marking a 52% year-over-year improve and a 14% rise sequentially. Most significantly, revenues from the U.S. industrial consumer section soared 121% 12 months over 12 months and 29% quarter over quarter to $397 million.

What’s extra, Palantir expects its fourth-quarter revenues to return in between $1.327 billion and $1.331 billion, and full-year gross sales to be even higher at $4.396 billion to $4.400 billion, and expects to submit optimistic GAAP internet revenue all year long.

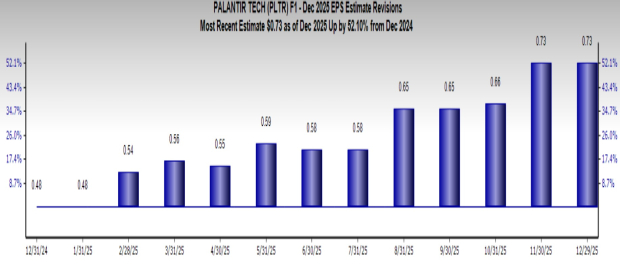

An increasing industrial consumer base in the USA will drive Palantir’s future progress, and rising authorities contracts will create hurdles for brand spanking new entrants. Thus, the corporate’s anticipated earnings progress price for subsequent 12 months is 42.5%. Palantir’s $0.73 Zacks Consensus Estimate for EPS is up 52.1% 12 months over 12 months.

Picture Supply: Zacks Funding Analysis

Whereas Micron has a Zacks Rank #1 (Robust Purchase), Palantir has a Zacks Rank #2 (Purchase). You may see the entire listing of right now’s Zacks Rank #1 shares right here.

Zacks Naming Prime 10 Shares for 2026

Wish to be tipped off early to our 10 prime picks for everything of 2026? Historical past suggests their efficiency might be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed accountability for the portfolio) by means of November, 2025, the Zacks Prime 10 Shares gained +2,530.8%, greater than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing by means of 4,400 corporations to handpick the very best 10 tickers to purchase and maintain in 2026. Don’t miss your probability to get in on these shares after they’re launched on January 5.

Be First to New Prime 10 Shares >>

Micron Know-how, Inc. (MU) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Palantir Applied sciences Inc. (PLTR) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.